College Accounting (Book Only): A Career Approach

12th Edition

ISBN: 9781305084087

Author: Cathy J. Scott

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 3PA

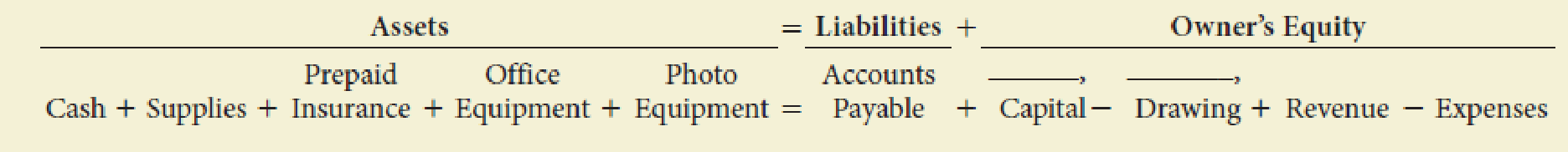

S. Davis, a graphic artist, opened a studio for her professional practice on August 1. The account headings are presented below. Transactions completed during the month follow.

- a. Davis deposited $20,000 in a bank account in the name of the business.

- b. Bought office equipment on account from Starkey Equipment Company, $4,120.

- c. Davis invested her personal photographic equipment, $5,370. (Increase the account Photo Equipment and increase the account S. Davis, Capital.)

- d. Paid the rent for the month, $1,500, Ck. No. 1000 (Rent Expense).

- e. Bought supplies for cash, $215, Ck. No. 1001.

- f. Bought insurance for two years, $1,840, Ck. No. 1002.

- g. Sold graphic services for cash, $3,616 (Professional Fees).

- h. Paid the salary of the part-time assistant, $982, Ck. No. 1003 (Salary Expense).

- i. Received and paid the bill for telephone service, $134, Ck. No. 1004 (Telephone Expense).

- j. Paid cash for minor repairs to graphics equipment, $185, Ck. No. 1005 (Repair Expense).

- k. Sold graphic services for cash, $3,693 (Professional Fees).

- l. Paid on account to Starkey Equipment Company, $650, Ck. No. 1006.

- m. Davis withdrew cash for personal use, $1,800, Ck. No. 1007.

Required

- 1. In the equation, write the owner’s name above the terms Capital and Drawing.

- 2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses.

- 3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Consider each of the transaction below independently. All expenditures were made in cash

In march, the Cleanway Laundromat bought equipment. Cleanway paid $5,000 down and signed a noninterest-bearing note requiring the payment of $30,000 in nine months. The cash price for the equipment was $34,000.

Prepare all necessary journal entries to record each the transaction. Use this format:

Date

Account Titles

DR

CR

Your Client, Ashley Mason, is an artist who specializes in henna tattoos. Four years ago, she entered into a five-year contract to rent a kiosk inside the local mall to sell henna tattoos to customers. She called the business “Ashley’s Arm Brands” and hired two other local artists to assist in the work. She opened a separate bank account to keep track of the business cash, and she tracked all expenses and income using a detailed spreadsheet. She is not incorporated. In the first year, the business did fairly well, but then revenues and customer interest declined. Another local artist opened a competing henna studio at a nearby location that seemed to get more foot traffic and was able to bring in celebrity artists to complete work. Ashley increased her marketing and advertising, including creating both a webpage and a Facebook page, offered discounts and contests, and created deals with other kiosks to increase business. Ashley works at the mall kiosk almost 40 hours a week. She is…

Valley Hardware (Mr. M. Jordan is the sole proprietor) established a petty cash fund on January 1, 2018. A cheque for $400 payable to cash was given to Kate, the petty cashier, who went to the bank and brought back $400 and put it in the petty cash box. The following transactions were completed during January.

Jan 1 Purchased business cards for $36 (this business records office supplies as expenses upon purchase)

Jan 10 Paid $60 for repairs to the office photocopier

Jan 15 Paid $66 COD charges on merchandise to be resold to customers (the business uses the periodic inventory system)

Jan 15 Purchased paper for the printer, $37

Jan 20 Paid $45 for an advertisement in the local January newspaper

Jan 25 M. Jordan took $90 from the cash box to pay for a personal gift for his mother

Jan 26 Paid $40 delivery charges on merchandise inventory sold to a customer

Jan 28 Paid $16 for stamps used for mailing cheques to its suppliers.

The money in the petty cash box was counted…

Chapter 1 Solutions

College Accounting (Book Only): A Career Approach

Ch. 1 - Prob. 1QYCh. 1 - Prob. 2QYCh. 1 - Which of the following accounts would increase...Ch. 1 - Which of the following statements is true? a....Ch. 1 - M. Parish purchased supplies on credit. What is...Ch. 1 - Define assets, liabilities, owners equity,...Ch. 1 - Prob. 2DQCh. 1 - How do Accounts Payable and Accounts Receivable...Ch. 1 - Describe two ways to increase owners equity and...Ch. 1 - What is the effect on the fundamental accounting...

Ch. 1 - When an owner withdraws cash or goods from the...Ch. 1 - Define chart of accounts and identify the...Ch. 1 - What account titles would you suggest for the...Ch. 1 - Prob. 1ECh. 1 - Determine the following amounts: a. The amount of...Ch. 1 - Dr. L. M. Patton is an ophthalmologist. As of...Ch. 1 - Describe a business transaction that will do the...Ch. 1 - Describe a transaction that resulted in each of...Ch. 1 - Label each of the following accounts as asset (A),...Ch. 1 - Describe a transaction that resulted in the...Ch. 1 - Describe the transactions that are recorded in the...Ch. 1 - On June 1 of this year, J. Larkin, Optometrist,...Ch. 1 - On July 1 of this year, R. Green established the...Ch. 1 - S. Davis, a graphic artist, opened a studio for...Ch. 1 - On March 1 of this year, B. Gervais established...Ch. 1 - In April, J. Rodriguez established an apartment...Ch. 1 - Prob. 1PBCh. 1 - In March, K. Haas, M.D., established the Haas...Ch. 1 - Prob. 3PBCh. 1 - In March, T. Carter established Carter Delivery...Ch. 1 - In October, A. Nguyen established an apartment...Ch. 1 - Why Does It Matter? MACS CUSTOM CATERING, Eugene,...Ch. 1 - What Would You Say? A friend of yours wants to...Ch. 1 - Prob. 3A

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- After operating for several months, artist Paul Marciano completed the following transactions during the latter part of June: June 15: Borrowed $25,000 from the bank, signing a note payable. June 22: Painted a portrait for a client on account totaling $9,000. June 28: Received $5,000 cash on account from clients. June 29: Received a utility bill of $ 600, which will be paid during July. June 30: Paid monthly salary of $2,500 to gallery assistant. Journalize the transactions of Paul Marciano, Artist. Include an explanation with each journal entry.arrow_forwardPrepare the following journal entry, all transactions that occurred in January: The Corporation purchased a Delivery Van for customer deliveries. The Delivery Van cost $21,400. A down payment of cash in the amount of $5,000 was paid to the Car Dealership, and a promissory note was signed for the remaining amount owed.arrow_forwardRick Rambis operates a ski lodge center at Bull Mountain in Alaska. He has just received the monthly bank statement at October 31 from Bull National Bank. The bank statement shows an ending balance at October 31 of $750. The following items are listed on the statement:1. The bank collected rent revenue for Rick in the amount of $330.2. Service charge of $10.3. Two NSF checks from customers totaling $110.4. Printing check charge of $11.In reviewing his cash records and the bank statement, Rick identifies the following:1. Outstanding checks totaling $603.2. Deposit in transit on October 31 of $1,770.3. An error made by Rick: Rick recorded a salary check for $31 but it cleared the bank at $310.Rick’s cash records show a balance on October 31 of $1,997.Requireda) Reconcile the bank account.b) Prepare journal entries that should be made as a result of the bank reconciliation.c) What should the balance in Rick’s Cash account be after the reconciliation?d) What total amount of cash should the…arrow_forward

- Home Office collected 100,000 from Branch’s customers on account. Requirements:a. Prepare the journal entries for both the Home Office and Branch books based on theabove transactions.arrow_forwardKathy Concepcion operates KC, a perfume and soap store. The company uses special journals. KC provides a special column for 12% VAT in its sales and purchases journal. VAT is included in the purchases, freight and sales amounts. All collections are immediately deposited. All payments amounting to $5,000 and above are made by checks. During May, the following transactions were completed: May 1 – Invested cash of $250,000 and merchandise of $50,000 to open the business. Deposited $200,000 of the cash investment with Citibank May 2 – Signed a contract of lease with Robinson’s Landholdings and made an advance payment for two month’s rent, $18,000. Check no. 201. Voucher 101. Paid for taxes and licenses to the BIR, $1,200 May 3 – Purchased merchandise on account from Subic, $ 13,440 Terms: 2/10, n/30. Purchase Invoice 422 May 5 – Purchased store supplies on account from Goodwill Bookstore, $1,792. Terms: 1/10, n/30. Purchase Invoice 422 May 8 – Sold merchandise on account to Rustan, $11,760…arrow_forwardChuck recently purchased brand new equipment for his sign making business. He received an invoice for $3,625 dated March 22 with terms 4/10, 2/20, n/60. Chuck paid $1,225 on April 1 and $480 on April 11. What balance was still owed after April 11? Your Answer:arrow_forward

- Sharon Samson starts a plumbing service called Reliable Waterworks. Selected transactions are described as follows: A) Sharon deposits $7,000 into a new checking account for the business, recording the capital contribution. B) Reliable pays $4,000 cash for equipment to be used for plumbing repairs. C) Reliable borrows $15,000 from a local bank and deposits the money in the checking account. D) Reliable pays $600 rent for the first month. E) Reliable pays $400 cash for plumbing supplies to be used on various jobs in the future. F) Reliable completes a plumbing repair project for a local lawyer and receives $1,300 cash. G) Sharon takes a cash withdrawal of $2,500. After all the transactions, what is the amount of total liabilities? a. $15,000 b. $4,400 c. $19,000 d. $4,000arrow_forwardJohn Grey owns Grey's Snow Plowing. In October, Grey's collects $12,000 cash for 6 commercial accounts for which he will provide snowplowing for the entire season. To record this transaction, Grey will enter which of the following entries? (Check all that apply.) Debit to Unearned Plowing Revenue Debit to Plowing Revenue Credit to Cash Credit to Unearned Plowing Revenue Debit to Cash Check all that apply. Credit to Plowing Revenuearrow_forwardFollowing are some transactions and events of Business Solutions. Feb. 26 The company paid cash to Lyn Addie for eight days' work at $130 per day. Mar. 25 The company sold merchandise with a $2,200 cost for $2,900 on credit to Wildcat Services, invoice dated March 25. Required:1. Assume that Lyn Addie is an unmarried employee. Her $1,040 of wages have deductions for FICA Social Security taxes, FICA Medicare taxes, and federal income taxes. Her federal income taxes for this pay period total $104. Compute her net pay for the eight days' work paid on February 26. (Round your answer to 2 decimal places. Do not round intermediate calculations.)2. Record the journal entry to reflect the payroll payment to Lyn Addie as computed in part 1. (Round your answers to 2 decimal places. Do not round intermediate calculations.)3. Record the journal entry to reflect the (employer) payroll tax expenses for the February 26 payroll payment. Assume Lyn Addie has not met earnings limits…arrow_forward

- Sharon Samson starts a plumbing service named Reliable Waterworks. Selected transactions are described as follows: A) Sharon deposits $7,000 into a new checking account for the business, recording the capital contribution. B) Reliable pays $4,000 cash for equipment to be used for plumbing repairs. C) Reliable borrows $15,000 from a local bank and deposits the money in the checking account. D) Reliable pays $600 rent for the first month. E) Reliable pays $400 cash for plumbing supplies to be used on various jobs in the future. F) Reliable completes a plumbing repair project for a local lawyer and receives $1,300 cash. G) Sharon takes a cash withdrawal of $2,500. After all of the transactions, what is the amount of total assets? A)25,200 B)5,200 C)24,200 D)20,200arrow_forwardSharon Samson starts a plumbing service named Reliable Waterworks. Selected transactions are described as follows: A) Sharon deposits $7,000 into a new checking account for the business, recording the capital contribution. B) Reliable pays $4,000 cash for equipment to be used for plumbing repairs. C) Reliable borrows $15,000 from a local bank and deposits the money in the checking account. D) Reliable pays $600 rent for the first month. E) Reliable pays $400 cash for plumbing supplies to be used on various jobs in the future. F) Reliable completes a plumbing repair project for a local lawyer and receives $1,300 cash. G) Sharon takes a cash withdrawal of $2,500. After all the transactions, what is the amount of total assets? a. $24,200 b. $25,700 c. $5,200 d. $20,200arrow_forwardBayoud has started a computer servicing center on May 1, 2021. Following are some events andtransactions that occurred in the month of May:May 1 Bayoud invested $7,000 cash in the business.3 Purchased $600 of supplies on account.5 Paid $125 to advertise in the County News.9 Received $4,000 cash for services performed.15 Received $5,400 for services to be performed in July.17 Paid $2,500 for employee salaries.20 Paid the one year’s rent in advance $1200.29 Purchased equipment for $4,200 on account.Instructions:(i) Show the tabular analysis of the above transactions. (ii) Give the necessary journals. (iii) Prepare the ledger for Cash accountarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY