Bluestone Ltd has provided the following figures for two investment projects, only one of which may be chosen. Project A Project B £ £ Initial outlay 190,000 170,000 Profit for year 1 55,000 15,000 2 40,000 25,000 3 25,000 45,000 4 10,000 65,000 Estimated resale value at end of year 4 50,000 20,000 Profit is calculated after deducting straight line depreciation. The business has a cost of capital of 10%. a) Calculate the payback period, net present value and accounting rate of return for each project, and provide brief recommendations as to what project needs to be chosen based on the following: The Payback Period. The Accounting Rate of Return/Return on Capital Employed. The Net Present Value.

Bluestone Ltd has provided the following figures for two investment projects, only one of which may be chosen.

| Project A | Project B | ||

| £ | £ | ||

| Initial outlay | 190,000 | 170,000 | |

| Profit for year 1 | 55,000 | 15,000 | |

| 2 | 40,000 | 25,000 | |

| 3 | 25,000 | 45,000 | |

| 4 | 10,000 | 65,000 | |

| Estimated resale value at end of year 4 | 50,000 | 20,000 |

Profit is calculated after deducting straight line

a) Calculate the payback period,

-

The Payback Period.

-

The Accounting Rate of Return/Return on Capital Employed.

-

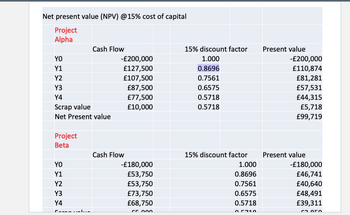

The Net Present Value.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Please calculate the

Can you please write the calculations step by step including the formulas. How did you calculate the Cash flow in order to calculate the cumulative cash flow after that?