Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

15th Edition

ISBN: 9780134476315

Author: Chad J. Zutter, Scott B. Smart

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 14, Problem 14.7P

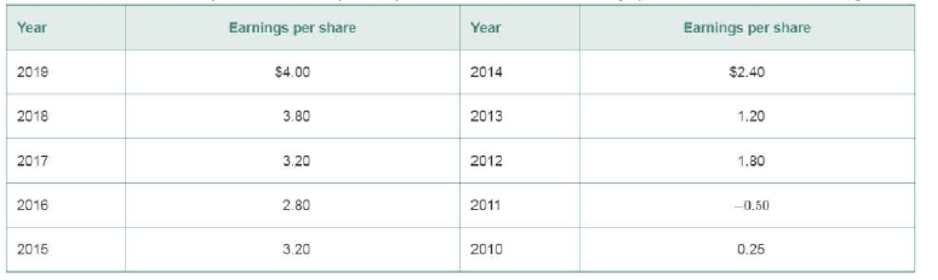

Alternative dividend policies Over the past 10 years, a firm has had the earnings per share shown in the following table.

- a. If the firm’s dividend policy were based on a constant payout ratio of 40% for all years with positive earnings and 0% otherwise, what would be the annual dividend for each year?

- b. If the firm had a dividend payout of $1.00 per share, increasing by $0.10 per share whenever the dividend payout fell below 50% for 2 consecutive years, what annual dividend would the firm pay each year?

- c. If the firm’s policy were to pay $0.50 per share each period except when earnings per share exceed $3.00, when an extra dividend equal to 80% of earnings beyond $3.00 would be paid, what annual dividend would the firm pay each year?

- d. Discuss the pros and cons of each dividend policy described in parts a through c.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Suppose that a company's most recent dividends per share paid upon the last year's net income was $1.6 . The share price of the company is fairly valued in the market at $10 . The expected dividend growth rate is 2% in perpetuity. Given that the risk-free rate is 3% and market risk premium is 10%, what happens to the share prices when the whole market increases by 10%?

a) increase by 15.32%b) increase by 15.00%c) increase by 11.79%d) increase by 21.89%e) other

Using the Dividend Growth Approach, suppose that your company is expected to pay a dividend of $1.25 per share next year. There has been a steady growth in dividends of 5.1% per year and the market expects that to continue. The current price is $29. What is the cost of equity?

The dividend policy of Gulden Gardens Inc. can be represented by a gradual

adjustment to a target dividend payout ratio. Last year Gulden had earnings

per share of $4.00 and paid a dividend of $0.80 a share. This year it estimates

earnings per share will be $6.00. If it has a 25% target payout ratio and uses

an adjustment factor of 0.2, what would be the dividends per share for this

year?

Chapter 14 Solutions

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Ch. 14.1 - What two ways can firms distribute cash to...Ch. 14.1 - Why do rapidly growing firms generally pay no...Ch. 14.1 - The dividend payout ratio equals dividends paid...Ch. 14.2 - Prob. 14.4RQCh. 14.2 - Prob. 14.5RQCh. 14.2 - What benefit is available to participants in a...Ch. 14.3 - Does following the residual theory of dividends...Ch. 14.3 - Contrast the basic arguments about dividend policy...Ch. 14.4 - Prob. 14.9RQCh. 14.5 - Describe a constant-payout-ratio dividend policy,...

Ch. 14.6 - Why do firms issue stock dividends? Comment on the...Ch. 14.6 - Compare a stock split with a stock dividend.Ch. 14 - Prob. 1ORCh. 14 - Prob. 14.1STPCh. 14 - Prob. 14.1WUECh. 14 - Prob. 14.2WUECh. 14 - Prob. 14.3WUECh. 14 - Prob. 14.4WUECh. 14 - Prob. 14.5WUECh. 14 - Dividend payment procedures At the quarterly...Ch. 14 - Prob. 14.2PCh. 14 - Prob. 14.3PCh. 14 - Dividend constraints The Howe Companys...Ch. 14 - Prob. 14.5PCh. 14 - Low-regular-and-extra dividend policy Bennett Farm...Ch. 14 - Alternative dividend policies Over the past 10...Ch. 14 - Alternative dividend policies Given the earnings...Ch. 14 - Stock dividend: Firm Columbia Paper has the...Ch. 14 - Cash versus stock dividend Milwaukee Tool has the...Ch. 14 - Stock dividend: Investor Sarah Warren currently...Ch. 14 - Stock dividend: Investor Security Data Company has...Ch. 14 - Stock split: Firm Growth Industries current...Ch. 14 - Prob. 14.14PCh. 14 - Stock split versus stock dividend: Firm Mammoth...Ch. 14 - Prob. 14.16PCh. 14 - Prob. 14.17PCh. 14 - Prob. 14.18PCh. 14 - Prob. 14.19P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Alternative dividend policies Over the last 10 years, a firm has had the earnings per share shown in the following table: a. If the firm's dividend policy were based on a constant payout ratio of 40% for all years with positive earnings and 0% otherwise, what would be the annual dividend for 2017? b. If the firm had a dividend payout of $1.00 per share, increasing by $0.10 per share whenever the dividend payout fell below 50% for two consecutive years, what annual dividend would the firm pay in 2017? c. If the firm's policy were to pay $0.50 per share each period except when earnings per share exceed $3.00, when an extra dividend equal to 80% of earnings beyond $3.00 would be paid, what annual dividend would the firm pay in 2017? d. Discuss the pros and cons of each dividend policy described in parts a through c. a. If the firm's dividend policy were based on a constant payout ratio of 40% for all years with positive earnings and 0% otherwise, the annual dividend for 2017 is $0.35…arrow_forwardSuppose that X company expected to pay$1.05 dividends for the coming year and currently the company paid a dividend of $1, What is the value of the stock? If the required return is 10%. And the growth rate is expected to continue.arrow_forwardIf the last dividend paid by Chemical Brothers Inc. was $1.25 and analysts expect these payments to increase 4% per year, what will the stock price be next year if the required return is 15%? Select one: O a. $12.29 O b. $11.82 O c. $31.25 O d. $12.78 O e. $23.11arrow_forward

- A firm’s earnings and dividends per share are expected to grow constantly by 5% a year. If next year’s dividend is £0.85 per share and the market capitalisation rate is 8%, which of the following is closest to the current price of the share? a. £0.83 b. £28.33 c. £10.63 d. £17.00arrow_forwardAssume Highline Company has just paid an annual dividend of $1.01. Analysts are predicting an 10.3% per year growth rate in earnings over the next five years. After then, Highline's earnings are expected to grow at the current industry average of 5.1% per year. If Highline's equity cost of capital is 8.2% per year and its dividend payout ratio remains constant, for what price does the dividend-discount model predict Highline stock should sell? The value of Highline's stock is $ (Round to the nearest cent.)arrow_forwardAssume Highline Company has just paid an annual dividend of $0.98. Analysts are predicting an 11.2% per year growth rate in earnings over the next five years. After then, Highline's earnings are expected to grow at the current industry average of 5.5% per year. If Highline's equity cost of capital is 9.2% per year and its dividend payout ratio remains constant, for what price does the dividend-discount model predict Highline stock should sell? The value of Highline's stock is $_____. (Round to the nearest cent.)arrow_forward

- Assume Highline Company has just paid an annual dividend of $1.04. Analysts are predicting an 11.3% per year growth rate in earnings over the next five years. After then, Highline's earnings are expected to grow at the current industry average of 5.5% per year. If Highline's equity cost of capital is 8.1% per year and its dividend payout ratio remains constant, for what price does the dividend - discount model predict Highline stock should sell? The value of Highline's stock is $. (Roun to the nearest cent.) Assume Highline Company has just paid an annual dividend of $1.04. Analysts are predicting an 11.3% per year growth rate in earnings over the next five years. After then, Highline's earnings are expected to grow at the current industry average of 5.5% per year. If Highline's equity cost of capital is 8.1% per year and its dividend payout ratio remains constant, for what price does the dividend-discount model predict Highline stock should sell? The value of Highline's stock is $…arrow_forwardGrateful Eight Co. is expected to maintain a constant 4.4 percent growth rate in its dividends indefinitely. If the company has a dividend yield of 6.2 percent, what is the required return on the company’s stock? Requred Return = ________ %arrow_forwardAssume Highline Company has just paid an annual dividend of $0.92. Analysts are predicting an 11.8% per year growth rate in earnings over the next five years. After then, Highline's earnings are expected to grow at the current industry average of 5.2% per year. If Highline's equity cost of capital is 9.4% per year and its dividend payout ratio remains constant, for what price does the dividend-discount model predict Highline stock should sell?arrow_forward

- Assume Highline Company has just paid an annual dividend of $1.06. Analysts are predicting an 11.3% per year growth rate in earnings over the next five years. After then, Highline's earnings are expected to grow at the current industry average of 5.4% per year. If Highline's equity cost of capital is 7.9% per year and its dividend payout ratio remains constant, for what price does the dividend - discount model predict Highline stock should sell?arrow_forwardThe dividend policy of Berkshire Gardens Inc. can be represented by a gradual adjustment to a target dividend payout ratio. Last year Berkshire had earnings per share of US$3.00 and paid a dividend of US$0.60 a share. This year it estimates earnings per share will be US$4.00. Find its dividend per share for this year if it has a 25% target payout ratio and uses a five-year period to adjust its dividend. US$0.85. US$0.50. US$0.68. US$0.80.arrow_forwardSuppose a company paid a dividend of $1.50 per share this year. Assuming the dividend growth rate is 3% a year and the market requires a return of 15%, how much should the stock be selling for?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Dividend disocunt model (DDM); Author: Edspira;https://www.youtube.com/watch?v=TlH3_iOHX3s;License: Standard YouTube License, CC-BY