Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

thumb_up100%

Chapter 10, Problem 20E

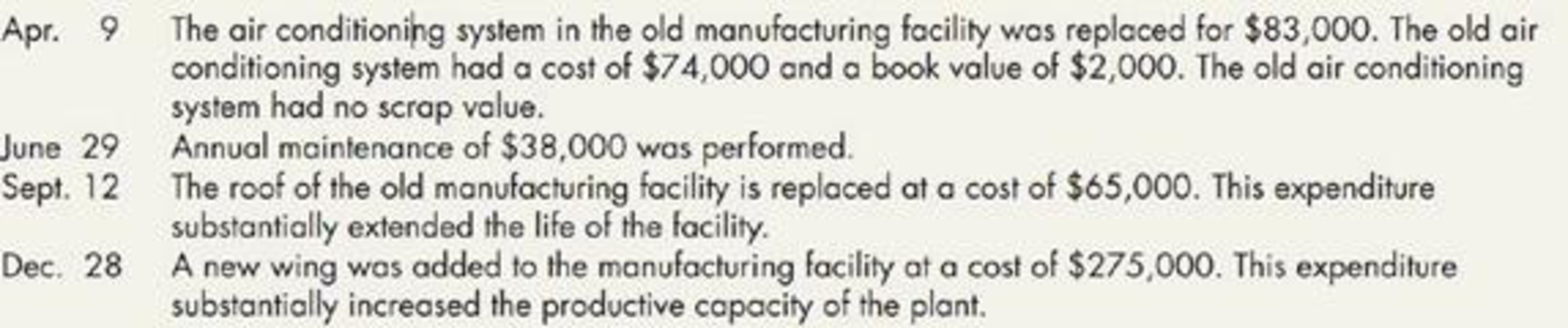

Expenditures after Acquisition McClain Company incurred the following expenditures during 2019:

Required:

- 1. Prepare

journal entries to record McClain’s expenditures for 2019. - 2. Next Level What is the effect on the financial statements if management had improperly accounted for the:

- a. addition of the new wing to the manufacturing facility

- b. annual maintenance expenditures

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Assume REH AG, a hypothetical company, incurs expenditures

of AC1,000 per month during the fiscal year ended December

31, 2019 to develop software for internal use. Under IFRS, the

company must treat the expenditures as an expense until the

software meets the criteria for recognition as an intangible

asset, after which time the expenditures can be capitalized as

an intangible asset.

1 What is the accounting impact of the company being able

to demonstrate that the software met the criteria for

recognition as an intangible asset on February 1 versus

December 1?

2 How would the treatment of expenditures differ if the

company reported under US GAAP and it had established in

2018 that the project was likely to be completed and the

software used to perform the function intended?

Required information

[The following information applies to the questions displayed below.)

Hulme Company operates a small manufacturing facility as a supplement to its regular service activities. At the beginning

of 2020, an asset account for the company showed the following balances:

Manufacturing equipment

Accumulated depreciation through 2019

$ 139,000

48,800

During 2020, the following expenditures were incurred for the equipment:

Major overhaul of the equi pment on January 2, 2020, that improved efficiency

Routine maintenance and repairs on the equipment

$ 11,000

1,300

The equipment is being depreciated on a straight-line basis over an estimated life of 20 years with a $17000 estimated

residual value. The annual accounting period ends on December 31.

2. Starting at the beginning of 2020, what is the remaining estimated life?

Remaining ife

years

Required:

3. Prepare the journal entries to record the two expenditures during 2020. (If no entry is required for a transaction/event,…

MBS Inc. acquires a building on February 1, 2019

at a cost of P5,500,000. The building has an

estimated useful life of 40 years and an estimated

salvage value of P500,000.

Required:

a. Prepare the following:

i. journal entry to record the purchase of

building.

ii. Adjusting entry on December 31 assuming

the company prepares its financial statements on

this date.

b. Determine the following (show solution):

i. amount of expense to be recognized for 2019

ii. book value of the building as of December 31,

2019.

Chapter 10 Solutions

Intermediate Accounting: Reporting And Analysis

Ch. 10 - Prob. 1GICh. 10 - Prob. 2GICh. 10 - What is the relationship between the book value...Ch. 10 - Prob. 4GICh. 10 - Prob. 5GICh. 10 - Prob. 6GICh. 10 - What are asset retirement obligations? How should...Ch. 10 - Prob. 8GICh. 10 - Prob. 9GICh. 10 - Prob. 10GI

Ch. 10 - At what amount does a company record the cost of a...Ch. 10 - Prob. 12GICh. 10 - Prob. 13GICh. 10 - Prob. 14GICh. 10 - Prob. 15GICh. 10 - Prob. 16GICh. 10 - Prob. 17GICh. 10 - What is the distinction between a capital and an...Ch. 10 - Distinguish between additions and...Ch. 10 - Distinguish between ordinary repairs and...Ch. 10 - Prob. 21GICh. 10 - Hickory Company made a lump-sum purchase of three...Ch. 10 - Prob. 2MCCh. 10 - Electro Corporation bought a new machine and...Ch. 10 - Prob. 4MCCh. 10 - Lyle Inc. purchased certain plant assets under a...Ch. 10 - Ashton Company exchanged a nonmonetary asset with...Ch. 10 - Prob. 7MCCh. 10 - Prob. 8MCCh. 10 - Prob. 9MCCh. 10 - Prob. 10MCCh. 10 - On January 1, Duane Company purchases land at a...Ch. 10 - Prob. 2RECh. 10 - Utica Corporation paid 360,000 to purchase land...Ch. 10 - Prob. 4RECh. 10 - Prob. 5RECh. 10 - Prob. 6RECh. 10 - Nabokov Company exchanges assets with Faulkner...Ch. 10 - Prob. 8RECh. 10 - Dexter Construction Corporation is building a...Ch. 10 - Prob. 10RECh. 10 - Prob. 11RECh. 10 - Ricks Towing Company owns three tow trucks. During...Ch. 10 - Inclusion in Property, Plant, and Equipment...Ch. 10 - Prob. 2ECh. 10 - Acquisition Costs Voiture Company manufactures...Ch. 10 - Determination of Acquisition Cost In January 2019,...Ch. 10 - Asset Retirement Obligation Big Cat Exploration...Ch. 10 - Prob. 6ECh. 10 - Prob. 7ECh. 10 - Prob. 8ECh. 10 - Exchange of Assets Two independent companies,...Ch. 10 - Exchange of Assets Use the same information as in...Ch. 10 - Prob. 11ECh. 10 - Exchange of Assets Goodman Company acquired a...Ch. 10 - Exchange of Assets Use the same information as in...Ch. 10 - Prob. 14ECh. 10 - Self-Construction Harshman Company constructed a...Ch. 10 - Prob. 16ECh. 10 - Prob. 17ECh. 10 - Prob. 18ECh. 10 - Prob. 19ECh. 10 - Expenditures after Acquisition McClain Company...Ch. 10 - Prob. 21ECh. 10 - Prob. 1PCh. 10 - Classification of Costs Associated with Assets The...Ch. 10 - Prob. 3PCh. 10 - Comprehensive At December 31, 2018, certain...Ch. 10 - Assets Acquired by Exchange Bremer Company made...Ch. 10 - Assets Acquired by Exchange Bussell Company...Ch. 10 - Self-Construction Olson Machine Company...Ch. 10 - Prob. 8PCh. 10 - Prob. 9PCh. 10 - Events Subsequent to Acquisition The following...Ch. 10 - Prob. 11PCh. 10 - Prob. 1CCh. 10 - Prob. 2CCh. 10 - Cost Issues Deskin Company purchased a new machine...Ch. 10 - Prob. 4CCh. 10 - Prob. 5CCh. 10 - Prob. 6CCh. 10 - Prob. 7CCh. 10 - Prob. 9CCh. 10 - Prob. 10CCh. 10 - Prob. 11C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On December 31, 2019, Vail Company owned the following assets: Vail computes depreciation and amortization expense to the nearest whole year. During 2020, Vail engaged in the following transactions: Required: 1. Check the accuracy of the accumulated depreciation balances at December 31, 2019. Round to the nearest whole dollar in all requirements. 2. Prepare journal entries to record the preceding events in 2020, as well as the year-end recording of depreciation expense. 3. Prepare an Accumulated Depreciation account for each category of assets, enter the beginning balance, post the journal entries from Requirement 2, and compute the ending balance.arrow_forwardBILL Company constructed an asset for its own use. Construction started on January 1, 2019 and the asset was completed on December 31,2019. Expenditures incurred during the year were as follows: January 1- $400,000 April 7 -$500,000 August 14- $480,000 December 15 $150,000 What is the average accumulated expenditures for the self-constructed asset?arrow_forwardJournalizing partial-year depreciation and asset disposals and exchanges During 2018, Mora Corporation completed the following transactions: Record the transactions in the journal of Mora Corporation.arrow_forward

- MBS Inc. acquires a building on February 1, 2019 at a cost of P5,500,000. The building has an estimated useful life of 40 years and an estimated salvage value of P500,000. a. Prepare the following: i. journal entry to record the purchase of building. ii. Adjusting entry on December 31 assuming the company prepares its financial statements on this date. b. Determine the following (show solution): i. amount of expense to be recognized for 2019 ii. book value of the building as of December 31, 2019.arrow_forwardA depreciation schedule for semi-trucks of Blossom Manufacturing Company was requested by your auditor soon after December 31, 2026, showing the additions, retirements, depreciation, and other data affecting the income of the company in the 4-year period 2023 to 2026, inclusive. The following data were ascertained. Balance of Trucks account, Jan. 1, 2023 Truck No. 1 purchased Jan. 1, 2020, cost Truck No. 2 purchased July 1, 2020, cost Truck No. 3 purchased Jan. 1, 2022, cost $22,140 27,060 36,900 Truck No. 4 purchased July 1, 2022, cost 29,520 Balance, Jan. 1, 2023 $115,620 The Accumulated Depreciation-Trucks account previously adjusted to January 1, 2023, and entered in the ledger, had a balance on that date of $37,146 (depreciation on the four trucks from the respective dates of purchase, based on a 5-year life, no salvage value). No charges had been made against the account before January 1, 2023. Transactions between January 1, 2023, and December 31, 2026, which were recorded in…arrow_forwardJournalizing partial-year depreciation and asset disposals and exchanges During 2018, Lora Company completed the following transactions: Record the transactions in the journal of Lora Company.arrow_forward

- Study the information given below and answer the following questions:5.1 Calculate the profit or loss on the disposal of the equipment. 5.2 Prepare the following note to the financial statements as at 28 February 2020:* Property, plant and equipment INFORMATIONThe following balances appeared in the general ledger of Umzinto Traders on 01 March 2019, the beginning of the financial year:RVehicles 300 000Accumulated depreciation on vehicles 140 000Equipment 130 000Accumulated depreciation on equipment 75 000Additional information1) A new vehicle, cost price R160 000, was purchased on credit on 01 December 2019.2) Equipment with a cost price of R10 000, was sold for cash on 31 August 2019 for R2 000. The accumulated depreciation on the equipment sold amounted to R7 000 on 01 March 2019.3) Depreciation is calculated on equipment at 10% per annum on cost.4) Depreciation is calculated on vehicles at 20% per annum on the diminishing balance.arrow_forwardAt the beginning of 2019, Robotics Inc. acquired a manufacturing facility for $13.4 million. $10.4 million of the purchase price was allocated to the building. Depreciation for 2019 and 2020 was calculated using the straight-line method, a 25-year useful life, and a $2.4 million residual value. Assume that 2019 depreciation was incorrectly recorded as $32,000. This error was discovered in 2021. Required1. Record the journal entry needed in 2021 to correct the error.2. What is depreciation on the building for 2021 assuming no change in estimate of useful life or residual value?arrow_forwardThere are two Journal Entries 1) Prepare journal entries for Wember to record the impairment of its intangible assets at December 31, 2019 2) Prepare journal entries for Wember to record the amortization expense for its intangibles at December 31, 2020arrow_forward

- Assume that Carleton reported the following information regarding a machine at December 31, 2019: Cost $60,000 Accumulated depreciation to date 30,000 Expected future net cash flows 26,000 Fair value 24,000 Assuming that Carleton will continue to use this asset in the future and the machine has a remaining useful life of 4 years. Instructions Prepare the journal entry (if any) to record the impairment of the asset on December 31, 2019. Besides, prepare the journal entry to record depreciation expenses for 2020. Assuming that Carleton intends to dispose of the machine in the coming year. It is expected that the cost of disposal will be $1,000. However, the machine was not sold by December 31, 2020. The fair value of the machine on that date is $26,800. Prepare the journal entry (if any) necessary to record this increase in fair value. Assume that Carleton has a crane which has an original cost of $150,000, an…arrow_forwardInformation for Blake Corporation’s property, plant, and equipment for 2019 is: 1. For each asset classification, prepare schedules showing depreciation and amortization expense, and accumulated depreciation and amortization that would appear on Blake’s income statement for the year ended December 31, 2019, and on the balance sheet at December 31, 2019, respectively 2. Prepare a schedule showing the gain or loss from disposal of assets that would appear in Blake’s income statement for the year ended December 31, 2019. 3. Prepare the property, plant, and equipment section of Blake’s December 31, 2019, balance sheet.arrow_forwardPresented below is information related to equipment owned by Suarez Company at December 31, 2019. Cost Rwf 27,000 Accumulated depreciation to date 3,000 Expected future net cash flows 21,000 Fair value 14,400 Assume that Suarez will continue to use this asset in the future. As of December 31, 2019, the equipment has a remaining useful life of 4 years. Instructions Prepare the journal entry (if any) to record the impairment of the asset at December 31, 2019. Prepare the journal entry to record depreciation expense for 2020. The fair value of the equipment at December 31, 2020, is Rwf 15,300. Prepare the journal entry (if any) necessary to record this increase in fair value.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

IAS 10 Events After the Reporting Period; Author: Silvia of CPDbox;https://www.youtube.com/watch?v=ijYZlb1_ZyQ;License: Standard Youtube License