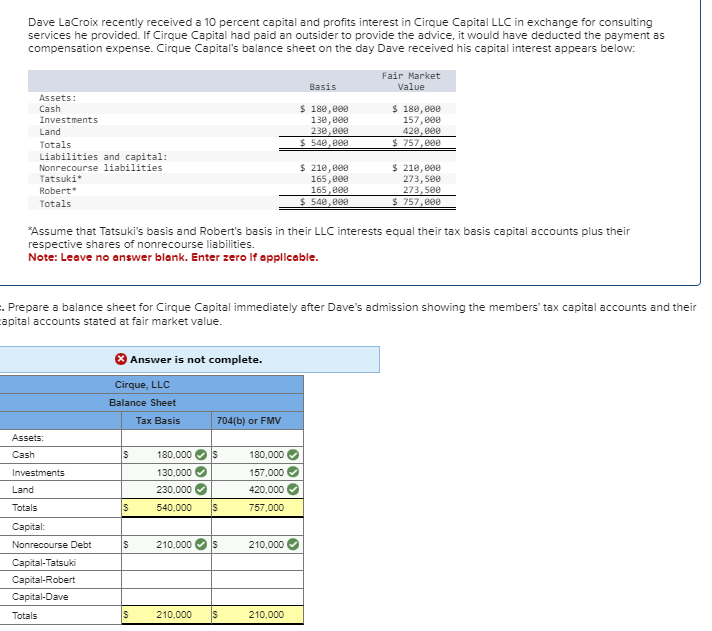

Dave LaCroix recently received a 10 percent capital and profits interest in Cirque Capital LLC in exchange for consulting services he provided. If Cirque Capital had paid an outsider to provide the advice, it would have deducted the payment as compensation expense. Cirque Capital's balance sheet on the day Dave received his capital interest appears below: Assets: Cash Investments Land Totals Liabilities and capital: Nonrecourse liabilities Tatsuki* Robert Totals Basis $ 180,000 130,000 230,000 $ 540,000 $ 210,000 165,000 165,000 $ 540,000 Fair Market Value $ 180,000 157,000 420,000 $ 757,000 $ 210,000 273,500 273,500 $757,000 *Assume that Tatsuki's basis and Robert's basis in their LLC interests equal their tax basis capital accounts plus their respective shares of nonrecourse liabilities. Note: Leave no answer blank. Enter zero If applicable. Prepare a balance sheet for Cirque Capital immediately after Dave's admission showing the members' tax capital accounts and their pital accounts stated at fair market value.

Dave LaCroix recently received a 10 percent capital and profits interest in Cirque Capital LLC in exchange for consulting services he provided. If Cirque Capital had paid an outsider to provide the advice, it would have deducted the payment as compensation expense. Cirque Capital's balance sheet on the day Dave received his capital interest appears below: Assets: Cash Investments Land Totals Liabilities and capital: Nonrecourse liabilities Tatsuki* Robert Totals Basis $ 180,000 130,000 230,000 $ 540,000 $ 210,000 165,000 165,000 $ 540,000 Fair Market Value $ 180,000 157,000 420,000 $ 757,000 $ 210,000 273,500 273,500 $757,000 *Assume that Tatsuki's basis and Robert's basis in their LLC interests equal their tax basis capital accounts plus their respective shares of nonrecourse liabilities. Note: Leave no answer blank. Enter zero If applicable. Prepare a balance sheet for Cirque Capital immediately after Dave's admission showing the members' tax capital accounts and their pital accounts stated at fair market value.

Chapter14: Choice Of Business Entity—operations And Distributions

Section: Chapter Questions

Problem 28P

Related questions

Question

Do not give image format

Transcribed Image Text:Dave LaCroix recently received a 10 percent capital and profits interest in Cirque Capital LLC in exchange for consulting

services he provided. If Cirque Capital had paid an outsider to provide the advice, it would have deducted the payment as

compensation expense. Cirque Capital's balance sheet on the day Dave received his capital interest appears below:

Assets:

Cash

Investments

Land

Totals

Liabilities and capital:

Nonrecourse liabilities

Tatsuki*

Robert*

Totals

Assets:

Cash

Investments

Totals

Land

Totals

Capital:

*Assume that Tatsuki's basis and Robert's basis in their LLC interests equal their tax basis capital accounts plus their

respective shares of nonrecourse liabilities.

Note: Leave no answer blank. Enter zero if applicable.

Nonrecourse Debt

Capital-Tatsuki

Capital-Robert

Capital-Dave

. Prepare a balance sheet for Cirque Capital immediately after Dave's admission showing the members' tax capital accounts and their

capital accounts stated at fair market value.

Cirque, LLC

Balance Sheet

Tax Basis

S

$

$

Answer is not complete.

$

704(b) or FMV

180,000

130,000

230,000

540,000 S

S

210,000 S

210,000 S

180,000

157,000

420,000

757,000

Basis

$ 180,000

130,000

230,000

$540,000

210,000

$ 210,000

165,000

165,000

$540,000

210,000

Fair Market

Value

$ 180,000

157,000

420,000

$ 757,000

$ 210,000

273,500

273,500

$ 757,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT