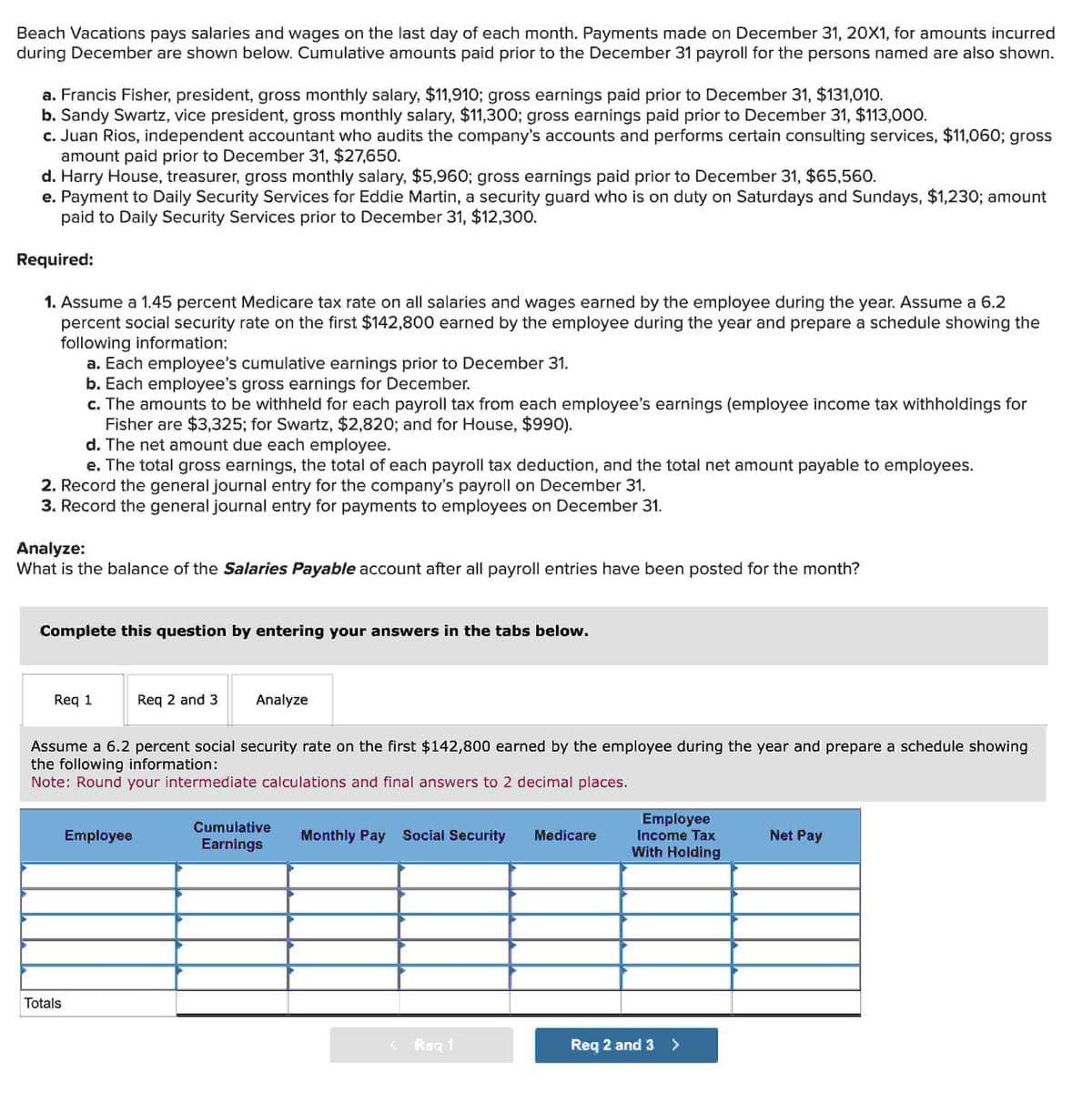

Beach Vacations pays salaries and wages on the last day of each month. Payments made on December 31, 20X1, for amounts incurre during December are shown below. Cumulative amounts paid prior to the December 31 payroll for the persons named are also shown a. Francis Fisher, president, gross monthly salary, $11,910; gross earnings paid prior to December 31, $131,010. b. Sandy Swartz, vice president, gross monthly salary, $11,300; gross earnings paid prior to December 31, $113,000. c. Juan Rios, independent accountant who audits the company's accounts and performs certain consulting services, $11,060; gross amount paid prior to December 31, $27,650. d. Harry House, treasurer, gross monthly salary, $5,960; gross earnings paid prior to December 31, $65,560. e. Payment to Daily Security Services for Eddie Martin, a security guard who is on duty on Saturdays and Sundays, $1,230; amount paid to Daily Security Services prior to December 31, $12,300. Required: 1. Assume a 1.45 percent Medicare tax rate on all salaries and wages earned by the employee during the year. Assume a 6.2 percent social security rate on the first $142,800 earned by the employee during the year and prepare a schedule showing the following information: a. Each employee's cumulative earnings prior to December 31. b. Each employee's gross earnings for December. c. The amounts to be withheld for each payroll tax from each employee's earnings (employee income tax withholdings for Fisher are $3,325; for Swartz, $2,820; and for House, $990). d. The net amount due each employee. e. The total gross earnings, the total of each payroll tax deduction, and the total net amount payable to employees. 2. Record the general journal entry for the company's payroll on December 31. 3. Record the general journal entry for payments to employees on December 31. Analyze: What is the balance of the Salaries Payable account after all payroll entries have been posted for the month?

Beach Vacations pays salaries and wages on the last day of each month. Payments made on December 31, 20X1, for amounts incurre during December are shown below. Cumulative amounts paid prior to the December 31 payroll for the persons named are also shown a. Francis Fisher, president, gross monthly salary, $11,910; gross earnings paid prior to December 31, $131,010. b. Sandy Swartz, vice president, gross monthly salary, $11,300; gross earnings paid prior to December 31, $113,000. c. Juan Rios, independent accountant who audits the company's accounts and performs certain consulting services, $11,060; gross amount paid prior to December 31, $27,650. d. Harry House, treasurer, gross monthly salary, $5,960; gross earnings paid prior to December 31, $65,560. e. Payment to Daily Security Services for Eddie Martin, a security guard who is on duty on Saturdays and Sundays, $1,230; amount paid to Daily Security Services prior to December 31, $12,300. Required: 1. Assume a 1.45 percent Medicare tax rate on all salaries and wages earned by the employee during the year. Assume a 6.2 percent social security rate on the first $142,800 earned by the employee during the year and prepare a schedule showing the following information: a. Each employee's cumulative earnings prior to December 31. b. Each employee's gross earnings for December. c. The amounts to be withheld for each payroll tax from each employee's earnings (employee income tax withholdings for Fisher are $3,325; for Swartz, $2,820; and for House, $990). d. The net amount due each employee. e. The total gross earnings, the total of each payroll tax deduction, and the total net amount payable to employees. 2. Record the general journal entry for the company's payroll on December 31. 3. Record the general journal entry for payments to employees on December 31. Analyze: What is the balance of the Salaries Payable account after all payroll entries have been posted for the month?

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter8: Employer Taxes, Payments, And Reports

Section: Chapter Questions

Problem 4E

Related questions

Question

Transcribed Image Text:Beach Vacations pays salaries and wages on the last day of each month. Payments made on December 31, 20X1, for amounts incurred

during December are shown below. Cumulative amounts paid prior to the December 31 payroll for the persons named are also shown.

a. Francis Fisher, president, gross monthly salary, $11,910; gross earnings paid prior to December 31, $131,010.

b. Sandy Swartz, vice president, gross monthly salary, $11,300; gross earnings paid prior to December 31, $113,000.

c. Juan Rios, independent accountant who audits the company's accounts and performs certain consulting services, $11,060; gross

amount paid prior to December 31, $27,650.

d. Harry House, treasurer, gross monthly salary, $5,960; gross earnings paid prior to December 31, $65,560.

e. Payment to Daily Security Services for Eddie Martin, a security guard who is on duty on Saturdays and Sundays, $1,230; amount

paid to Daily Security Services prior to December 31, $12,300.

Required:

1. Assume a 1.45 percent Medicare tax rate on all salaries and wages earned by the employee during the year. Assume a 6.2

percent social security rate on the first $142,800 earned by the employee during the year and prepare a schedule showing the

following information:

a. Each employee's cumulative earnings prior to December 31.

b. Each employee's gross earnings for December.

c. The amounts to be withheld for each payroll tax from each employee's earnings (employee income tax withholdings for

Fisher are $3,325; for Swartz, $2,820; and for House, $990).

d. The net amount due each employee.

e. The total gross earnings, the total of each payroll tax deduction, and the total net amount payable to employees.

2. Record the general journal entry for the company's payroll on December 31.

3. Record the general journal entry for payments to employees on December 31.

Analyze:

What is the balance of the Salaries Payable account after all payroll entries have been posted for the month?

Complete this question by entering your answers in the tabs below.

Req 1

Req 2 and 3

Analyze

Assume a 6.2 percent social security rate on the first $142,800 earned by the employee during the year and prepare a schedule showing

the following information:

Note: Round your intermediate calculations and final answers to 2 decimal places.

Totals

Employee

Employee

Cumulative

Earnings

Monthly Pay Social Security

Medicare

Income Tax

With Holding

Net Pay

<Rag 1

Req 2 and 3 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning