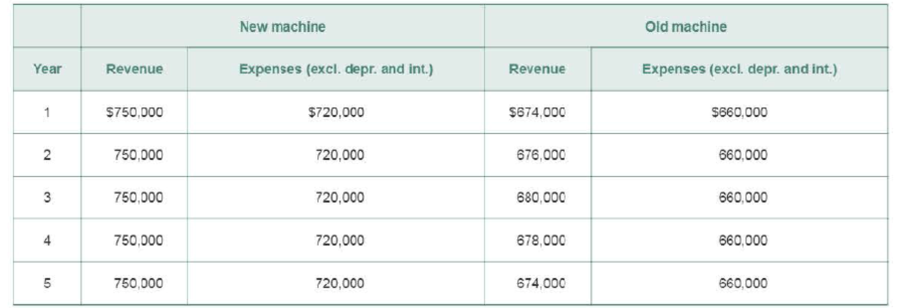

Net cash flows: No terminal value Central Laundry and Cleaners is considering replacing an existing piece of machinery with a more sophisticated machine. The old machine was purchased 3 years ago at a cost of $50,000, and this amount was being

- a. Calculate the initial investment associated with replacement of the old machine by the new one.

- b. Determine the operating cash flows associated with the proposed replacement. (Note: Be sure to consider the deprecation in year 6.)

- c. Depict on a timeline the net cash flows found in parts a and b associated with the proposed replacement decision.

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

- Friedman Company is considering installing a new IT system. The cost of the new system is estimated to be 2,250,000, but it would produce after-tax savings of 450,000 per year in labor costs. The estimated life of the new system is 10 years, with no salvage value expected. Intrigued by the possibility of saving 450,000 per year and having a more reliable information system, the president of Friedman has asked for an analysis of the projects economic viability. All capital projects are required to earn at least the firms cost of capital, which is 12 percent. Required: 1. Calculate the projects internal rate of return. Should the company acquire the new IT system? 2. Suppose that savings are less than claimed. Calculate the minimum annual cash savings that must be realized for the project to earn a rate equal to the firms cost of capital. Comment on the safety margin that exists, if any. 3. Suppose that the life of the IT system is overestimated by two years. Repeat Requirements 1 and 2 under this assumption. Comment on the usefulness of this information.arrow_forwardCullumber Bottling Corporation is considering the purchase of a new bottling machine. The machine would cost $163,500 and has an estimated useful life of 8 years with zero salvage value. Management estimates that the new bottling machine will provide net annual cash flows of $30,700. Management also believes that the new bottling machine will save the company money because it is expected to be more reliable than other machines, and thus will reduce downtime. Assume a discount rate of 12%. Click here to view PV table. Calculate the net present value. (If the net present value is negative, use either a negative sign preceding the number eg-45 or parentheses eg (45). For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round present value answer to O decimal places, eg. 125) Net present value $ How much would the reduction in downtime have to be worth in order for the project to be acceptable? (Round answer to O decimal places, e.g. 125) $arrow_forwardThe management of Ballard MicroBrew is considering the purchase of an automated bottling machine for $69,000. The machine would replace an old piece of equipment that costs $17,000 per year to operate. The new machine would cost $7,000 per year to operate. The old machine currently in use could be sold now for a salvage value of $23,000. The new machine would have a useful life of 10 years with no salvage value. Required: 1. What is the annual depreciation expense associated with the new bottling machine? 2. What is the annual incremental net operating income provided by the new bottling machine? 3. What is the amount of the initial investment associated with this project that should be used for calculating the simple rate of return? 4. What is the simple rate of return on the new bottling machine? (Round your answer to 1 decimal place i.e. 0.123 should be considered as 12.3%.) 1. Depreciation expense 2. Incremental net operating income 3 Initial…arrow_forward

- Henrie's Drapery Service is investigating the purchase of a new machine for cleaning and blocking drapes. The machine would cost $151,640, including freight and installation, Henrie's estimated the new machine would increase the company's cash inflows, net of expenses, by $40,000 per year. The machine would have a five-year useful life and no salvage value. Required: 1. What is the machine's internal rate of return? Note: Round your answer to the nearest whole percentage.arrow_forwardThe management of Ballard MicroBrew is considering the purchase of an automated bottling machine for $55,000. The machine would replace an old piece of equipment that costs $14,000 per year to operate. The new machine would cost $6,000 per year to operate. The old machine currently in use could be sold now for a salvage value of $20,000. The new machine would have a useful life of 10 years with no salvage value. Required: 1. What is the annual depreciation expense associated with the new bottling machine? 2. What is the annual incremental net operating income provided by the new bottling machine? 3. What is the amount of the initial investment associated with this project that should be used for calculating the simple rate of return? 4. What is the simple rate of return on the new bottling machine? (Round your answer to 1 decimal place i.e. 0.123 should be considered as 12.3%.)arrow_forwardVastine Medical, Inc., is considering replacing its existing computer system, which was purchased 2 years ago at a cost of $318,000. The system can be sold today for $203,000. It is being depreciated using MACRS and a 5-year recovery period (see the table). A new computer system will cost $506,000 to purchase and install. Replacement of the computer system would not involve any change in net working capital. Assume a 21% tax rate on ordinary income and capital gains. a. Calculate the book value of the existing computer system. b. Calculate the after-tax proceeds of its sale for $203,000. c. Calculate the initial cash flow associated with the replacement project. Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year* Recovery year 3 years 5 years 7 years 10 years 1 33% 20% 14% 10% 2 45% 32% 25% 18% 3 15% 19% 18% 14% 4 7% 12% 12% 12% 5 12% 9% 9% 6 5% 9% 8% 7 9%…arrow_forward

- note: can you help me answer the question for a, b and c?Muthusamy Curry Mills (MCM) is considering the purchase of a new milling equipment to replace an existing one that has a book value of $3,000 and can be sold for $1,500. The old machine is being depreciated on a straight-line basis and its estimated salvage value 3 years from now is zero. The new machine will reduce costs (before taxes) by $7,000 per year. It has a 3-year life; with an installed cost of $14,000; and it can be sold for an expected $2,000 at the end of the third year. The new machine would be depreciated over its 3-year life using the MACRS method. The applicable depreciation rates are as follows: Year 1: 33% Year 2: 45% Year 3: 15% Year 4: 7% Assume a 40% tax rate and a cost of capital of 16%. a. The initial investment associated with the replacement of the old milling equipment by the new one is? b. The incremental operating cash flows associated with the proposed replacement in Year 1 is? c. The…arrow_forwardVastine Medical, Inc., is considering replacing its existing computer system, which was purchased 2 years ago at a cost of $322,000. The system can be sold today for $201,000. It is being depreciated using MACRS and a 5-year recovery period (see the table attached).A new computer system will cost $505,000 to purchase and install. Replacement of the computer system would not involve any change in net working capital. Assume a 21% tax rate on ordinary income and capital gains. a. Calculate the book value of the existing computer system. b. Calculate the after-tax proceeds of its sale for $201,000. c. Calculate the initial cash flow associated with the replacement project.arrow_forwardBAK Corp. is considering purchasing one of two new diagnostic machines. Either machine would make it possible for the company to bid on jobs that it currently isn't equipped to do. Estimates regarding each machine are provided here Original cost Estimated life Salvage value Estimated annual cash inflows Estimated annual cash outflows Machine A $75,500 8 years 0 Net present value Profitability index $20,000 $5,000 Click here to view PV table. Calculate the net present value and profitability index of each machine. Assume a 9% discount rate. (If the net present value is negative, use either a negative sign preceding the number eg -45 or parentheses es (45). Round answer for present value to 0 decimal places, eg. 125 and profitability index to 2 decimal places, eg. 10.50. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Machine A Which machine should be purchased? Machine A should be purchased Machine B $180,000 8 years 0 $40,000 $10,000 Machine B…arrow_forward

- The management of Kunkel Company is considering the purchase of a $22,000 machine that would reduce operating costs by $5,000 per year. At the end of the machine’s five-year useful life, it will have zero salvage value. The company’s required rate of return is 16%. Required: 1. Determine the net present value of the investment in the machine. 2. What is the difference between the total, undiscounted cash inflows and cash outflows over the entire life of the machine?arrow_forwardBakers Pride Corporation is considering purchasing one of two new mixing machines. Either machine would make it possible for the company to bid on jobs that it currently isn't equipped to do. Estimates regarding each machine are provided below. Original Cost Estimated Useful Life Annual Cash Flows Annual cash outflow Dough-Matic Model 100 $99,000 8 years $25,000 $ 5,000 Dough-Matic Model 200 $149,000 8 years $40,000 $10,000 Instructions Calculate the net present value and profitability index of each machine. Assume a 9% discount rate. Which machine should be purchased? Note: factor for the present value of an ordinary annuity 8 years @9% = 5.53482arrow_forwardSub-Prime Loan Company is thinking of opening a new office, and the key data are shown below. The company owns the building that would be used, and it could sell it for $100,000 after taxes if it decides not to open the new office. The equipment for the project would be depreciated by the straight-line method over the project's 3-year life, after which it would be worth nothing and thus it would have a zero salvage value. No change in net operating working capital would be required, and revenues and other operating costs would be constant over the project's 3-year life. What is the project's NPV? (Hint: Cash flows are constant in Years 1-3.) Do not round the intermediate calculations and round the final answer to the nearest whole number. WACC 10.0% Opportunity cost $100,000 Net equipment cost (depreciable basis) $65,000 Straight-line depr. rate for equipment 33.333% Annual sales revenues $128,000 Annual operating costs (excl. depr.) $25,000 Tax rate 35%arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning