Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN: 9781305654174

Author: Gary A. Porter, Curtis L. Norton

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 2.4E

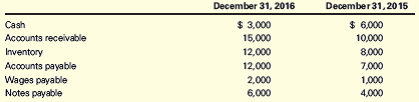

Baldwin Corp. reported the following current accounts at the end of two recent years:

Required

- Compute Baldwin’s current ratio at the end of each of the two years.

- How has Baldwin’s liquidity changed at the end of 2016 compared to the end of 2015?

- Comment on the relative composition of Baldwin’s current assets at the end of 2016 compared to the end of 2015.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

1. Compute the following ratios for the comparative periods (2018 and 2019). The company used 365 days in its computation for some of the ratios. Show your solution.

a. Working Capital

b. Current Ratio

c. Acid Test Ratio

d. Accounts Receivable Turnover Ratio

e. Average Collection Period

f. Inventory Turnover Ratio

g. Average Days in Inventory

h. Number of days in Operating Cycle

i. Debt to Total Assets Ratio

j. Debt to Equity Ratio

k. Times Interest Earned Ratio

l. Gross Profit Ratio

m. Profit Margin Ratio

n. Return on Assets

o. Return on Equity

p. Assets Turnover Ratio

1. Compute the following ratios for the comparative periods (2018 and 2019). The company used 365 days in its computation for some of the ratios. Show your solution.

d. Accounts Receivable Turnover Ratio

e. Average Collection Period

f. Inventory Turnover Ratio

g. Average Days in Inventory

h. Number of days in Operating Cycle

i. Debt to Total Assets Ratio

j. Debt to Equity Ratio

k. Times Interest Earned Ratio

l. Gross Profit Ratio

m. Profit Margin Ratio

n. Return on Assets

o. Return on Equity

p. Assets Turnover Ratio

The condensed financial statements of Ivanhoe Company for the years 2020-2021 are presented below:

(See Images)

Compute the following financial ratios by placing the proper amounts for numerators and denominators. (Round per unit answers to 2 decimal places, e.g. 52.75.)

(a)

Current ratio at 12/31/21

$

$

(b)

Acid test ratio at 12/31/21

$

$

(c)

Accounts receivable turnover in 2021

$

$

(d)

Inventory turnover in 2021

$

$

(e)

Profit margin on sales in 2021

$

$

(f)

Earnings per share in 2021

$

(g)

Return on common stockholders’ equity in 2021

$

$

(h)

Price earnings ratio at 12/31/21

$

$

(i)

Debt to assets at 12/31/21

$

$

(j)

Book value per share at 12/31/21

$

Chapter 2 Solutions

Financial Accounting: The Impact on Decision Makers

Ch. 2 - Read each definition below and write the number of...Ch. 2 - Prob. 2.1ECh. 2 - The Operating Cycle Two Wheeler Cycle Shop buys...Ch. 2 - Classification of Financial Statement Items Regal...Ch. 2 - Current Ratio Baldwin Corp. reported the following...Ch. 2 - Classification of Assets and Liabilities Indicate...Ch. 2 - Selling Expenses and General and Administrative...Ch. 2 - Prob. 2.7ECh. 2 - Income Statement Ratio The income statement of...Ch. 2 - Statement of Retained Earnings Landon Corporation...

Ch. 2 - Components of the Statement of Cash Flows Identify...Ch. 2 - Prob. 2.11ECh. 2 - Prob. 2.12MCECh. 2 - Prob. 2.13MCECh. 2 - Prob. 2.14MCECh. 2 - Materiality Joseph Knapp, a newly hired accountant...Ch. 2 - Costs and Expenses The following costs are...Ch. 2 - Prob. 2.3PCh. 2 - Prob. 2.4PCh. 2 - Working Capital and Current Ratio The balance...Ch. 2 - Single-Step Income Statement The following income...Ch. 2 - Multiple-Step Income Statement and Profit Margin...Ch. 2 - Statement of Cash Flows Colorado Corporation was...Ch. 2 - Basic Elements of Financial Reports Comparative...Ch. 2 - Prob. 2.10MCPCh. 2 - Prob. 2.11MCPCh. 2 - Prob. 2.12MCPCh. 2 - Prob. 2.1APCh. 2 - Prob. 2.2APCh. 2 - Prob. 2.3APCh. 2 - Prob. 2.4APCh. 2 - Working Capital and Current Ratio The balance...Ch. 2 - Single-Step Income Statement The following income...Ch. 2 - Prob. 2.7APCh. 2 - Prob. 2.8APCh. 2 - Prob. 2.9APCh. 2 - Comparability and Consistency in Income Statements...Ch. 2 - Prob. 2.12AMCPCh. 2 - Prob. 2.1DCCh. 2 - Prob. 2.2DCCh. 2 - Analysis of Cash Flow for a Small Business...Ch. 2 - Prob. 2.4DCCh. 2 - The Expenditure Approval Process Roberto is the...Ch. 2 - Prob. 2.6DC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Financial statement data for years ending December 31 for Latchkey Company follows: a. Determine the ratio of sales to assets for 2016 and 2015. b. Does the change in the ratio of sales to assets from 2015 to 2016 indicate a favorable or an unfavorable trend?arrow_forwardDebt Management and Short-Term Liquidity Ratios The following items appear on the balance sheet of Figgins Company at the end of 2018 and 2019: Required: Between 2018 and 2019, indicate whether Figgins debt to equity ratio increased or decreased. Also, indicate whether Figgins current ratio increased or decreased. Interpret these ratios.arrow_forwardFINANCIAL RATIO: Requirement: Compute for the following financial ratios for the year 2021 (round-off answers to two decimal places) a. Current ratio b. Quick (Acid-test) ratio c. Working capital d. Inventory turnover e. Days of inventory (use 365 days) f. Accounts receivable turnover (assume all sales are on credit) g. Days of receivable (use 365 days) h. Debt ratio i. Equity ratio j. Debt-to-equity ratio k. Gross profit ratio 1. Net profit ratio m. Return on assets n. Return on equityarrow_forward

- Find the following financial ratios for LVMH Moet Hennessy Louis Vuitton SA (use year-end figures rather than average values where appropriate) (Round your answers to 2 decimal places (e.g., 32.16).) : 2015 2016 Short-term solvency ratios: Current ratio Quick ratio Cash ratio Asset utilization ratios: Total asset turnover Inventory turnover Receivables turnover Long-term solvency ratios: Total debt ratio Debt–equity ratio Equity multiplier Times interest earned ratio Profitability ratios: Profit margin % % Return on assets % % Return on equity % %arrow_forwardFINANCIAL RATIO: Requirement: Compute for the following financial ratios for the year 2021 (round-off answers to two decimal places) f. Accounts receivable turnover (assume all sales are on credit) g. Days of receivable (use 365 days) h. Debt ratio i. Equity ratio j. Debt-to-equity ratio k. Gross profit ratio 1. Net profit ratio m. Return on assets n. Return on equityarrow_forwardAccess the February 21, 2017, filing of the December 31, 2016, 10-K report of The Hershey Company (ticker: HSY) at SEC.gov and complete the following requirements. Required Compute or identify the following profitability ratios of Hershey for its years ending December 31, 2016, and December 31, 2015. Interpret its profitability using the results obtained for these two years. 1. Profit margin ratio (round the percent to one decimal). 2. Gross profit ratio (round the percent to one decimal). 3. Return on total assets (round the percent to one decimal). (Total assets at year-end 2014 were $5,622,870 in thousands.) 4. Return on common stockholders’ equity (round the percent to one decimal). (Total shareholders’ equity at year-end 2014 was $1,519,530 in thousands.) 5. Basic net income per common share (round to the nearest cent).arrow_forward

- Computing rate of return on total assets Barot’s 2018 financial statements reported the following items—with 2017 figures given for comparison: Net income for 2018 was $3,910, and interest expense was $240. Compute Barot’s rate of return on total assets for 2018. (Round to the nearest percent.)arrow_forward(Ratio Computations and Analysis) Prior Company’s condensed financial statements provide the following information. Check the below image for information. Instructions(a) Determine the following for 2017.(1) Current ratio at December 31.(2) Acid-test ratio at December 31.(3) Accounts receivable turnover.(4) Inventory turnover.(5) Return on assets.(6) Profit margin on sales.(b) Prepare a brief evaluation of the financial condition of Prior Company and of the adequacy of its profits.arrow_forwardLiverton Co.’s income statement for the year ended 31 March 2019 and statements of financial position at 31 March 2019 and 2018 were as follows in the images. Calculate for the financial year ended 31 March 2019 and, where possible, for 31 March 2018, the following ratios: i) Gross profit marginii) Assets usageiii) Current ratioiv) Acid testv) Inventories holding periodvi) Debt to Equity ratioarrow_forward

- Instructions Using the financial statements and additional information, compute the following ratios for the El Camino Company for 2021. Show all computations. Computations 1. Current ratio 2. Return on common stockholders' equity 3. Price-earnings ratio 4. Inventory turnover 5. Accounts receivable turnover 6. Times interest earned 7. Profit margin 8. Days in inventory 9. Payout ratio 10. Return on assetsarrow_forwardPerez Company reported an increase in inventories in thepast year. Discuss the effect of this change on the currentratio (current assets ÷ current liabilities). What does thistell a statement user about Perez Company’s liquidity?arrow_forwardSummary financial information for Gandaulf Company is as follows. Compute the amount and percentage changes in 2022 using horizontal analysis, assuming 2024 is the base year. (Enter negative amounts and percentages using either a negative sign preceding the number e.g. -45,-45% or parentheses e.g. (45), (45%). Round percentages to 2 decimal places, e.g. 1.25%.) Current Assets Dec. 31, 2022 Dec. 31, 2024 $191,100 $210,000 $ Plant Assets 1,058,600 790,000 Total assets $1,249,700 $1,000,000 $ Increase (Decrease) in 2022 Amount Percent % % %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License