Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

16th Edition

ISBN: 9780134475585

Author: Srikant M. Datar, Madhav V. Rajan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 18, Problem 18.30E

FIFO method, spoilage. Refer to the information in Exercise 18-29.

- 1. Do Exercise 18-29 using the FIFO method of

process costing .

Required

- 2. Should LogicCo’s managers choose the weighted-average method or the FIFO method? Explain briefly.

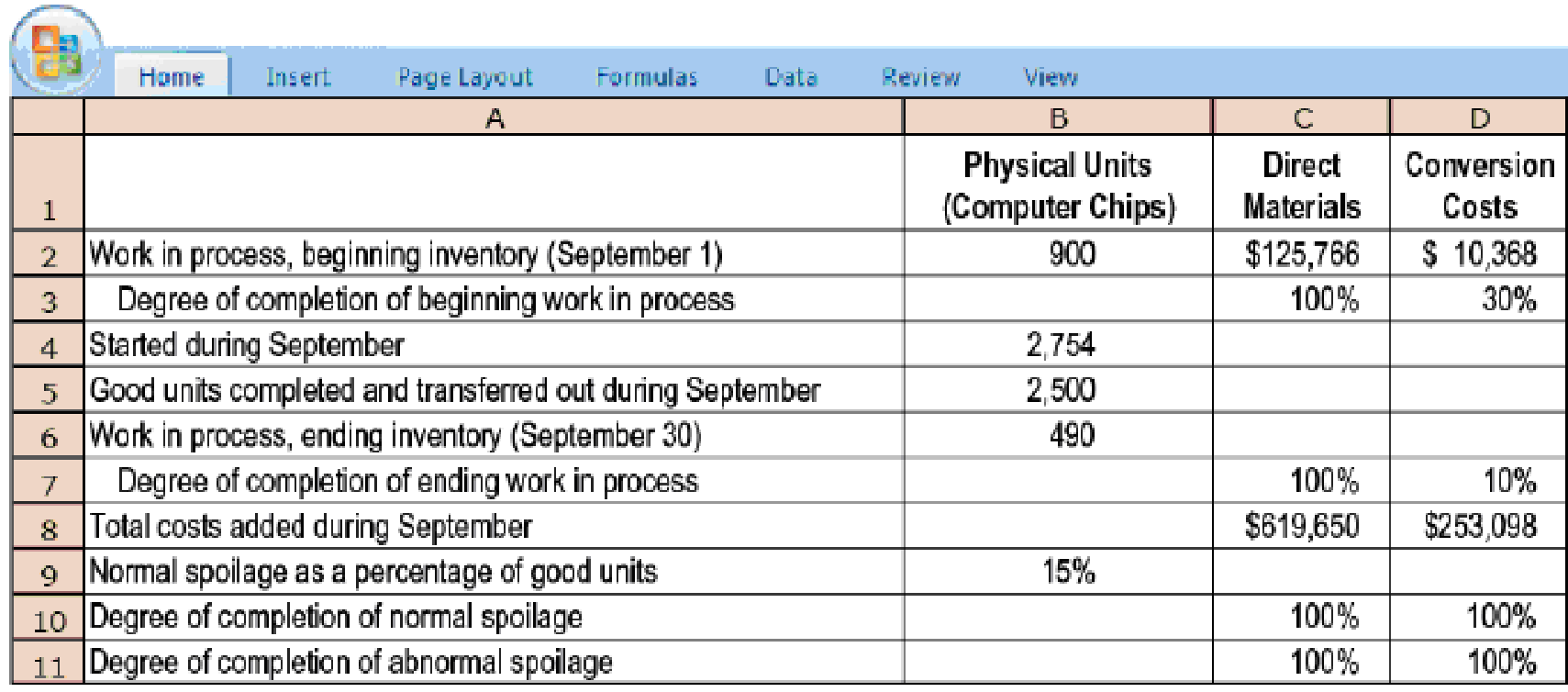

18-29 Weighted-average method, spoilage. LogicCo is a fast-growing manufacturer of computer chips. Direct materials are added at the start of the production process. Conversion costs are added evenly during the process. Some units of this product are spoiled as a result of defects not detectable before inspection of finished goods. Spoiled units are disposed of at zero net disposal value. LogicCo uses the weighted-average method of process costing.

Summary data for September 2017 are as follows:

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Central Perk, LLC, a manufacturer of coffee beans, is considering switching its

operations to an Activity Based Costing system. The following manufacturing

overhead activities and cost drivers have been identified:

Activity.

Machine setup

Machine assembly

Product inspection

Product movement

General factory

Cost Driver

Number of machine setups

Machine hours logged

Inspection hours logged

Number of moves

Machine hours logged

Based on the above descriptions, which of the following correctly pairs the activity

with its appropriate cost level?

O A. Product Inspection... batch level cost

OB. Product Movement... facility level cost

O C. Machine Assembly... unit level cost

O D. General Factory... batch level cost

O E. Machine Setup... unit level cost

Wojtek Nakowski has prepared the following list of statements about process cost accounting.

Identify each statement as true or false.

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

Process cost systems are used to apply costs to similar products that are mass-produced in a

continuous fashion.

A process cost system is used when each finished unit is indistinguishable from another.

Companies that produce soft drinks, motion pictures, and computer chips would all use process cost

accounting.

In a process cost system, costs are tracked by individual jobs.

Job-order costing and process costing track different manufacturing cost components.

Both job-order costing and process costing account for direct materials, direct labour, and

manufacturing overhead.

Costs flow through the accounts in the same basic way for both job-order costing and process costing.

In a process cost system, only one work in process inventory account is used.

In a process cost system, costs are summarized in a job cost sheet.

In a…

LogicCO is a fast-growing manufacturer of computer chips. Direct materials are added at the start of the production process. Conversion costs are added evenly during the process. Some units of this product are spoiled as a result of defects not detectable before inspection of finished goods. Spoiled units are disposed of at zero net disposal value. uses the FIFO method of process costing. Summary data and weighted-average data for are as follows: Requirements : 1.

For each cost category, compute equivalent units. Show physical units in the first column.

2.

Summarize total costs to account for; calculate cost per equivalent unit for each cost category; and assign costs to units completed and transferred out (including normal spoilage), to abnormal spoilage, and to units in ending work in process.

3.

Should 's managers choose the weighted-average method or the FIFO method? Explain.

Chapter 18 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Ch. 18 - Why is there an unmistakable trend in...Ch. 18 - Distinguish among spoilage, rework, and scrap.Ch. 18 - Normal spoilage is planned spoilage. Discuss.Ch. 18 - Costs of abnormal spoilage are losses. Explain.Ch. 18 - What has been regarded as normal spoilage in the...Ch. 18 - Units of abnormal spoilage are inferred rather...Ch. 18 - In accounting for spoiled units, we are dealing...Ch. 18 - Total input includes abnormal as well as normal...Ch. 18 - Prob. 18.9QCh. 18 - The unit cost of normal spoilage is the same as...

Ch. 18 - In job costing, the costs of normal spoilage that...Ch. 18 - The costs of rework are always charged to the...Ch. 18 - Abnormal rework costs should be charged to a loss...Ch. 18 - When is a company justified in inventorying scrap?Ch. 18 - How do managers use information about scrap?Ch. 18 - Prob. 18.16MCQCh. 18 - Which of the following is a TRUE statement...Ch. 18 - Healthy Dinners Co. produces frozen dinners for...Ch. 18 - Fresh Products, Inc. incurred the following costs...Ch. 18 - Normal and abnormal spoilage in units. The...Ch. 18 - Weighted-average method, spoilage, equivalent...Ch. 18 - Weighted-average method, assigning costs...Ch. 18 - FIFO method, spoilage, equivalent units. Refer to...Ch. 18 - FIFO method, assigning costs (continuation of...Ch. 18 - Weighted-average method, spoilage. LaCroix Company...Ch. 18 - FIFO method, spoilage. 1. Do Exercise 18-25 using...Ch. 18 - Spoilage, journal entries. Plastique produces...Ch. 18 - Recognition of loss from spoilage. Spheres Toys...Ch. 18 - Weighted-average method, spoilage. LogicCo is a...Ch. 18 - FIFO method, spoilage. Refer to the information in...Ch. 18 - Standard-costing method, spoilage. Refer to the...Ch. 18 - Spoilage and job costing. (L. Bamber) Barrett...Ch. 18 - Reworked units, costs of rework. Heyer Appliances...Ch. 18 - Scrap, job costing. The Russell Company has an...Ch. 18 - Weighted-average method, spoilage. World Class...Ch. 18 - FIFO method, spoilage. Refer to the information in...Ch. 18 - Weighted-average method, shipping department...Ch. 18 - FIFO method, shipping department (continuation of...Ch. 18 - Physical units, inspection at various levels of...Ch. 18 - Spoilage in job costing. Jellyfish Machine Shop is...Ch. 18 - Rework in job costing, journal entry (continuation...Ch. 18 - Scrap at time of sale or at time of production,...Ch. 18 - Physical units, inspection at various stages of...Ch. 18 - Weighted-average method, inspection at 80%...Ch. 18 - Job costing, classifying spoilage, ethics....

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A new product Zico was recently introduced by Philadelphia Co., in order to complement its other products, Novo and Domo. The accountant used to allocate the indirect cost according to the units produced. With the recent addition of an expanded computer system, Sonata would like to investigate the possibility of implementing ABC. Before making a final decision, management has come to you for advice. You collected the following information regarding manufacturing overhead: Table (1) Mfg. Overhead Mfg. Overhead Allocation bases Costs $ 40,000 $ 45,000 $ 9,000 $ 21,000 Number of set-ups Set-up Ordering materials Handling materials Inspection Number of material orders Number of times material was handled Number of inspection hours $115,000 Table (2) Products Activity Zico Novo Domo Total Number of set-ups 5 20 55 Total Number of material orders 1 2 7 Total Number of times material was handled 1 17 Total Number of inspection hours Number of units produced 3 10 6,000 3,000 1,000 Required: 1.…arrow_forwardA new product Zico was recently introduced by Philadelphia Co., in order to complement its other products, Novo and Domo. The accountant used to allocate the indirect cost according to the units produced. With the recent addition of an expanded computer system, Sonata would like to investigate the possibility of implementing ABC. Before making a final decision, management has come to you for advice. You collected the following information regarding manufacturing overhead: Table (1) Mfg. Overhead Mfg. Overhead Costs Allocation bases Set-up $ 40,000 Number of set-ups Ordering materials $ 45,000 Number of material orders Handling materials $ 9,000 Number of times material was handled Inspection $ 21,000 Number of inspection hours $115,000 Table (2) Activity Products Zico Novo Domo Total Number of set-ups 5 20 55 Total…arrow_forwardFor situations 1 trough 6, provide the following information:a. An estimate of the non-value-added cost caused by each activityb. The root caused of the activity cost (such as plant layout, process design, and product design)c. The appropriate cost reduction measure: activity elimination, activity reduction, activity sharing,or activity selection 1. It takes 1 hour and six pounds of material to produce a product using a traditional manufacturing process. A process reengineering study provided a new manufacturing process design (using existing technology) that would take 30 minutes and four pounds of material. The cost per labor hour is $12, and the cost per pound of material is $102. With its original design, a product requires 10 hours of setup time. Redesigning the product could replace the setup time to an absolute minimum of 30 minutes. The cost per hour of setup time is $250. 3. A product currently requires eight moves. By redesigning the manufacturing layout, the number of moves…arrow_forward

- 4. Mr Khizar has prepared the following list of statements about process cost accounting. а. 1. Process cost systems are used to apply costs to similar products that are mass-produced in a continuous fashion. b. 2. A process cost system is used when each finished unit is indistinguishable from another. 3. Companies that produce soft drinks, motion pictures, and computer chips would all use process cost accounting. С. d. 4. In a process cost system, costs are tracked by individual jobs. 5. Job order costing and process costing е. track different manufacturing cost elements. f. 6. Both job order costing and process costing account for direct materials, direct labor, and manufacturing overhead. Instructions: Identify each statement as true or false. If false, indicate how to correct the statement.arrow_forwardFor situations 1 trough 6, provide the following information: a. An estimate of the non-value-added cost caused by each activity b. The root caused of the activity cost (such as plant layout, process design, and product design) c. The appropriate cost reduction measure: activity elimination, activity reduction, activity sharing, or activity selection 1. It takes 1 hour and six pounds of material to produce a product using a traditional manufacturing process. A process reengineering study provided a new manufacturing process design (using existing technology) that would take 30 minutes and four pounds of material. The cost per labor hour is $12, and the cost per pound of material is $10 2. With its original design, a product requires 10 hours of setup time. Redesigning the product could replace the setup time to an absolute minimum of 30 minutes. The cost per hour of setup time is $250. 3. A product currently requires eight moves. By redesigning the manufacturing layout, the number of…arrow_forward1. Explain the role of activity drivers in assigning costs to products. 2. Why are the accounting requirements for job order costing more demanding than those of process costing? 3. Folio Glass produces custom glass platters. For one job, the trainee assigned to cut the glass set the template incorrectly into the computer. This template was unusable and had to be discarded; another template was cut to the correct dimensions. How is the cost of the spoiled template handled?arrow_forward

- Assume that a company has recently switched to JIT manufacturing. Each manufacturing cell produces a single product or major subassembly. Cell workers have been trained to perform a variety of tasks. Additionally, many services have been decentralized. Costs are assigned to products using direct tracing, driver tracing, and allocation. For each cost listed, indicate the most likely product cost assignment method used before JIT and after JIT. Set up a table with three columns: Cost Item, Before JIT, and After JIT. You may assume that direct tracing is used whenever possible, followed by driver tracing, with allocation being the method of last resort. Inspection costs Power to heat, light, and cool plant Minor repairs on production equipment Salary of production supervisor (department/cell) Oil to lubricate machinery Salary of plant supervisor Costs to set up machinery Salaries of janitors Power to operate production equipment Taxes on plant and equipment Depreciation on production…arrow_forwardSnowden Industries produces two electronic decoders, P and Q. Decoder P is more sophisticated and requires more programming and testing than does Decoder Q. Because of these product differences, the company wants to use activity-based costing to allocate overhead costs. It has identified four activity pools. Relevant information follows. *Need help for informatio going into excel*arrow_forwardYour Company has two products: A and B. The company uses activity-based costing. The estimated total cost and expected activity for each of the company's three activity cost pools are as follows: Estimated Expected Activity Activity Cost Pool Cost Product A Product B Total Machine related $17,600 700 300 1,000 MH Batch setup $32,600 600 200 800 Setups Other $52,500 900 500 1,400 DLH What is the activity rate under the activity-based costing system for Batch setups? Group of answer choices $54.33 $40.75 $40.75 per Setup $16.30 $16.30 per Setup $54.33 per Setuparrow_forward

- Activity-Based Costing, Reducing the Number of Drivers and EqualAccuracy Reducir, Inc., produces two different types of hydraulic cylinders. Reducir produces a major subassembly for the cylinders in the Cutting and Welding Department. Other parts and the sub-assembly are then assembled in the Assembly Department. The activities, expected costs, and drivers associated with these two manufacturing processes are given below. Required:1. Using a plantwide rate based on machine hours, calculate the total overhead cost assignedto each product and the unit overhead cost.2. Using activity rates, calculate the total overhead cost assigned to each product and the unitoverhead cost. Comment on the accuracy of the plantwide rate. 3. Calculate the global consumption ratios.4. Calculate the consumption ratios for welding and materials handling (Assembly) and showthat two drivers, welding hours and number of parts, can be used to achieve the same ABCproduct costs calculated in Requirement 2. Explain…arrow_forwardTrue or False "Setup costs should not be allocated directly to products via machine hours." The answer is True. The company should allocate setup costs to the batch of products that will run after the setup occurs. My question: Are setup costs allocated indirectly to products via machine hours? Please explain the answer thoroughly with examples.arrow_forwardPerez Industries produces two electronic decoders, P and Q. Decoder P is more sophisticated and requires more programming and testing than does Decoder Q. Because of these product differences, the company wants to use activity-based costing to allocate overhead costs. It has identified four activity pools. Relevant information follows: b. Determine the overhead cost allocated to each product.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY