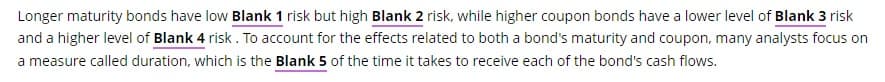

Longer maturity bonds have low Blank 1 risk but high Blank 2 risk, while higher coupon bonds have a lower level of Blank 3 and a higher level of Blank 4 risk. To account for the effects related to both a bond's maturity and coupon, many analysts fo a measure called duration, which is the Blank 5 of the time it takes to receive each of the bond's cash flows.

Q: Kwon Jewelers is evaluating a 1-year project that would involve an initial investment in equipment…

A: To calculate the net present value (NPV) of the project when Kwon Jewelers borrows $32,000 to pay…

Q: The practical benefit of ownership in the firm for shareholders is that... The practical benefit of…

A: In this question, we are required to determine the practical benefit of ownership in the firm for…

Q: ces Suppose your firm is considering investing in a project with the cash flows shown below, that…

A: MIRR is stands for modified internal rate of return. It is one of the capital budgeting method to…

Q: You are investing in a share of stock. The share just paid a dividend of $7.46. The dividend has…

A: Recently paid dividend (D0) = $7.46Growth rate (g) = 5.26% or 0.0526Required rate of return (r) =…

Q: please explain me how to the green boxes now filled, show the formulas and compuations step by step

A: The objective of the question is to understand how the values in the table are calculated. The table…

Q: Marin Corporation issued $470,400 of 7% bonds on November 1, 2025, for $499,520. The bonds were…

A: Par value of the bonds issued = $470,400Issue price of the bonds = $499,520Stated interest rate =…

Q: On january 1, 2010, you put 1000.00 in a savings account that pays 6(1)/(4)% interest, and you will…

A: The time value of money is a concept in finance that evaluates the worth of cash flows at any given…

Q: A portfolio analyst has been asked to allocate investment funds among three different stocks. The…

A: Portfolio return is calculated as shown below.Portfolio standard deviation is calculated as shown…

Q: Bart Software has 8 percent coupon bonds on the market with 23 years to maturity. The bonds make…

A: Current yield of the bond can be referred to as the yield that can be found by dividing the annual…

Q: United Pigpen is considering a proposal to manufacture high-protein hog feed. The project would…

A: NPV means present value of benefits arises in future from the project. It can be simply calculated…

Q: Suppose that you have 12, 000 in a rather risky investment recommended by your financial advisor.…

A: Percentage return is the gain or loss on an investment, expressed as a proportion of the initial…

Q: O Nighthawk Steel, a manufacturer of specialized tools, has $5,050,000 in assets. Temporary current…

A: Temporary current assets=$210000Permanent current assets=$155000Short term interest…

Q: Rare Agri-Products Ltd. is considering a new project with a projected life of seven (7) years. The…

A: Discounting rates are the minimal rate of return that is expected by an investor from the investment…

Q: Rare Agri-Products Ltd. is considering a new project with a projected life of seven (7) years. The…

A: The objective of the question is to calculate the appropriate discount rate for the project's cash…

Q: Problem 2-17 Margin Interest (LO3, CFA2) Suppose you take out a margin loan for $75,000. The rate…

A: Principal = $75,000Rate = 8.9% per year (as an effective annual rate)Time = 180 days / 365 days (to…

Q: 1. Answer the below questions for bond A. Bond A Coupon 8% Yield to maturity 10% Maturity (years) 10…

A: Coupon rate = 8%Yield to maturity = 10% Maturity = 10 yearsPar value = $100Bond price = $87.5378To…

Q: Please help solve this and please show all the steps to solve this step by step in Excel. Two years…

A: The mortgage is the debt obligation that the borrower owes to the lender, it is a structure in which…

Q: You've collected the following information from your favorite financial website. 52-Week Price…

A: A stock is a financial instrument that provides the investor an ownership interest which entitles…

Q: Required information Skip to question [The following information applies to the questions displayed…

A: Expected returnStandard deviationBond fund9%Bond fund27%Stock fund15%Stock fund36%Risk free…

Q: A share of stock pays a constantly growing (end-of-the-year) dividend. If the stock sells for…

A: The dividend discount model refers to the method of stock valuation where it is considered that the…

Q: 52-WEEK VOLUME NET HI 75.43 LO 45.86 STOCK (DIV) RJW 175 YLD% PE 19 2.9 100s 10 CLOSE CHANGE ?? -.55…

A: Given Data: Stock Dividend 1.75Dividend Yield2.90%P/E Ratio19Net change-0.55

Q: Nobility Homes, Incorporated, is a small maker of manufactured homes sold throughout the state of…

A:

Q: You have a balance of $12,000 for your tuition on your American Express credit card. Assume that you…

A: Minimum payment refers to the amount that remains at the end of each month for maintaining the…

Q: The 13-year $1 comma 000 par bonds of Vail Inc. pay 12 percent interest. The market's required yield…

A: Given: Current Price 890Coupon Rate12%Face Value1000Years 13

Q: Problem 4. On January 1, 2023, Joseph & Benjamin Company purchased ten-year bonds with a face amount…

A: Bond : Bond is one of the way that company raises finance it issues Bonds at a certain value…

Q: If an investor is concerned about interest risk, which of the following bonds should a registered…

A: Bonds are fixed-income securities that represent loans made by investors to borrowers, typically…

Q: You expect to enroll in a four-year medical school six years from today, and you are planning…

A:

Q: Single - payment loan repayment Personal Finance Problem A person borrows $370 that he must repay in…

A: Present Value = pv = $370Interest Rate = r = 7.4%

Q: f the corporate tax rate is 23 percent, what is the aftertax cost of the company's debt?

A: The cost of debt denotes the actual rate at which a company compensates for its borrowed capital,…

Q: A stock investment generated the following annual (total) returns over these 3 years: • 2015: 20% •…

A: The geometric average return is a method of calculating the average rate of return on an investment…

Q: Problem 2-7 Answer the following questions based on the information in the table. Assume a tax rate…

A: The return on equity is the financial ratio that evaluates the return of the company relative the…

Q: The common stock of the P.U.T.T. Corporation has been trading in a narrow price range for the past…

A: Part A: Price of a 6-month Put Option To find the price of a 6-month put option using the…

Q: A bond has a $1,000 par value bond with a 4% annual coupon rate and it matures in 8 years. The…

A: Callable bonds are the type of bonds that can be redeemed before their maturity date. Not all bonds…

Q: You've collected the following information from your favorite financial website. 52-Week Price…

A: For Georgette, Incorporated,Dividend = 2.1452-week high price = 56.4152-week low price = 34.02The…

Q: Having heard about IPO underpricing, I put in an order to my broker for 1, 120 shares of every IPO…

A: Data given:IPOShares Allocated to mePrice per share ($)Initial Return…

Q: Logan had seamless rain gutters installed around her home at a cost of $1,500. She financed the…

A: Here,Cost of Home (PV) is $1,500Interest Rate (r) is 2.5%Time Period (t) is 18 monthsCompounding…

Q: Problem 2-25 Calculating Short Sale Returns (LO4, CFA3) You just sold short 850 shares of Wetscope,…

A: A stock is a financial market security that gives the investor an ownership interest in the company…

Q: Suppose you are considering an ARM with the following characteristics: Mortgage Amount = $ 350,000…

A: Here, Initial Contract Rate5.50%Index for Year 2 Onwards6.50%Margin2.50%Annual Cap2.00%Lifetime…

Q: what is the aftertax salvage value of the asset? (MACRS schedule) (Do not round intermediate…

A: The after-tax salvage value is finding the amount you will receive for selling something after you…

Q: Mittuch Corp. is evaluating a project with the following cash flows. The company uses a discount…

A: YearCash flow0 $ -15,900.001 $ 7,000.002 $ 8,200.003 $ 7,800.004 $ 6,600.005 $…

Q: Explain the best a possible quantitative research design and sampling technique that can be used for…

A: The objective of the question is to identify the most suitable quantitative research design and…

Q: $9.3 percent, a YTM of 7.3 percent ond making semiannual payments. $9.3 percent, and also has 18 ye…

A: Bond XBond YFace value$1,000.00$1,000.00Coupon rate9.3%7.3%YTM7.3%9.3%Compounding frequency22Years…

Q: Rare Agri-Products Ltd. is considering a new project with a projectedlife of seven (7) years. The…

A: The objective of the question is to evaluate the financial feasibility of a new project for Rare…

Q: K Checking Accounts. Why do individuals use checking accounts? What is the disadvantage of having…

A: The question is asking about the purpose of checking accounts, the disadvantages of having funds in…

Q: Atlantic corporations ebit 440 debt 290 equity 960 Pacific corporation ebit 520 debt 1540 equity 370

A: To analyze the financial position of Atlantic Corporation and Pacific Corporation using the provided…

Q: Bond X Is a premium bond making semiannual payments. The bond has a coupon rate of 9.7 percent, a…

A: Given,two bonds Bond X and Bond YBoth bonds have face value of $1000

Q: Emperor's Clothes Fashions can invest $7 million in a new plant for producing invisible makeup. The…

A: Sales price per jar = $2.70Variable cost per jar = $1.20Fixed costs = $2,100,000Opportunity cost of…

Q: Mary's portfolio consists of two stocks. She invested $5,000 in BCD stock and $5,000 in EFG stock.…

A:

Q: Consider the single-index model. The alpha of a stock is 2.00%. The return on the market index is…

A: Alpha of the stock = 2%Return on market (RM) = 12%Risk-free rate of return (RF) = 5.5%Actual return…

Q: If employee-investors are unsophisticated and unlikely to be materially influenced by educational…

A: Employee-investors refers to employees who are also shareholders in their company through their…

Step by step

Solved in 3 steps with 2 images

- A security with higher risk will have a higher expected return. A bond’s risk level is reflected in its yield, but understanding the different risks involved when investing in bonds is important. The curves on the following graph show the prices of two 10% annual coupon bonds at various interest rates. Based on the graph, which of the following statements is true? Both bonds have equal interest rate risk. The 10-year bond has more interest rate risk. Neither bond has any interest rate risk. The 1-year bond has more interest rate risk. Frank Barlowe is retiring soon, so he’s concerned about his investments providing him with a steady income every year. He’s aware that if interest rates , the potential earnings power of the cash flow from his investments will increase. In particular, he is concerned that a decline in interest rates might lead to annual income from his investments. What kind of risk is Frank most concerned about protecting…A bond that had a 20-year original maturity with 1 year left to maturity has more price risk than a 10-year original maturity bond with 1 year left to maturity. (Assume that the bonds have equal default risk and equal coupon rates, and they cannot be called.) True FalseCoupon payments are fixed, but the percentage return that investors receive varies based on market conditions. This percentage return is referred to as the bond’s yield. Yield to maturity (YTM) is the rate of return expected from a bond held until its maturity date. However, the YTM equals the expected rate of return under certain assumptions. Which of the following is one of those assumptions? The bond has an early redemption feature. The bond will not be called.

- If the bondholder’s required rate of return equals the coupon interest rate, the bond will sell at _______________. A premium bond sells for ____________ as maturity approaches. The discount bond sells for ____________ as maturity approaches.Coupon payments are fixed, but the percentage return that investors receive varies based on market conditions. This percentage return is referred to as the bond’s yield. Yield to maturity (YTM) is the rate of return expected from a bond held until its maturity date. However, the YTM equals the expected rate of return under certain assumptions. Which of the following is one of those assumptions? The bond has an early redemption feature. The bond will not be called. Consider the case of BTR Co.: BTR Co. has 9% annual coupon bonds that are callable and have 18 years left until maturity. The bonds have a par value of $1,000, and their current market price is $1,100.35. However, BTR Co. may call the bonds in eight years at a call price of $1,060. What are the YTM and the yield to call (YTC) on BTR Co.’s bonds? Value YTM YTC If interest rates are expected to remain constant, what is the best estimate of the remaining life left…Which of the following statements correctly describes the sensitivity of a bond’s price to a change in market yields? Group of answer choices A. The price of a zero-coupon bond with four years until expiry is going to be more sensitive to changes in market yields than the price of a coupon paying bond issued by the same company with the same term to expiry. B. Holding all other factors constant, the longer the term to expiry, the less sensitive a bond’s price is to changing market yields. C. Holding all other factors constant, the higher the coupon rate, the more sensitive is a bond’s price to changing market yields. D. More than one of the other statements are correct.

- Coupon payments are fixed, but the percentage return that investors receive varies based on market conditions. This percentage return is referred to as the bond’s yield. Q1. Yield to maturity (YTM) is the rate of return expected from a bond held until its maturity date. However, the YTM equals the expected rate of return under certain assumptions. Which of the following is one of those assumptions? a. The bond is callable. b. The probability of default is zero. Consider the case of RTE Inc: Q2. RTE Inc. has 9% annual coupon bonds that are callable and have 18 years left until maturity. The bonds have a par value of $1,000, and their current market price is $1,130.35. However, RTE Inc. may call the bonds in eight years at a call price of $1,060. What are the YTM and the yield to call (YTC) on RTE Inc.’s bonds? Value YTM ? YTC ? Q3. If interest rates are expected to remain constant, what is the best estimate of the remaining life left for RTE Inc.’s bonds? a. 8 years b. 10…Select all of those that are correct: A) prices of zero coupon bonds increase as the time to maturity decreases. B) prices of zero coupon bonds increase as the time to maturity increases. C) prices of zero coupon bonds converge to the bond's face value as maturity approaches. D) prior to maturity, the price of a zero coupon bond is less than the bond's face value. If the current interest rate exceeds the bond’s coupon rate, the bond will sell at a___________. The value of a bond to increase if there is a/an ________ in interest rates. A bond’s coupon rate is more than the interest rate, therefore the bond is selling at a_____________. As interest rate increases the value of a bond will ______________. If the bondholder’s required rate of return equals the coupon interest rate, the bond will sell at _________. A premium bond sells for ____________ as maturity approaches. The discount bond sells for ____________ as maturity approaches. A bondholder with a short-term bond is exposed to ___________ interest rate risk than when owing a long-term bond. When interest rates __________, the market required rates of return ________, and the bond prices will ________. If interest rates increase after a bond issue, the yield-to-maturity will ______,

- Which of the following statements is false? A. Other things being equal, an increase in a bond’s maturity will increase its interest rate risk. B. Other things being equal, an increase in the coupon rate of a bond will decrease its interest rate risk. C. Other things being equal, an increase in a bond’s YTM will decrease its interest rate risk. D. Effective duration is calculated as Macaulay duration divided by one plus the bond’s yield to maturity.Two bonds have same time to maturity and coupon rates. One is callable at 102 and the other is callable at 106. Which one should have lower price? Why?If the current interest rate exceeds the bond’s coupon rate, the bond will sell at a ___________.