Concept explainers

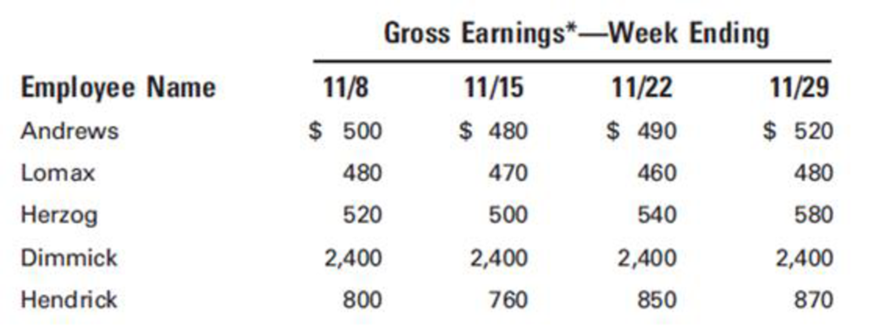

An analysis of the payroll for the month of November for CinMar Inc. reveals the information shown:

*All regular time

Andrews, Lomax, and Herzog are production workers, and Dimmick is the plant manager. Hendrick is in charge of the office.

Cumulative earnings paid (before deductions) in this calendar year prior to the payroll period ending November 8 were as follows: Andrews, $21,200; Lomax, $6,800; Herzog, $11,500; Dimmick, $116,200; and Hendrick, $32,800.

The solution to this problem requires the following forms, using the indicated column headings:

- 1. Prepare an employee earnings record for each of the five employees.

- 2. Prepare a payroll record for each of the four weeks.

- 3. Prepare a labor cost summary for the month.

- 4. Prepare

journal entries to record the following:- a. The payroll for each of the four weeks.

- b. The payment of wages for each of the four payrolls.

- c. The distribution of the monthly labor costs per the labor cost summary.

- d. The company's payroll taxes covering the four payroll periods.

1.

Organize an employee earning record for each employee of C Company.

Explanation of Solution

Payroll Account:

A payroll account is a separate checking account for the company to record the payment of the payroll checks to their employees. A payroll account includes the money a company pays to their employees like salaries, wages, bonuses and withheld taxes.

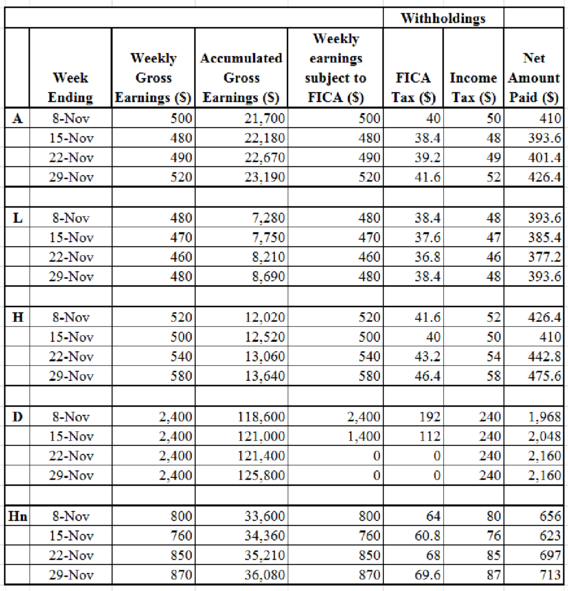

Employee Earning Records

Table.1

2.

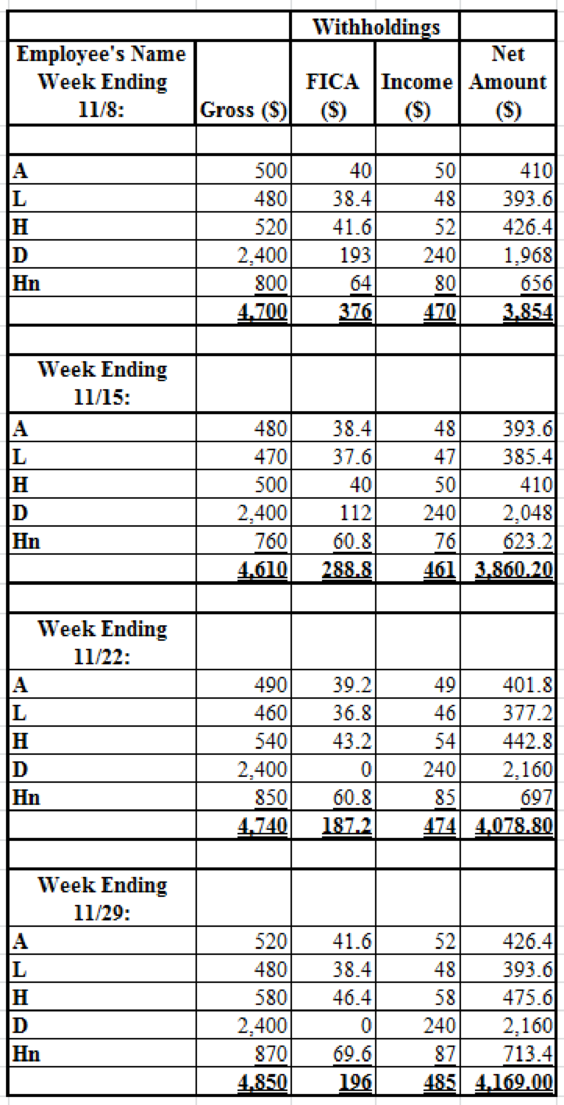

Organize a payroll record for each of the four weeks of C Company.

Explanation of Solution

Table.2

3.

Prepare a labor cost summary for C Company for the entire month of November

Explanation of Solution

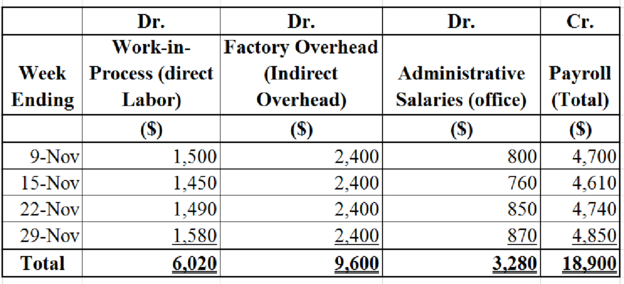

Table.3

4.

Journalize the following transactions of C Company.

Explanation of Solution

a.

Pass journal entries to record the payroll for each of the four weeks.

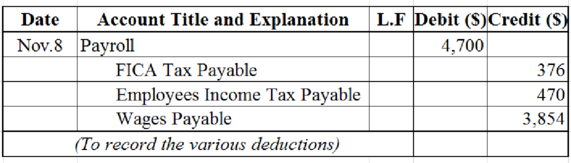

Table.4

- Payroll account is an expense account and it increased. Therefore, debit the payroll account by $4,700.

- FICA tax is a liability account and it increased. Therefore, credit the FICA tax payable account by $376.

- Employee’s income tax is a liability account and it increased. Therefore, credit the employee’s income tax payable account by $470.

- Wages payable is a liability account and it increased. Therefore, credit the wages payable account by $ 3,854.

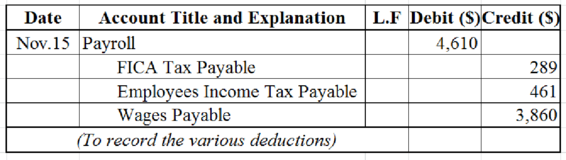

Table.5

- Payroll account is an expense account and it increased. Therefore, debit the payroll account by $4,610.

- FICA tax is a liability account and it increased. Therefore, credit the FICA tax payable account by $289.

- Employee’s income tax is a liability account and it increased. Therefore, credit the employee’s income tax payable account by $461.

- Wages payable is a liability account and it increased. Therefore, credit the wages payable account by $ 3,860.

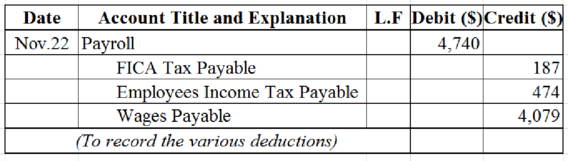

Table.6

- Payroll account is an expense account and it increased. Therefore, debit the payroll account by $4,740.

- FICA tax is a liability account and it increased. Therefore, credit the FICA tax payable account by $187.

- Employee’s income tax is a liability account and it increased. Therefore, credit the employee’s income tax payable account by $474.

- Wages payable is a liability account and it increased. Therefore, credit the wages payable account by $4,049.

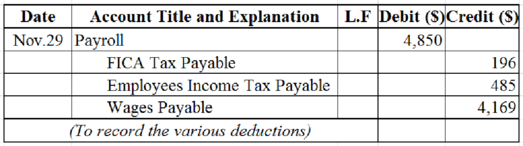

Table.7

- Payroll account is an expense account and it increased. Therefore, debit the payroll account by $4,850.

- FICA tax is a liability account and it increased. Therefore, credit the FICA tax payable account by $196.

- Employee’s income tax is a liability account and it increased. Therefore, credit the employee’s income tax payable account by $485.

- Wages payable is a liability account and it increased. Therefore, credit the wages payable account by $ 4,169.

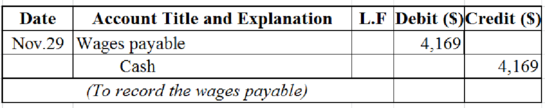

b.

Pass journal entries to record the payment of wages for each of the four weeks.

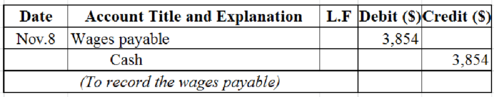

Table.8

- Wages payable is a liability account and it increased. Therefore, debit the wages payable account by $3,854.

- Cash is an asset account and it decreased. Therefore, credit the cash account by $3,854.

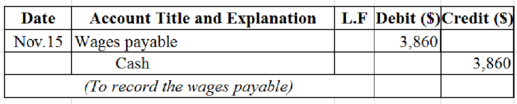

Table.9

- Wages payable is a liability account and it increased. Therefore, debit the wages payable account by $3,860.

- Cash is an asset account and it decreased. Therefore, credit the cash account by $3,860.

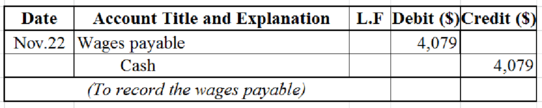

Table.10

- Wages payable is a liability account and it increased. Therefore, debit the wages payable account by $4,079.

- Cash is an asset account and it decreased. Therefore, credit the cash account by $4,079.

Table.11

- Wages payable is a liability account and it increased. Therefore, debit the wages payable account by $4,169.

- Cash is an asset account and it decreased. Therefore, credit the cash account by $4,169.

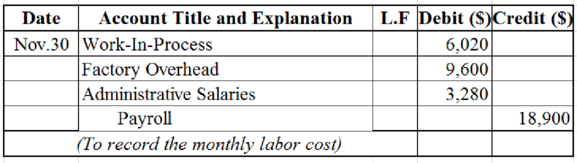

c.

Pass journal entry to record the distribution of monthly labor cost per the labor cost summary.

Table.13

- Work-in-Process is an asset account and it increased. Therefore debit the work-in-process account by $6,020.

- Factory overhead is a liability account and it increased. Therefore, debit the factory overhead account by $9,600.

- Administrative salaries are and expense account and it increased. Therefore, debit the administrative salaries account by $3,280.

- Payroll account is an expense account and it decreased. Therefore, credit the payroll account by $18,900.

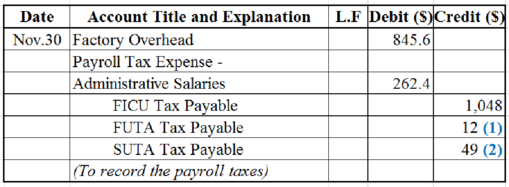

d.

Pass journal entries to record the payroll taxes of C Company that covers the four payroll periods.

Table.13

Working Notes:

(1) Compute the value of FUTA tax payable.

(2) Compute the value of SUTA tax payable.

- Factory overhead is an expense account and it increased. Therefore, debit the factory overhead account by $845.6.

- Administrative salaries are an expense account and it increased. Therefore, debit the administrative salaries account by $262.4.

- FICU tax is a liability account and it increased. Therefore, credit the FICU tax payable account by $1,048.

- FUTA tax is a liability account and it increased. Therefore, credit the FICU tax payable account by $12.

- SUTA tax is a liability account and it increased. Therefore, credit the FICU tax payable account by $49.

Want to see more full solutions like this?

Chapter 3 Solutions

Principles of Cost Accounting

- The total wages and salaries earned by all employees of Langen Electronics, Ltd. during March, as shown in the labor cost summary and the schedule of fixed administrative and sales salaries, are classified as follows: a. Prepare a journal entry to distribute the wages earned during March. b. What is the total amount of payroll taxes that will be imposed on the employer for the payroll, assuming that two administrative employees with combined earnings this period of 3,000 have exceeded 8,000 in earnings prior to the period?arrow_forwardA review of the accounting records of Adams Manufacturing indicated that the company incurred the following payroll costs during the month of March. Assume the company's financial statements are prepared in accordance with GAAP. Salary of the company president—$32,100. Salary of the vice president of manufacturing—$16,500. Salary of the chief financial officer—$18,800. Salary of the vice president of marketing—$15,300. Salaries of middle managers (department heads, production supervisors) in manufacturing plant—$187,000. Wages of production workers—$933,000. Salaries of administrative secretaries—$106,000. Salaries of engineers and other personnel responsible for maintaining production equipment—$179,000. Commissions paid to sales staff—$247,000. What amount of payroll cost would be classified as SG&A expense? Assuming that Adams made 3,300 units of product and sold 2,805 of them during the month of March, determine the amount of payroll cost that would be…arrow_forwardA review of the accounting records of Solomon Manufacturing indicated that the company incurred the following payroll costs during the month of March. Assume the company's financial statements are prepared in accordance with GAAP. 1. Salary of the company president-$32,100. 2. Salary of the vice president of manufacturing-$16,200. 3. Salary of the chief financial officer-$17,900. 4. Salary of the vice president of marketing-$16,000. 5. Salaries of middle managers (department heads, production supervisors) in manufacturing plant-$202,000. 6. Wages of production workers-$935,000. 7. Salaries of administrative secretaries-$104,000. 8. Salaries of engineers and other personnel responsible for maintaining production equipment-$172,000. 9. Commissions paid to sales staff-$243,000. Required a. What amount of payroll cost would be classified as SG&A expense? b. Assuming that Solomon made 4,900 units of product and sold 4,165 of them during the month of March, determine the amount of payroll…arrow_forward

- A review of the accounting records of Campbell Manufacturing indicated that the company incurred the following payroll costs during the month of March. Assume the company's financial statements are prepared in accordance with GAAP. 1. Salary of the company president-$32,300. 2. Salary of the vice president of manufacturing-$15,700. 3. Salary of the chief financial officer-$19,200. 4. Salary of the vice president of marketing-$15,700. 5. Salaries of middle managers (department heads, production supervisors) in manufacturing plant-$199,000. 6. Wages of production workers-$940,000. 7. Salaries of administrative secretaries-$102,000. 8. Salaries of engineers and other personnel responsible for maintaining production equipment-$169,000. 9. Commissions paid to sales staff-$260,000. Required a. What amount of payroll cost would be classified as SG&A expense? b. Assuming that Campbell made 4,500 units of product and sold 3,825 of them during the month of March, determine the amount of payroll…arrow_forwardA review of the accounting records of Stuart Manufacturing indicated that the company incurred the following payroll costs during the month of March. Assume the company's financial statements are prepared in accordance with GAAP. 1. Salary of the company president-$31,200. 2. Salary of the vice president of manufacturing-$16,600. 3. Salary of the chlef financial officer-$17,900. 4. Salary of the vice president of marketing-$15,900. 5. Salaries of middle managers (department heads, production supervisors) in manufacturing plant-$194,000. 6. Wages of production workers-$937,000. 7. Salaries of administrative personnel-$105,000. 8. Salaries of engineers and other personnel responsible for maintaining production equipment-$173,000. 9. Commissions paid to sales staff-$252,000. Required a. What amount of payroll cost would be classified as SG&A (selling, general, and administrative) expense? b. Assuming that Stuart made 3,600 units of product and sold 3,240 of them during the month of March,…arrow_forwardA review of the accounting records of Baird Manufacturing indicated that the company incurred the following payroll costs during the month of March. Assume the company's financial statements are prepared in accordance with GAAP. 1. Salary of the company president-$75,000. 2. Salary of the vice president of manufacturing-$50,000. 3. Salary of the chief financial officer-$42,000. 4. Salary of the vice president of marketing-$40,000. 5. Salaries of middle managers (department heads, production supervisors) in manufacturing plant-$147,000. 6. Wages of production workers-$703,500. 7. Salaries of administrative secretaries-$60,000. 8. Salaries of engineers and other personnel responsible for maintaining production equipment-$133,500. 9. Commissions paid to sales staff-$146,000. Required a. What amount of payroll cost would be classified as SG&A expense? b. Assuming that Baird made 5,000 units of product and sold 4,000 of them during the month of March, determine the amount of payroll cost…arrow_forward

- A review of the accounting records of Finch Manufacturing indicated that the company incurred the following payroll costs during the month of March. Assume the company's financial statements are prepared in accordance with GAAP. 1. Salary of the company president—$32,300.2. Salary of the vice president of manufacturing—$16,700.3. Salary of the chief financial officer—$19,000.4. Salary of the vice president of marketing—$14,900.5. Salaries of middle managers (department heads, production supervisors) in manufacturing plant—$189,000.6. Wages of production workers—$929,000.7. Salaries of administrative secretaries—$105,000.8. Salaries of engineers and other personnel responsible for maintaining production equipment—$183,000.9. Commissions paid to sales staff—$243,000. Requireda. What amount of payroll cost would be classified as SG&A expense?b. Assuming that Finch made 3,400 units of product and sold 3,060 of them during the month of March, determine the amount of payroll cost…arrow_forwardA review of the accounting records of Rundle Manufacturing indicated that the company incurred the following payroll costs during the month of March. Assume the company's financial statements are prepared in accordance with GAAP. 1. Salary of the company president-$31,400. 2. Salary of the vice president of manufacturing-$16,100. 3. Salary of the chief financial officer-$18,000. 4. Salary of the vice president of marketing-$15,600. 5. Salaries of middle managers (department heads, production supervisors) in manufacturing plant-$204,000. 6. Wages of production workers-$945,000. 7. Salaries of administrative secretaries-$103,000. 8. Salaries of engineers and other personnel responsible for maintaining production equipment-$169,000. 9. Commissions paid to sales staff-$255,000. Required a. What amount of payroll cost would be classified as SG&A expense? b. Assuming that Rundle made 3,300 units of product and sold 2,475 of them during the month of March, determine the amount of payroll cost…arrow_forwardMcLoyd Company completed the salaries and wages payroll for March. The payroll provided the following details: Salaries and wages earned Employee income taxes withheld FICA taxes withheld Unemployment taxes $ 550,000 50,875 39,325 3,825 Required: 1. Considering both employee and employer payroll taxes, use the preceding information to calculate the total labor cost for the company for March. 2. & 3. Prepare the journal entry to record the payroll for March, including employee deductions (but excluding employer payroll taxes) and record employer's FICA taxes and unemployment taxes.arrow_forward

- During the first full week of 20--, the Payroll Department of Quigley Corporation is preparing the Forms W-2 for distribution to its employees along with their payroll checks on January 10. In this problem, you will complete six of the forms in order to gain some experience in recording the different kinds of information required. Assume each employee earned the same weekly salary for each of the 52 paydays in 20--, the previous year. Using the following information obtained from the personnel and payroll records of the firm, complete Copy A of the last two Forms W-2 reproduced below. Also complete Form W-3. This is the second half of the problem that began with (PR.04.13A.Part1). You will need the data from the first four W-2s on Part 1, along with the two W-2s in this problem to complete the Form W-3. The form is to be signed by the president, Kenneth T. Ford, and is prepared by Ralph I. Volpe. Company Information: Address: 4800 River Road Philadelphia, PA 19113-5548…arrow_forwardMcLoyd Company completed the salaries and wages payroll for March. The payroll provided the following details: Salaries and wages earned $ 570,000 Employee income taxes withheld 52,725 FICA taxes withheld 40,755 Unemployment taxes 3,965 Required: 1. Considering both employee and employer payroll taxes, use the preceding information to calculate the total labor cost for the company for March. 2, & 3. Prepare the journal entry to record the payroll for March, including employee deductions (but excluding employer payroll taxes) and record employer’s FICA taxes and unemployment taxes. Employees were paid in March but amounts withheld were not yet remitted.arrow_forwardIn the Illustrative Case in this chapter, payroll transactions for Brookins Company were analyzed, journalized, and posted for the third quarter of the fiscal year. In this problem, you are to record the payroll transactions for the last quarter of the firm's fiscal year. The last quarter begins on April 1, 20--. Narrative of Transactions: Apr. 1. Paid the treasurer of the union the amount of union dues withheld from workers' earnings during March. 15. Payroll: $6,105. All wages and salaries taxable. Withheld $565 for federal income taxes, $107.32 for state income taxes, and $50 for union dues. 15. Paid the treasurer of the state the amount of state income taxes withheld from workers' earnings during the first quarter. 15. Electronically transferred funds to remove the liability for FICA taxes and employees' federal income taxes withheld on the March payrolls. 29. Payroll: $5,850. All wages and salaries taxable. Withheld $509 for federal income taxes,…arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning