Traditional and Contribution Format Income Statements.

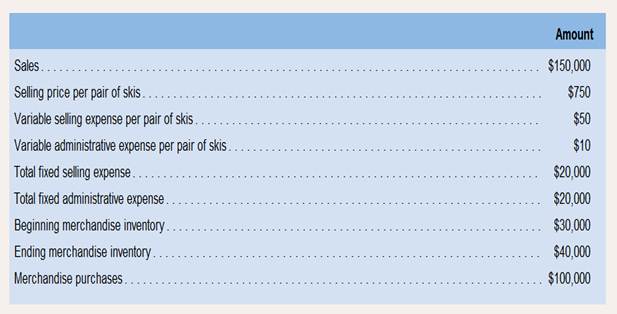

The Alpine House, Inc., is a large retailer of snow skis. The company assembled the information shown below for the quarter ended March 31:

Required:

1. Prepare a traditional income statement for the quarter ended March 31.

2. Prepare a contribution format income statement for the quarter ended March 31.

3. What was the contribution margin per unit?

1)

Traditional Income Statement

- Traditional Income Statement records the costs of goods manufactured for a particular reporting period by classifying the costs into direct and indirect costs

- Direct costs are variable in nature. Examples: Direct Materials, Direct Labor etc.

- Indirect costs are costs incurred for selling and administrative purposes such as Salary of staff, warehouse rent etc.

- The profit or loss of operations is carried forward to the next period

To Prepare:

Traditional Income Statement for the quarter ended 31 March

Answer to Problem 15E

Solution:

| Particulars | Amount | Particulars | Amount |

| Beginning Merchandise Inventory | $30,000 | Sales | $150,000 |

| Merchandise Purchases | $100,000 | Ending Merchandise Inventory | $40,000 |

| Variable Selling Expense | $10,000 | ||

| Fixed Selling Expense | $20,000 | ||

| Variable Administrative Expense | $2,000 | ||

| Fixed Administrative Expense | $20,000 | ||

| Profit | $8,000 | ||

| $190,000 | $190,000 |

Explanation of Solution

- Given: Sales = $150,000

Sales Price per unit = $750

Variable Selling Expense per unit = $50

Variable Administrative Expense per unit = $10

Formula Used:

- Calculations:

Variable Selling Expense = 200 @$50 = $10,000

Variable Administrative Expense = 200 @$10 = $2,000

- Variable costs are costs that are impacted by the volume of goods produced and have a direct correlation with the number of goods produced.

- Fixed costs are costs that have to be incurred irrespective of the volume of goods produced.

- The costs and revenues are recorded in the income statement for the quarter ended 31 March

- The costs consist of the Variable as well as Fixed costs and the cost of purchases

- The difference in the Beginning and Ending Inventory is also considered for calculation of Profit or Loss

Hence the traditional income statement for the quarter ended 31 March is prepared.

2)

Contribution and Fixed and Variable Costs in Manufacturing

- Variable costs refer to the costs of manufacture that have a direct co-relation with the volume of the goods manufactured, i.e. the costs increase with an increase in the goods produced.

- Examples are costs of direct material and direct labor.

- Fixed costs refer to the costs of manufacture that have an inverse co-relation with the volume of the goods manufactured, i.e. the costs decrease with an increase in the goods produced.

- Examples are costs of factory rent, depreciation on plant and equipment

- Manufacturing costs are costs that are directly incurred in connection with manufacture of goods.

- Examples are Direct materials and Manufacturing Overhead

- Contribution is the difference between the Sales revenue and the Variable cost per unit. This is an indicator of the contribution of the goods manufactured to the profit and bottom line of the organization.

To Prepare:

Contribution Income statement for the quarter ended 31 March

Answer to Problem 15E

Solution:

| Particulars | Per unit | Total |

| Sales | 750 | 150000 |

| Direct Materials | 500 | $100,000 |

| Variable Selling Expense | 50 | $10,000 |

| Variable Administrative Expense | 10 | $2,000 |

| Contribution | 190 | $38,000 |

| Fixed Selling Expense | $20,000 | |

| Fixed Administrative Expense | $20,000 | |

| Profit / (Loss) | ($2,000) |

Explanation of Solution

- Given:

Sales = $150,000

Sales Price per unit = $750

Variable Selling Expense per unit = $50

Variable Administrative Expense per unit = $10 Purchases = $100,000

- Formula Used:

Calculations:

- Variable Selling Expense = 200 @$50 = $10,000

Variable Administrative Expense = 200 @$10 = $2,000

Direct Materials = $100,000 / 200 = $500 per unit

Contribution = $150,000 - $100,000 - $10,000 - $2,000 = $38,000

- Variable costs are costs that are impacted by the volume of goods produced and have a direct correlation with the number of goods produced.

- Fixed costs are costs that have to be incurred irrespective of the volume of goods produced.

- The costs considered for calculation of contribution are variable costs.

- Contribution is the difference between the Sales and Variable Costs including cost of Materials

Hence the contribution format income statement has been prepared for the quarter ended 31 March.

3)

Contribution and Fixed and Variable Costs in Manufacturing

- Variable costs refer to the costs of manufacture that have a direct co-relation with the volume of the goods manufactured, i.e. the costs increase with an increase in the goods produced.

- Examples are costs of direct material and direct labor.

- Fixed costs refer to the costs of manufacture that have an inverse co-relation with the volume of the goods manufactured, i.e. the costs decrease with an increase in the goods produced.

- Examples are costs of factory rent, depreciation on plant and equipment

- Manufacturing costs are costs that are directly incurred in connection with manufacture of goods.

- Examples are Direct materials and Manufacturing Overhead

- Contribution is the difference between the Sales revenue and the Variable cost per unit. This is an indicator of the contribution of the goods manufactured to the profit and bottom line of the organization.

Contribution Margin Per unit

Answer to Problem 15E

Solution:

The contribution Margin per unit is $190

Explanation of Solution

Sales = $150,000

Sales Price per unit = $750

Variable Selling Expense per unit = $50

Variable Administrative Expense per unit = $10 Purchases = $100,000

Formula Used:

Calculations:

- Variable Selling Expense = 200 @ $50 = $10,000

Variable Administrative Expense = 200 @$10 = $2,000

Direct Materials = $100,000 / 200 = $500 per unit

Contribution = $150,000 - $100,000 - $10,000 - $2,000 = $38,000

| Particulars | Per unit | Total |

| Sales | 750 | 150000 |

| Direct Materials | 500 | $100,000 |

| Variable Selling Expense | 50 | $10,000 |

| Variable Administrative Expense | 10 | $2,000 |

| Contribution | 190 | $38,000 |

- The costs considered for calculation of contribution are variable costs.

- Contribution is the difference between the Sales and Variable Costs including cost of Materials

- Contribution per unit is the total Contribution divided by the Units Produced.

Hence the Contribution margin per unit is calculated.

Want to see more full solutions like this?

Chapter 1 Solutions

Introduction To Managerial Accounting

- Using the information in the previous exercises about Marleys Manufacturing, determine the operating income for department B, assuming department A sold department B 1,000 units during the month and department A reduces the selling price to the market price.arrow_forward2.Question 5 pts Sees Corp., a merchandising company, reported the following results for July. Cost of Goods Sold 276,213 Fixed selling and administrative expense 55,665 Sales Revenue 541,967 ar sign or the calculat Variable selling and administrative expense 56,728 This question is independent of all other questions. Please use only the information in this question to calculate the answer. Based on the information provided above, calculate the Contribution Margin for July. Cost of Goods Sold is a variable cost in this company. Enter only the amount of the Contribution Margin in the box provided below. Enter the amount only. Do not enter letters, words, or the calculation. ministrativ THHE ning A or gaitas vd s on il grinismoy sal 10 nudi zaol at zinvonis visas worla of 313 Loy 15 of gollesio 30 enoilointantis welarrow_forwardPresented here is the income statement for Big Sky Incorporated for the month of February: Sales $ 60,000 Cost of goods sold 51,900 Gross profit $ 8, 100 Operating expenses 15,200 Operating loss $ (7,100) Based on an analysis of cost behavior patterns, it has been determined that the company's contribution margin ratio is 19%. Required: Rearrange the preceding income statement to the contribution margin format. If sales increase by 10%, what will be the firm's operating income (or loss)? Calculate the amount of revenue required for Big Sky to break even.arrow_forward

- 7. What is the factory cost per case if Pro-Leather manufactured 19,200 cases for tablets for the year?8. How does the format of the income statement for a manufacturing concern differ from the income statement of a merchandising entity?arrow_forwardCost of Goods Sold, Profit margin, and Net Income for a Manufacturing Company The following information is available for Bandera Manufacturing Company for the month ending January 31: Cost of goods manufactured elling expenses dministrative expenses ales inished goods inventory, January 1 inished goods inventory, January 31 . For the month ended January 31, determine Bandera Manufacturing's cost of goods sold. Bandera Manufacturing Company Cost of Goods Sold January 31 . For the month ended January 31, determine Bandera Manufacturing's gross profit. Bandera Manufacturing Company Gross Profit January 31 . For the month ended January 31, determine Bandera Manufacturing's net income. Bandera Manufacturing Company Net Income January 31 $167,280 55,880 29,540 355,910 40,220 36,660 Operating expenses: Total operating expenses 100arrow_forwardWest Island distributes a single product. The companys sales and expenses for the month of June are shown. Using the information presented, answer these questions: A. What is the break-even point in units sold and dollar sales? B. What is the total contribution margin at the break-even point? C. If West Island wants to earn a profit of $21,000, how many units would they have to sell? D. Prepare a contribution margin income statement that reflects sales necessary to achieve the target profit.arrow_forward

- Fanelli Corporation, a merchandising company, reported the following results for July: Number of units sold Selling price per unit Unit cost of goods sold 5,400 $ 590 $ 406 Variable selling expense per unit Total fixed selling expense Variable administrative expense per unit Total fixed administrative expense Cost of goods sold is a variable cost in this company. Required: a. Prepare a traditional format income statement for July. b. Prepare a contribution format income statement for July. Complete this question by entering your answers in the tabs below. Required A Required B Prepare a traditional format income statement for July. Fanelli Corporation For the month of July Traditional Income Statement Selling and administrative expenses: $ 58 $ 124,900 $ 28 $ 206,800arrow_forwardSales Selling price per pair of skis Variable selling expense per pair of skis Variable administrative expense per pair of skis Total fixed selling expense Total fixed administrative expense Beginning merchandise inventory Ending merchandise inventory Merchandise purchases Required: 1. Prepare a traditional income statement for the quarter ended March 31. 2. Prepare a contribution format income statement for the quarter ended March 31. 3. What was the contribution margin per unit? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare a traditional income statement for the quarter ended March 31. The Alpine House, Incorporated Traditional Income Statement 138 25 Cost of goods sold Gross margin Selling and administrative expenses: Selling expenses Administrative expenses 1 Required 3 Net operating income $ 1,470,000 $ 420 49 $16 $ 135,000 $ 110,000 HON 1.470 000 $ 65,000 $ 115,000 $ 320,000 0arrow_forwardMorning Company reports the following information for March: E (Click the icon to view the data.) Read the requirements. Requirement 1. Calculate the gross profit and operating income for March using absorption costing. Morning Company Income Statement (Absorption Costing) For the Month Ended March 31 Data Table Net Sales Revenue 67,850 Variable Cost of Goods Solłd 19,300 Operating income Fixed Cost of Goods Sold 8,400 Variable Selfing and Administrative Costs 16,500 Requirements Fixed Selling and Administrative Costs 3,800 1. Calculate the gross profit and operating income for March using absorption costing. 2. Calculate the contribution margin and operating income for March using variable costing. Print Donearrow_forward

- Smithen Company, a wholesale distributor, has been operating for only a few months. The company sells three products-sinks, mirrors, and vanities. Budgeted sales by product and in total for the coming month are shown below based on planned unit sales as follows: Sinks Mirrors Vanities Total Units 1,000 500 500 2,000 Percentage of total sales Sales Variable expenses Contribution margin Contribution margin per unit Fixed expenses Operating income Break-even point in unit sales: Percentage sex 25% 25% 100% Break-even point in sales dollars: Total Fixed expenses. Weighted-average CM per unit Sinks 48% Product Mirrors 20% $264,000 100.00% $110,000 100.00% $176,000 100.00% $550,000 100.00% 80,000 30.30% 72,000 65.45% 82,000 46.59% 219,300 39.87% 53.41% 60.13% $184,000 $ 94,000 330,700 69.70% 38,000 34.55% S 76.00 $ 184.00 $ 188.00 Fixed expenses Overall CM ratio $293,300 $158.00 Vanities 32% $293,300 0.60 1,856.33 units Total 100% 293,300 $ 37,400 = $487,798.61 *($184.00 0.50) + ($76.00 x…arrow_forwardAccounting Questionarrow_forwardLucido Products markets two computer games: Claimjumper and Makeover. A contribution format incomestatement for a recent month for the two games appears below:Claimjumper Makeover TotalSales ............................................ $30,000 $70,000 $100,000Variable expenses ...................... 20,000 50,000 70,000Contribution margin ..................... $10,000 $20,000 30,000Fixed expenses .......................... 24,000Net operating income .................. $ 6,000Required:1. Compute the overall contribution margin (CM) ratio for the company.2. Compute the overall break-even point for the company in sales dollars.3. Verify the overall break-even point for the company by constructing a contribution format incomestatement showing the appropriate levels of sales for the two products.arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub