Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN: 9781305654174

Author: Gary A. Porter, Curtis L. Norton

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 1, Problem 1.8P

Statement of

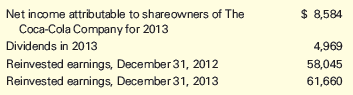

The Coca-Cola Company and Subsidiaries reported the following amounts in various statements included in its Form 10-K for the year ended December 31, 2013. (All amounts are stated in millions of dollars.)

Required

- Prepare a statement of retained earnings for The Coca-Cola Company for the year ended December 31, 2013.

- The Coca-Cola Company does not actually present a statement of retained earnings in its annual report. Instead, it presents a broader statement of shareholders’ equity. Describe the information that would be included on this statement that is not included on a statement of retained earnings.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Preparing a corporate income statement

ABC Corporation's accounting records include the following items, listed in no particular order, at December 31, 2018:

The income tax rate for ABC Corporation is 39%.

Prepare ABC’s income statement for the year ended December 31, 2018. Omit earnings per share. Use the multi-step format.

Sandhill Corporation recently filed the following financial statements with the SEC.

Sandhill CorporationIncome Statement for the FiscalYear Ended July 31, 2017

Net sales

$83,489

Cost of products sold

59,385

Gross profit

$24,104

Selling, general, and administrative expenses

10,640

Depreciation

1,208

Operating income (loss)

$12,256

Interest expense

740

Earnings (loss) before income taxes

$11,516

Income taxes

4,031

Net earnings (loss)

$7,485

What are the company’s current ratio and quick ratio? (Round answers to 2 decimal places, e.g. 52.75.)

Current ratio

Quick ratio

Pharoah Corporation recently filed the following financial statements with the SEC.

Pharoah CorporationIncome Statement for the FiscalYear Ended July 31, 2017

Net sales

$77,630

Cost of products sold

55,218

Gross profit

$22,412

Selling, general, and administrative expenses

9,893

Depreciation

1,124

Operating income (loss)

$11,395

Interest expense

688

Earnings (loss) before income taxes

$10,707

Income taxes

3,748

Net earnings (loss)

$6,959

What are the company’s current ratio and quick ratio? (Round answers to 2 decimal places, e.g. 52.75.)

Current ratio

Quick ratio

Chapter 1 Solutions

Financial Accounting: The Impact on Decision Makers

Ch. 1 - Prob. 1.1KTQCh. 1 - Prob. 1.1ECh. 1 - Prob. 1.2ECh. 1 - The Accounting Equation For each of the following...Ch. 1 - The Accounting Equation Ginger Enterprises began...Ch. 1 - The Accounting Equation Using the accounting...Ch. 1 - Changes in Owners Equity The following amounts are...Ch. 1 - The Accounting Equation For each of the following...Ch. 1 - Classification of Financial Statement Items...Ch. 1 - Classification of Financial Statement Items Regal...

Ch. 1 - Net Income (or Loss) and Retained Earnings The...Ch. 1 - Statement of Retained Earnings Ace Corporation has...Ch. 1 - Accounting Principles and Assumptions The...Ch. 1 - Prob. 1.13ECh. 1 - Prob. 1.14ECh. 1 - Prob. 1.15MCECh. 1 - Prob. 1.16MCECh. 1 - Prob. 1.1PCh. 1 - Users of Accounting Information and Their Needs...Ch. 1 - Prob. 1.3PCh. 1 - Prob. 1.4PCh. 1 - Income Statement, Statement of Retained Earnings,...Ch. 1 - Income Statement and Balance Sheet Green Bay...Ch. 1 - Prob. 1.7PCh. 1 - Statement of Retained Earnings for The Coca-Cola...Ch. 1 - Prob. 1.9PCh. 1 - Prob. 1.10MCPCh. 1 - Prob. 1.1APCh. 1 - Users of Accounting Information and Their Needs...Ch. 1 - Prob. 1.3APCh. 1 - Prob. 1.4APCh. 1 - Income Statement, Statement of Retained Earnings,...Ch. 1 - Income Statement and Balance Sheet Fort Worth...Ch. 1 - Corrected Financial Statements Heidis Bakery Inc....Ch. 1 - Statement of Retained Earnings for Brunswick...Ch. 1 - Prob. 1.9APCh. 1 - Prob. 1.10AMCPCh. 1 - Prob. 1.1DCCh. 1 - Reading and Interpreting Chipotles Financial...Ch. 1 - Comparing Two Companies in the Same Industry:...Ch. 1 - Prob. 1.5DCCh. 1 - Prob. 1.6DCCh. 1 - Prob. 1.7DC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The unqualified quarterly statement of income issued by Bailey Corporation to its stockholders are usually prepared on the same basis as annual statements. This statement is referred to as: a. O b. C. d. Billing Statement Qualified Opinion Report Interim Financial Statements Annual Financial Statementsarrow_forwardComparative Statements of Retained Earnings for Renn-Dever Corporation were reported as follows for the fiscal years ending December 31, 2022, 2023, and 2024. RENN-DEVER CORPORATION Statements of Retained Earnings For the Years Ended December 31 2024 2023 2022 Balance at beginning of year $ 6,970,692 $ 5,584,452 $ 5,694,552 Net income (loss) 3,315,700 2,310,900 (110,100) Deductions: Stock dividend (35,400 shares) 249,000 Common shares retired, September 30 (140,000 shares) 219,660 Common stock cash dividends 896,950 705,000 0 Balance at end of year $ 9,140,442 $ 6,970,692 $ 5,584,452 At December 31, 2021, paid-in capital consisted of the following: Common stock, 1,910,000 shares at $1 par $ 1,910,000 Paid in capital—excess of par 7,490,000 No preferred stock or potential common shares were outstanding during any of the periods shown. Required: Compute Renn-Dever’s earnings per share as it would have appeared in income statements for the…arrow_forwardOriole Corporation recently filed the following financial statements with the SEC. Look at the image for the balance sheet and more! Oriole CorporationIncome Statement for the FiscalYear Ended July 31, 2017 Net sales $77,630 Cost of products sold 55,218 Gross profit $22,412 Selling, general, and administrative expenses 9,893 Depreciation 1,124 Operating income (loss) $11,395 Interest expense 688 Earnings (loss) before income taxes $10,707 Income taxes 3,748 Net earnings (loss) $6,959 Use the DuPont identity to calculate the return on equity (ROE). In the process, calculate the following ratios: net profit margin, total asset turnover, equity multiplier, EBIT return on assets (EROA), and return on assets. (Do not round intermediate calculations. Round answers to 2 decimal places, e.g. 52.75 or 52.75%.) Net profit margin % Total asset turnover Equity multiplier EBIT return on assets % Return on assets %…arrow_forward

- The unqualified quarterly statement of income issued by Bailey Corporation to its stockholders are usually prepared on the same basis as annual statements. This statement is referred to as: a. Interim Financial Statements b. Annual Financial Statements c. Qualified Opinion Report d. Billing Statementarrow_forwardOriole Paper Mill, Inc., had, at the beginning of the current fiscal year, April 1, 2016, retained earnings of $ 322,525. During the year ended March 31, 2017, the company produced net income after taxes of $ 713,175 and paid out 41 percent of its net income as dividends. Construct a statement of retained earnings and compute the year-end balance of retained earnings. (Round answers to 2 decimal places, e.g. 15.25. List items that increase retained earnings first.) Oriole Paper Mill, Inc.Retained Earnings for 2017arrow_forwardACCOUNTING Carry out the following practical case: The company “Inversiones San Remo SAC”, with RUC: 20234125239, began activities in 2005, is dedicated to the manufacture of curtains, operates in its own premises located in La Victoria, has 33 employees (monthly average), and According to the General Shareholders' Meeting, in 2018 they calculated the dividend distribution of 40%. They request to assemble the Financial Statements with the following information: Prepare the 2018 Income Statement. Prepare the Statement of Financial Position 2017 and 2018. Statement of Cash Flow for the year 2018. Direct method Perform the acid test calculation, the two periods and explain what the results found mean Notes to the Financial Statements: Selling expenses correspond to depreciation expenses for 2018. Administrative expenses corresponding to payroll expenses (salaries) for the 2018 financial year. Financial income corresponds to earnings from the profitability of cash surpluses that…arrow_forward

- At the beginning of its fiscal year on April 1, 2018, Extra Vienna Oil Corp, had a balance of $4,740.000 in its retained earnings account. The company generated its highest net income ever of $4,150,750, so it paid large dividends of $975,000 and $750,000 to its preferred and common shareholders, respectively. Required: Prepare the March 31, 2019 (fiscal year end) retained earnings statement for Extra Vienna Oil Corp.arrow_forwardPrepare a statement of retained earnings for Tidal Company for the current year ended December 31 using the following data. (Amounts to be deducted should be indicated by a minus sign.) Cash dividends declared and paid in current year Retained earnings at December 31, prior year Net income in current year Tidal Company Statement of Retained Earnings For Current Year Ended December 31 $ 8,800 61,600 34,600arrow_forwardWildhorse, Inc. has the following data for the year ended December 31, 2025: Net sales Loss on discontinued operations Cost of goods sold Interest expense Selling expenses Administrative expenses $271,900 23,000 165,000 5,400 15,300 36,230 The company has average shares of capital stock outstanding of 20,000 for the year and a tax rate of 20% on all items. Prepare a multiple-step income statement for Wildhorse, Inc. for the year ended December 31, 2025. (Round earnings per share answers to 2 decimal places, e.g. 5.25.)arrow_forward

- Access the February 21, 2017, filing of the December 31, 2016, 10-K report of The Hershey Company (ticker: HSY) at SEC.gov and complete the following requirements. Required Compute or identify the following profitability ratios of Hershey for its years ending December 31, 2016, and December 31, 2015. Interpret its profitability using the results obtained for these two years. 1. Profit margin ratio (round the percent to one decimal). 2. Gross profit ratio (round the percent to one decimal). 3. Return on total assets (round the percent to one decimal). (Total assets at year-end 2014 were $5,622,870 in thousands.) 4. Return on common stockholders’ equity (round the percent to one decimal). (Total shareholders’ equity at year-end 2014 was $1,519,530 in thousands.) 5. Basic net income per common share (round to the nearest cent).arrow_forwardIncome Statement Goldfinger Corporation had account balances at the end of the current year as follows: sales revenue, $13,600; cost of goods sold, $8,300; operating expenses, $3,200; and income tax expense, $630. Assume shareholders owned 500 shares of Goldfinger's common stock during the year. Prepare Goldfinger's income statement for the current year. GOLDFINGER CORPORATION Income Statement For the Year Ended December 31, Current Year Sales revenuearrow_forwardAssume a company starts operations on 1/1/2013 with an equity investment of $776,750. The companies next 7 years of financial performance are listed below. Assume that the company has no permanent or temporary differences for the first three fiscal years. During fiscal 2016 the company experiences a net operating loss. The marginal corporate tax rates for each year are located on the Income Statement. Calculate taxable income (IRS), taxes payable (IRS)and tax expenses (USGAAP). How should the company accounts for the Net Operating Loss. Provide all Journal Entries & T-Accounts. Create a complete set of financial statements (I/S, SRE, B/S, SCF) for the firm for years 2013 through 2019. INCOME STATEMENT 1/1/13 12/31/13 12/31/14 12/31/15 12/31/16 12/31/17 12/31/18 12/31/19 Cash Sales - $776,750 $776,750 $776,750 $119,500 $836,500 $717,000 $746,875 Credit Sales - - - - - - - - Instalment Sales - - - - - -…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Dividend explained; Author: The Finance Storyteller;https://www.youtube.com/watch?v=Wy7R-Gqfb6c;License: Standard Youtube License