Cost per unit Direct materials Quanitity Cost Total ? pounds ? hours ? hours ? per pound ? per hour ? per hour Direct labor ? Manufacturing overhead Unit product cost Construct the Income Statement budget Sales ? ? ? ? ? ? Cost of Goods Sold: Gross margin S & A expense Interest epxense Net income

Cost per unit Direct materials Quanitity Cost Total ? pounds ? hours ? hours ? per pound ? per hour ? per hour Direct labor ? Manufacturing overhead Unit product cost Construct the Income Statement budget Sales ? ? ? ? ? ? Cost of Goods Sold: Gross margin S & A expense Interest epxense Net income

Financial & Managerial Accounting

14th Edition

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter20: Variable Costing For Management Analysis

Section: Chapter Questions

Problem 20.4BPR: Salespersons' report and analysis Pachec Inc. employs seven salespersons to sell and distribute its...

Related questions

Question

How do I prepare the bugdet and replace all question marks into formula?

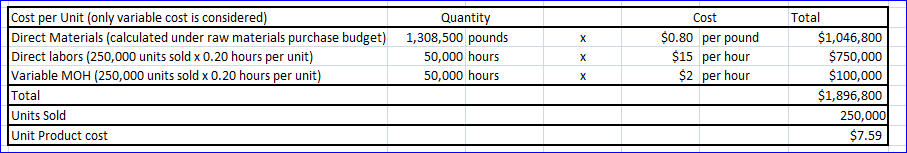

Transcribed Image Text:Cost per unit

Quanitity

? pounds

? hours

Cost

Total

? per pound

? per hour

? per hour

Direct materials

?

Direct labor

Manufacturing overhead

Unit product cost

? hours

?

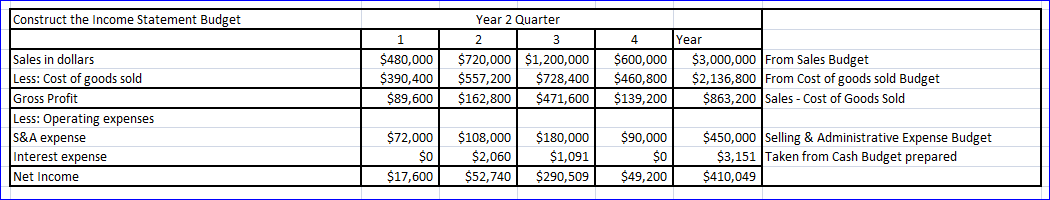

Construct the Income Statement budget

Sales

?

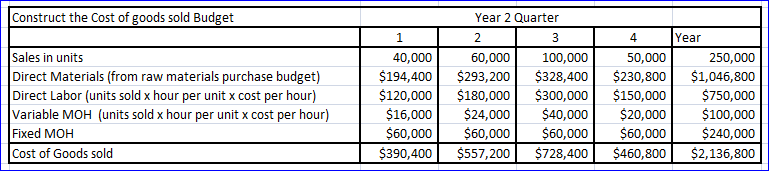

Cost of Goods Sold:

?

Gross margin

S & A expense

?

?

Interest epxense

?

Net income

?

Transcribed Image Text:Data

Year 2 Quarter

Year 3 Quarter

1

2

3

4

1

2

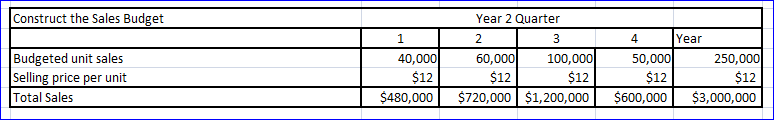

Budgeted unit sales

40,000

60,000

100,000

50,000

70,000

80,000

• Selling price per unit

• Accounts receivable, beginning balance

• Sales collected in the quarter sales are made

• Sales collected in the quarter after sales are made

• Desired ending finished goods inventory is

• Finished goods inventory, beginning

• Raw materials required to produce one unit

• Desired ending inventory of raw materials is

• Raw materials inventory, beginning

• Raw material costs

• Raw materials purchases are paid

and

• Accounts payable for raw materials, beginning balance

$12 per unit

$65,000

75%

25%

30% of the budgeted unit sales of the next quarter

12,000 units

5 pounds

10% of the next quarter's production needs

23,000 pounds

$0.80 per pound

60% in the quarter the purchases are made

40% in the quarter following purchase

$81,500

•Direct labor cost per hour

•Direct labor hour per unit

$15 per hour

0.2 hour per unit

$2 per hour

$60,000

•Variable MOH rate

•Total fixed MOH

•Variable S&A expense rate

$1.80 per unit

$50,000

12%

•Minimum cash balance

•Annual Interest rate

Expert Solution

Step 1

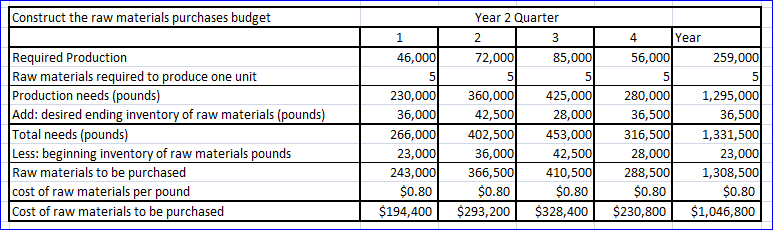

Answer :

All the required calculations are also given under budget form.

Step 2

Answer :

Income budget is as follows:

All the Calculation required are also given below:

Step by step

Solved in 3 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning