Interim Income Statement

Chris Inc. has accumulated the following information for its second−quarter income statement for20X2:

Additional In formation

1. First-quarter income before taxes was $100,000, and the estimated effective annual tax rate was 40 percent. At the end of the second quarter, expected annual income is $600,000, and a dividend exclusion of $30,000 and a business tax credit of $15,000 are anticipated. The combined state and federal tax rate is 50 percent.

2. The $420,000 cost of goods sold is determined by using the LIFO method and includes 7,500 units from the base layer at a cost of $12 per unit. However, you have determined that theseunits are expected to be replaced at a cost of $26 per unit.

3. The operating expenses of $230,000 include a $60,000 factory rearrangement cost incurred inApril. You have determined that the second quarter will receive about 25 percent of the benefits from this project with the remainder benefiting the third and fourth quarters.

Required

- Calculate the effective annual tax rate expected at the end of the second quarter for Chris Inc.

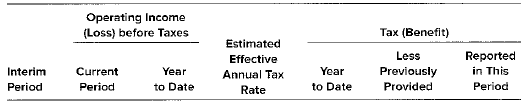

- Prepare the income statement for the second quarter of 20X2. Your solution should include a computation of income tax (or benefit) with the following headings:

Want to see the full answer?

Check out a sample textbook solution

Chapter 13 Solutions

Advanced Financial Accounting

- Grateful Enterprises had the following income before tax provision and effective annual tax rate for the first three quarters of the current year: 1st Quarter - 5,000,000 (30%); 2nd Quarter - 6,000,000 (30%); 3rd Quarter- 7,000,000 (25%). What amount should be reported as income tax expense in the interim income statement for the third quarter? * Your answerarrow_forwardIn Geri Co, the 5 year weighted average historical pre-tax economic earnings are $1,250,000. The tax rate is 28%. The hurdle and debt rate are 12.25%. The adjusted net assets from prior year-end is $2,050,000. The cap rate applicable to this kind of company is 25% pretax. Determine the value of this business using reasonable rate return on assets. a. $3,995,500 b. $2,050,000 c. $6,045,500 d. Cannot be determined from the information provided.arrow_forwardAbitz Corporation has the following pretax operating income in its first three quarters of 20X5. The effective tax rate for each quarter is provided. Determine the third quarter income tax or benefit. Current Effective Quarter First Period $40,000 (25,000) 50,000 Tax Rate 25% Second 25% Third 30% a. $3,750 b. $15,000 c. $15,750 d. $20,000arrow_forward

- Grateful Enterprises had the following income before tax provision andeffective annual tax rate for the first three quarters of the current year: 1stQuarter - 5,000,000 (30%); 2nd Quarter - 6,000,000 (30%); 3rd Quarter-7,000,000 (25%). What amount should be reported as income taxexpense in the interim income statement for the third quarter?arrow_forwardPrepare a projected statement of comprehensive income for the year ended 31 December 2021 to determine the sales needed to produce a profit after tax that is 25% more than that for the year ending 31 December 2020.(Where applicable round of amounts to the nearest rand) INFORMATION:Calder EnterprisesStatement of Comprehensive Income for the year ended 31 December 2020 Additional information:1. Cost of sales is expected to be 60% of sales.2. Operating expenses will increase by 4%.3. Interest expense will increase to R120 000.4. The tax rate will remain at 28%3.2 Use the information from question 3.1 (not your solution) and calculate the following for the year ending 31 December 2020:3.2.1 Gross margin 3.2.2 Net profit margin 3.2.3 Operating margin 3.2.4 Interest coveragearrow_forwardQuestion: How much is the income or loss after tax for 2021? Kindly prepare a good presentation of your computation. The store opened on January 01, 2021 and had total sales for the 1st month of Php 300,000.00. Corresponding increase in sales of 10% was realized for the remaining months of the 1st quarter. Second quarter sales were the same as the 1stquarter, corresponding 5% increase for the 3rd quarter, and 4thquarter sales is the same as the 1st quarter. The company had a miscellaneous income for the year of Php 50,000.00 but it seems that it has no effect on its financial since they also incurred the same amount for the spoilages, considered as other expense. Let us assume that the annual tax percentage will be 12%. Sales breakdown is: 70% from the beverages and the remaining percentage for the pastry line. Total investment of Ms. Cortesi amounted to Php1.5M and she is expecting the Payback Period on the 3rd year. Renovation cost of the rented space of the store amounted to Php…arrow_forward

- Brush Company has the following income before income tax and estimated effective annual income tax rates for the first three quarters of 2019. Quarter Income before income Estimated Effective Tax Tax provision rate 7 st 120,000 12 2nd 130,000 10 3rd 140,000 14 Required: What should be Brush company estimated income for "First" quarter income statement? Select one: a. $54,600 b. None of the other points c. $39,000 Od. $46,800 %24arrow_forwardIn 2019, Beta had an annual effective tax rate of 20%. In the 2020 first quarter, the company would pay tax at 25% just for that quarter alone. Beta management estimates that the 2020 full year effective tax rate will be 15%. Based on a first quarter 2020 income before tax of $200,000 what amount of provision for income taxes should be accrued under the integral method. a. $50,000 b. $40,000 c. $60,000 d. $0 e. $30,000arrow_forwardJosh Company, a calendar-year corporation has the following income before income tax provison and estimated effective annual income tax rates for the first three quarters of year 1: Income before income tax provision Estimated effective annual rate at end of quarter Quarter First P600,000 40% Second 700,000 40% Third 400,000 45% 1. Josh income tax provision in its interim income statement for the third quarter should be?arrow_forward

- Compute the income after income tax given the following: Net Sales of 100,00,00.00; Marketing Expense of 5,000,000.00; Tax Rate of 30%. Based on the latest income statement, revenue is 500,000,000.00; COGS is 400,000,000.00 and operating expense amounted to 40,000,000.00. Income after income tax is _____.arrow_forwardShenron, Inc. had pre-tax accounting income of P1,350,000 and a tax rate of 40% in 2020, its first year of operations. During 2020 the company had the following transactions: Received rent from Master, Co. for 2021 P48,000 Municipal bond income P60,000 Depreciation for tax purposes in excess of book depreciation P30,000 Installment sales revenue to be collected in 2021 P81,000 For 2020 what is the amount of income taxes payable for Shenron, Inc? a. P579,600 b. P452,400 c. P514,800 d. P490,800arrow_forwardAnusha Berhad’s sales pattern for the first quarter 2021 and projected revenues are as follows: Additional information:i. Historically, Anusha Berhad’s sales were on cash basis.ii. Anusha purchase raw material two month before the sales month and paid in cash equal to 60 percent of its sales.iii. Fixed monthly rent of RM11,000.iv. A depreciation expense is RM400 per month.v. Dividend of RM3,000 will be received at the end of each quarter.vi. Wages and salaries are estimated RM15,000 per month.vii. Anusha decide to repay RM40,000 of their loan on April.viii. Interest on accumulated loan is at 9 percent annual interest and paid in the following month.ix. Ending cash balance for the budget period is RM20,000 and it would like to maintain minimum desired balance of RM20,000 per month. Prepare a monthly cash budget for the first quarter 2021 for Anusha Berhad.arrow_forward

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning