a. Record the income tax journal entry on December 31. •Note: If a line in a journal entry isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero). Date Account Name Dec. 31 Income Tax Expense N/A Income Tax Payable Deferred Tax Liability To record income tax expense Dr. Cr. 60,000 0 0 0 46,000 14,000 b. Prepare the income tax section of the income statement for the year and provide the disclosure of current and deferred tax expense. •Note: Do not use negative signs with your answers.

a. Record the income tax journal entry on December 31. •Note: If a line in a journal entry isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero). Date Account Name Dec. 31 Income Tax Expense N/A Income Tax Payable Deferred Tax Liability To record income tax expense Dr. Cr. 60,000 0 0 0 46,000 14,000 b. Prepare the income tax section of the income statement for the year and provide the disclosure of current and deferred tax expense. •Note: Do not use negative signs with your answers.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 9MC: Brooks Company reported a prior period adjustment of 512,000 in pretax financial "income" and...

Related questions

Question

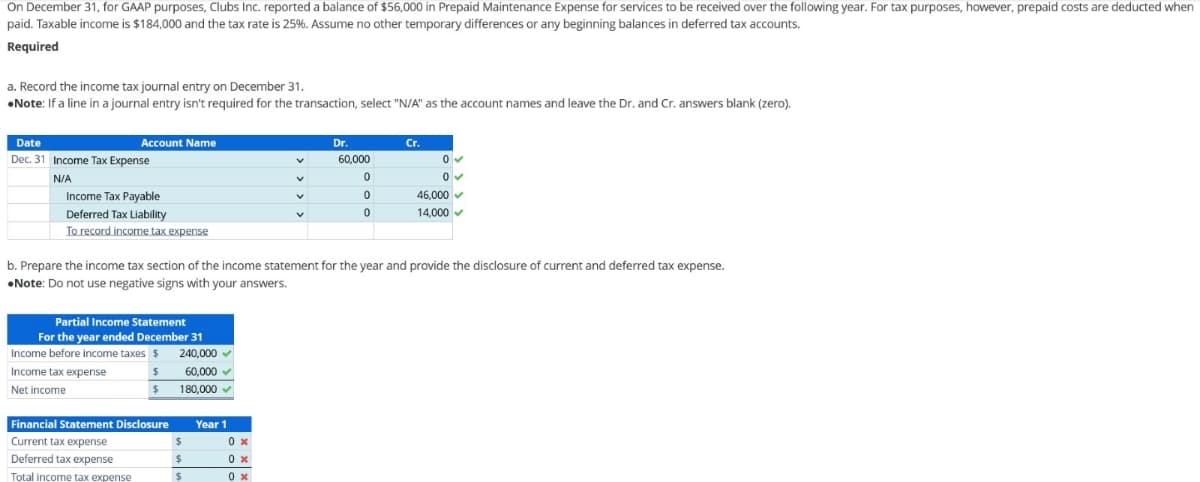

Transcribed Image Text:On December 31, for GAAP purposes, Clubs Inc. reported a balance of $56,000 in Prepaid Maintenance Expense for services to be received over the following year. For tax purposes, however, prepaid costs are deducted when

paid. Taxable income is $184,000 and the tax rate is 25%. Assume no other temporary differences or any beginning balances in deferred tax accounts.

Required

a. Record the income tax journal entry on December 31.

•Note: If a line in a journal entry isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero).

Date

Account Name

Dec. 31 Income Tax Expense

N/A

Income Tax Payable

Deferred Tax Liability

To record income tax expense

Dr.

Cr.

60,000

0

0

0

0

46,000 ▼

0

14,000

b. Prepare the income tax section of the income statement for the year and provide the disclosure of current and deferred tax expense.

•Note: Do not use negative signs with your answers.

Partial Income Statement

For the year ended December 31

Income before income taxes $

240,000

Income tax expense

$

60,000

Net income

$

180,000

Financial Statement Disclosure

Year 1

Current tax expense

$

0 x

Deferred tax expense

$

Total income tax expense

$

0 x

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning