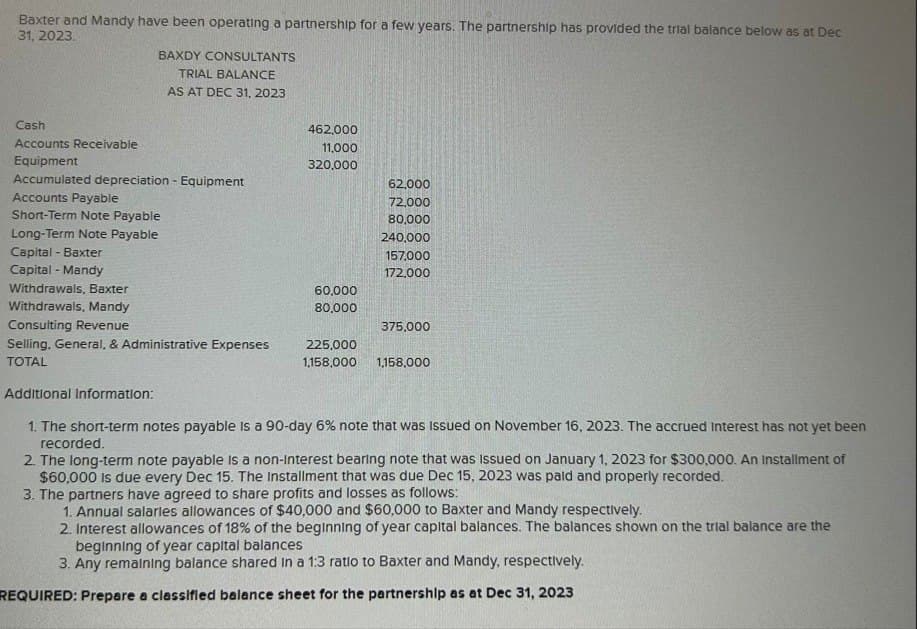

Baxter and Mandy have been operating a partnership for a few years. The partnership has provided the trial balance below as at Dec 31, 2023. BAXDY CONSULTANTS TRIAL BALANCE AS AT DEC 31, 2023 Cash Accounts Receivable Equipment Accumulated depreciation Equipment Accounts Payable Short-Term Note Payable 462,000 11,000 320,000 62,000 72,000 80,000 Long-Term Note Payable 240,000 Capital - Baxter Capital Mandy Withdrawals, Baxter 157,000 172,000 60,000 Withdrawals, Mandy 80,000 Consulting Revenue 375,000 Selling, General, & Administrative Expenses TOTAL 225,000 1,158,000 1,158,000 Additional Information: 1. The short-term notes payable is a 90-day 6% note that was issued on November 16, 2023. The accrued Interest has not yet been recorded. 2. The long-term note payable is a non-interest bearing note that was issued on January 1, 2023 for $300,000. An Installment of $60,000 is due every Dec 15. The Installment that was due Dec 15, 2023 was paid and properly recorded. 3. The partners have agreed to share profits and losses as follows: 1. Annual salaries allowances of $40,000 and $60,000 to Baxter and Mandy respectively. 2. Interest allowances of 18% of the beginning of year capital balances. The balances shown on the trial balance are the beginning of year capital balances 3. Any remaining balance shared in a 1:3 ratio to Baxter and Mandy, respectively. REQUIRED: Prepare a classified balance sheet for the partnership as at Dec 31, 2023

Baxter and Mandy have been operating a partnership for a few years. The partnership has provided the trial balance below as at Dec 31, 2023. BAXDY CONSULTANTS TRIAL BALANCE AS AT DEC 31, 2023 Cash Accounts Receivable Equipment Accumulated depreciation Equipment Accounts Payable Short-Term Note Payable 462,000 11,000 320,000 62,000 72,000 80,000 Long-Term Note Payable 240,000 Capital - Baxter Capital Mandy Withdrawals, Baxter 157,000 172,000 60,000 Withdrawals, Mandy 80,000 Consulting Revenue 375,000 Selling, General, & Administrative Expenses TOTAL 225,000 1,158,000 1,158,000 Additional Information: 1. The short-term notes payable is a 90-day 6% note that was issued on November 16, 2023. The accrued Interest has not yet been recorded. 2. The long-term note payable is a non-interest bearing note that was issued on January 1, 2023 for $300,000. An Installment of $60,000 is due every Dec 15. The Installment that was due Dec 15, 2023 was paid and properly recorded. 3. The partners have agreed to share profits and losses as follows: 1. Annual salaries allowances of $40,000 and $60,000 to Baxter and Mandy respectively. 2. Interest allowances of 18% of the beginning of year capital balances. The balances shown on the trial balance are the beginning of year capital balances 3. Any remaining balance shared in a 1:3 ratio to Baxter and Mandy, respectively. REQUIRED: Prepare a classified balance sheet for the partnership as at Dec 31, 2023

Chapter2: Income Tax Concepts

Section: Chapter Questions

Problem 80DC

Related questions

Question

answer in detail with concept introduction explanation calculation concept introduction steps correctly and completely in detail answer in text

Transcribed Image Text:Baxter and Mandy have been operating a partnership for a few years. The partnership has provided the trial balance below as at Dec

31, 2023.

BAXDY CONSULTANTS

TRIAL BALANCE

AS AT DEC 31, 2023

Cash

Accounts Receivable

Equipment

Accumulated depreciation Equipment

Accounts Payable

Short-Term Note Payable

462,000

11,000

320,000

62,000

72,000

80,000

Long-Term Note Payable

240,000

Capital - Baxter

Capital Mandy

Withdrawals, Baxter

157,000

172,000

60,000

Withdrawals, Mandy

80,000

Consulting Revenue

375,000

Selling, General, & Administrative Expenses

TOTAL

225,000

1,158,000 1,158,000

Additional Information:

1. The short-term notes payable is a 90-day 6% note that was issued on November 16, 2023. The accrued Interest has not yet been

recorded.

2. The long-term note payable is a non-interest bearing note that was issued on January 1, 2023 for $300,000. An Installment of

$60,000 is due every Dec 15. The Installment that was due Dec 15, 2023 was paid and properly recorded.

3. The partners have agreed to share profits and losses as follows:

1. Annual salaries allowances of $40,000 and $60,000 to Baxter and Mandy respectively.

2. Interest allowances of 18% of the beginning of year capital balances. The balances shown on the trial balance are the

beginning of year capital balances

3. Any remaining balance shared in a 1:3 ratio to Baxter and Mandy, respectively.

REQUIRED: Prepare a classified balance sheet for the partnership as at Dec 31, 2023

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 5 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning