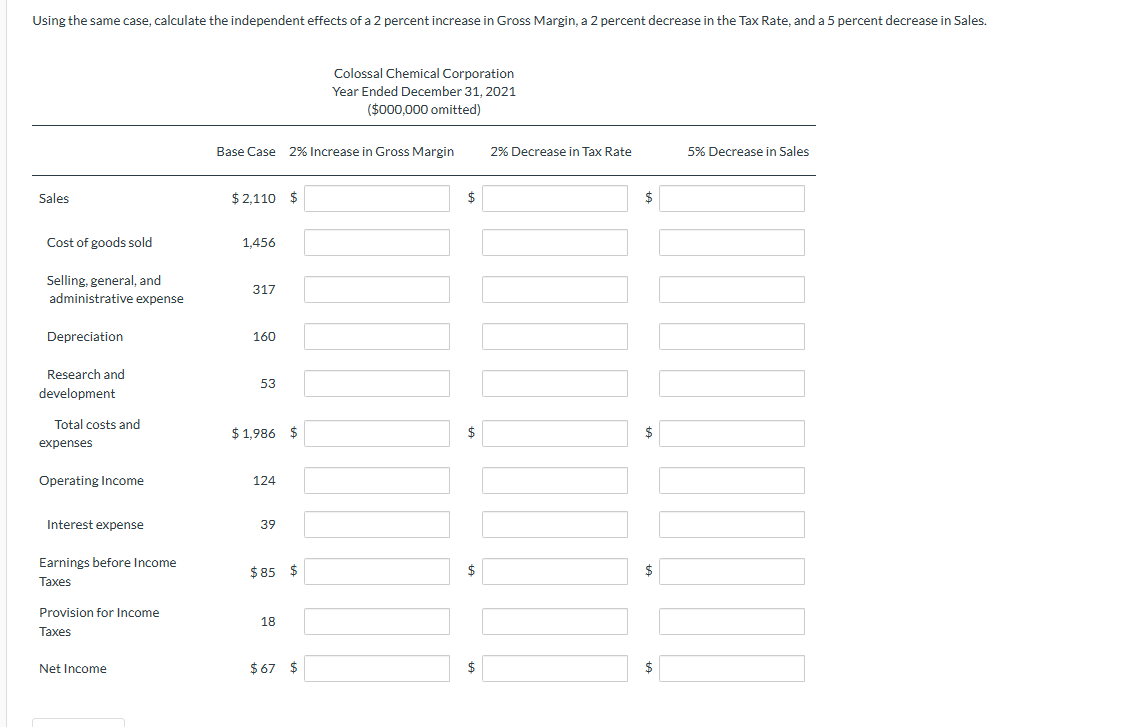

Using the same case, calculate the independent effects of a 2 percent increase in Gross Margin, a 2 percent decrease in the Tax Rate, and a 5 percent decrease in Sales. Sales Cost of goods sold Selling, general, and administrative expense Depreciation Research and development Total costs and expenses Operating Income Interest expense Earnings before Income Taxes Provision for Income Taxes Net Income Base Case 2% Increase in Gross Margin $2,110 $ 1,456 317 160 53 $ 1,986 $ 124 39 $85 $ 18 Colossal Chemical Corporation Year Ended December 31, 2021 ($000,000 omitted) $67 $ $ $ $ 2% Decrease in Tax Rate $ $ $ $ 5% Decrease in Sales

Using the same case, calculate the independent effects of a 2 percent increase in Gross Margin, a 2 percent decrease in the Tax Rate, and a 5 percent decrease in Sales. Sales Cost of goods sold Selling, general, and administrative expense Depreciation Research and development Total costs and expenses Operating Income Interest expense Earnings before Income Taxes Provision for Income Taxes Net Income Base Case 2% Increase in Gross Margin $2,110 $ 1,456 317 160 53 $ 1,986 $ 124 39 $85 $ 18 Colossal Chemical Corporation Year Ended December 31, 2021 ($000,000 omitted) $67 $ $ $ $ 2% Decrease in Tax Rate $ $ $ $ 5% Decrease in Sales

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 1RE: Brandt Corporation had sales revenue of 500,000 for the current year. For the year, its cost of...

Related questions

Question

Transcribed Image Text:For the base case in this section, as a percentage of sales, COGS = 69 percent, SGA = 15 percent, R&D = 2.5 percent. Depreciation, Interest expense are fixed as stated. Tax Rate is 21 percent.

Transcribed Image Text:Using the same case, calculate the independent effects of a 2 percent increase in Gross Margin, a 2 percent decrease in the Tax Rate, and a 5 percent decrease in Sales.

Sales

Cost of goods sold

Selling, general, and

administrative expense

Depreciation

Research and

development

Total costs and

expenses

Operating Income

Interest expense

Earnings before Income

Taxes

Provision for Income

Taxes

Net Income

Base Case 2% Increase in Gross Margin

$2,110 $

1,456

317

160

53

$1,986 $

124

39

$85 $

18

Colossal Chemical Corporation

Year Ended December 31, 2021

($000,000 omitted)

$67 $

$

$

$

$

2% Decrease in Tax Rate

$

$

$

$

5% Decrease in Sales

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning