Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 5PA

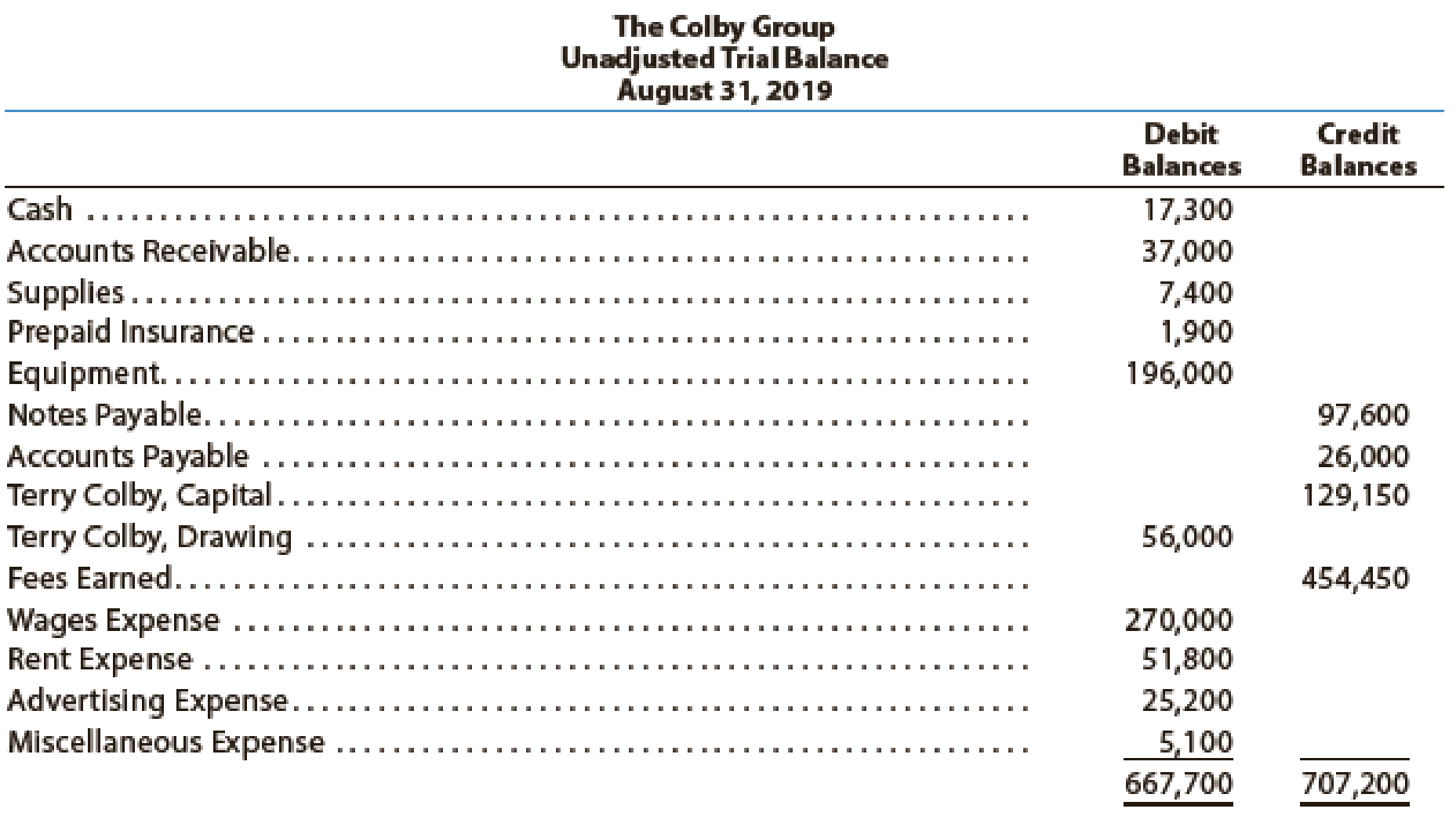

The Colby Group has the following unadjusted

The debit and credit totals are not equal as a result of the following errors:

- a. The cash entered on the trial balance was understated by $6,000.

- b. A cash receipt of $5,600 was posted as a debit to Cash of $6,500.

- c. A debit of $11,000 to Accounts Receivable was not posted.

- d. A return of $150 of defective supplies was erroneously posted as a $1,500 credit to Supplies.

- e. An insurance policy acquired at a cost of $1,200 was posted as a credit to Prepaid Insurance.

- f. The balance of Notes Payable was understated by $20,000.

- g. A credit of $4,800 in Accounts Payable was overlooked when determining the balance of the account.

- h. A debit of $7,000 for a withdrawal by the owner was posted as a credit to Terry Colby, Capital.

- i. The balance of $58,100 in Rent Expense was entered as $51,800 in the trial balance.

- j. Gas, Electricity, and Water Expense, with a balance of $24,150, was omitted from the trial balance.

Instructions

- 1. Prepare a corrected unadjusted trial balance as of August 31, 2019.

- 2.

Does the fact that the unadjusted trial balance in (1) is balanced mean that there are no errors in the accounts? Explain.

Does the fact that the unadjusted trial balance in (1) is balanced mean that there are no errors in the accounts? Explain.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

The Colby Group has the following unadjusted trial balance as of August 31, 2019

The debit and credit totals are not equal as a result of the following errors:a. The cash entered on the trial balance was understated by $6,000.b. A cash receipt of $5,600 was posted as a debit to Cash of $6,500.c. A debit of $11,000 to Accounts Receivable was not posted.d. A return of $150 of defective supplies was erroneously posted as a $1,500 credit to Supplies.e. An insurance policy acquired at a cost of $1,200 was posted as a credit to PrepaidInsurance.f. The balance of Notes Payable was understated by $20,000.g. A credit of $4,800 in Accounts Payable was overlooked when determining the balanceof the account.h. A debit of $7,000 for a withdrawal by the owner was posted as a credit to Terry Colby, Capital.i. The balance of $58,100 in Rent Expense was entered as $51,800 in the trial balance.j. Gas, Electricity, and Water Expense, with a balance of $24,150, was omitted from thetrial…

Tech Support Services has the following unadjusted trial balance as of January 31, 2019:

The debit and credit totals are not equal as a result of the following errors:a. The cash entered on the trial balance was overstated by $8,000.b. A cash receipt of $4,100 was posted as a debit to Cash of $1,400.

c. A debit of $12,350 to Accounts Receivable was not posted.d. A return of $235 of defective supplies was erroneously posted as a $325 credit to Supplies.e. An insurance policy acquired at a cost of $3,000 was posted as a credit to PrepaidInsurance.f. The balance of Notes Payable was overstated by $21,000.g. A credit of $3,450 in Accounts Payable was overlooked when the balance of the account was determined.h. A debit of $6,000 for a withdrawal by the owner was posted as a debit to ThadEngelberg, Capital.i. The balance of $28,350 in Advertising Expense was entered as $23,850 in the trialbalance.j. Miscellaneous Expense, with a balance of $4,600, was omitted from the trial…

The debit and credit totals are not equal as a result of the following errors:a. The cash entered on the trial balance was understated by $6,000.b. A cash receipt of $5,600 was posted as a debit to Cash of $6,500.c. A debit of $11,000 to Accounts Receivable was not posted.d. A return of $150 of defective supplies was erroneously posted as a $1,500 credit to Supplies.e. An insurance policy acquired at a cost of $1,200 was posted as a credit to Prepaid Insurance.f. The balance of Notes Payable was understated by $20,000.g. A credit of $4,800 in Accounts Payable was overlooked when determining the balance of the account.h. A debit of $7,000 for a withdrawal by the owner was posted as a credit to Terry Colby, Capital.i. The balance of $58,100 in Rent Expense was entered as $51,800 in the trial balance.j. Gas, Electricity, and Water Expense, with a balance of $24,150, was omitted from the trial balance.Instructions1. Prepare a corrected unadjusted trial balance as of August 31, 2014.2. Does…

Chapter 2 Solutions

Financial Accounting

Ch. 2 - What is the difference between an account and a...Ch. 2 - Prob. 2DQCh. 2 - Prob. 3DQCh. 2 - eCatalog Services Company performed services in...Ch. 2 - If the two totals of a trial balance are equal,...Ch. 2 - Assume that a trial balance is prepared with an...Ch. 2 - Assume that when a purchase of supplies of 2,650...Ch. 2 - Assume that Muscular Consulting erroneously...Ch. 2 - Assume that Sunshine Realty Co. borrowed 300,000...Ch. 2 - Checking accounts are a common form of deposits...

Ch. 2 - State for each account whether it is likely to...Ch. 2 - State for each account whether it is likely to...Ch. 2 - Prepare a journal entry for the purchase of office...Ch. 2 - Prob. 2PEBCh. 2 - Prepare a journal entry on April 30 for fees...Ch. 2 - Prepare a journal entry on August 13 for cash...Ch. 2 - Prepare a journal entry on December 23 for the...Ch. 2 - Prepare a journal entry on June 30 for the...Ch. 2 - Prob. 5PEACh. 2 - On August 1, the supplies account balance was...Ch. 2 - For each of the following errors, considered...Ch. 2 - For each of the following errors, considered...Ch. 2 - The following errors took place in journalizing...Ch. 2 - The following errors took place in journalizing...Ch. 2 - Prob. 8PEACh. 2 - Prob. 8PEBCh. 2 - The following accounts appeared in recent...Ch. 2 - Oak Interiors is owned and operated by Fred Biggs,...Ch. 2 - Outdoor Leadership School is a newly organized...Ch. 2 - The following table summarizes the rules of debit...Ch. 2 - During the month, Midwest Labs Co. has a...Ch. 2 - Identify each of the following accounts of...Ch. 2 - Concrete Consulting Co. has the following accounts...Ch. 2 - On September 18, 2019, Afton Company purchased...Ch. 2 - The following selected transactions were completed...Ch. 2 - During the month, Warwick Co. received 515,000 in...Ch. 2 - a. During February, 186,500 was paid to creditors...Ch. 2 - As of January 1, Terrace Waters, Capital had a...Ch. 2 - National Park Tours Co. is a travel agency. The...Ch. 2 - Based upon the T accounts in Exercise 2-13,...Ch. 2 - Based upon the data presented in Exercise 2-13,...Ch. 2 - The accounts in the ledger of Hickory Furniture...Ch. 2 - Indicate which of the following errors, each...Ch. 2 - The following preliminary unadjusted trial balance...Ch. 2 - The following errors occurred in posting from a...Ch. 2 - Identify the errors in the following trial...Ch. 2 - The following errors took place in journalizing...Ch. 2 - The following errors took place in journalizing...Ch. 2 - The following data (in millions) are taken from...Ch. 2 - The following data (in millions) were taken from...Ch. 2 - Connie Young, an architect, opened an office on...Ch. 2 - On January 1, 2019, Sharon Matthews established...Ch. 2 - On June 1, 2019, Kris Storey established an...Ch. 2 - Elite Realty acts as an agent in buying, selling,...Ch. 2 - The Colby Group has the following unadjusted trial...Ch. 2 - Ken Jones, an architect, opened an office on April...Ch. 2 - Prob. 2PBCh. 2 - On October 1, 2019, Jay Pryor established an...Ch. 2 - Valley Realty acts as an agent in buying, selling,...Ch. 2 - Tech Support Services has the following unadjusted...Ch. 2 - The transactions completed by PS Music during June...Ch. 2 - Buddy Dupree is the accounting manager for On-Time...Ch. 2 - Prob. 5CPCh. 2 - The following discussion took place between Tony...Ch. 2 - Prob. 7CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Tech Support Services has the following unadjusted trial balance as of January 31, 2019: The debit and credit totals are not equal as a result of the following errors: a. The cash entered on the trial balance was overstated by 8,000. b. A cash receipt of 4,100 was posted as a debit to Cash of 1,400. c. A debit of 12,350 to Accounts Receivable was not posted. d. A return of 235 of defective supplies was erroneously posted as a 325 credit to Supplies. e. An insurance policy acquired at a cost of 3,000 was posted as a credit to Prepaid Insurance. f. The balance of Notes Payable was overstated by 21,000. g. A credit of 3,450 in Accounts Payable was overlooked when the balance of the account was determined. h. A debit of 6,000 for a withdrawal by the owner was posted as a debit to Thad Engelberg, Capital. i. The balance of 28,350 in Advertising Expense was entered as 23,850 in the trial balance. j. Miscellaneous Expense, with a balance of 4,600, was omitted from the trial balance. Instructions 1. Prepare a corrected unadjusted trial balance as of January 31, 2019. 2. Does the fact that the unadjusted trial balance in (1) is balanced mean that there are no errors in the accounts? Explain.arrow_forwardThe Colby Group has the following unadjusted trial balance as of August 31, 2019: The Colby Group Unadjusted Trial Balance August 31, 2019 Credit Balances Debit Balances Cash 17,300 37,000 7,400 Accounts Receivable Supplies Prepaid Insurance Equipment.. Notes Payable.. Accounts Payable Terry Colby, Capital.. Terry Colby, Drawing 1,900 196,000 97,600 26,000 129,150 56,000 Fees Earned.. 454,450 Wages Expense Rent Expense Advertising Expense.. Miscellaneous Expense 270,000 51,800 25,200 5,100 667,700 707,200arrow_forwardThe following errors were discovered during the financial year ended 28 February 2021. a) A debtor that was owing N$ 600 was erroneously written-off as bad debt; b) Cash receipt of $300 was recorded as bank receipt; c) A payment of N$ 1 500 received from a customer was recorded on supplier; d) Credit sales of N$ 4 300 was recorded to supplier account; Page 18 of 19 e) Bank charge of $420 was completely omitted from the records; f) Stationery purchased of $ 580 was debited to advertisement; g) Printing that was purchased by EFT was completely ignored in the books, $630; h) A customer that was owing $1 250 was declared bankrupt and the transaction was not recorded; i) The owner withdraws a cheque for $900 and deposited in the business; j) Depreciation for motor vehicle was not provided for. Depreciation is at 10% straight line and no residual value. k) Depreciation for computer equipment was not provided for. Depreciation as at 15%, straight line with N$ 2 000 residual value. REQUIRED…arrow_forward

- The following errors were discovered during the financial year ended 28 February 2021.a) A debtor that was owing N$ 600 was erroneously written-off as bad debt;b) Cash receipt of $300 was recorded as bank receipt;c) A payment of N$ 1 500 received from a customer was recorded on supplier;d) Credit sales of N$ 4 300 was recorded to supplier account; Page 18 of 19e) Bank charge of $420 was completely omitted from the records;f) Stationery purchased of $ 580 was debited to advertisement;g) Printing that was purchased by EFT was completely ignored in the books, $630;h) A customer that was owing $1 250 was declared bankrupt and the transaction was notrecorded;i) The owner withdraws a cheque for $900 and deposited in the business;j) Depreciation for motor vehicle was not provided for. Depreciation is at 10% straight lineand no residual value.k) Depreciation for computer equipment was not provided for. Depreciation as at 15%,straight line with N$ 2 000 residual value.REQUIREDPrepare a…arrow_forwardThe trial balance of the Sterling investigative Services shown next age does not balance. Your review of the general ledger reveals that each account has a normal balance. You also discovered the following errors. a. The totals of the debit sides of Rent Deposit, Accounts Payable, and Representation Expense were each understood to be P1,000. b. Transposition errors were made in Accounts Receivable and Service Revenue. Based on postings made, the correct balances were P25,700 and P69,600, respectively. c. Check payment for P9.400 was properly recorded, and the cash credit properly posted, but the accountant failed to post to the debit side of the taxes payable account. d. The trial balance shows some accounts are not on their proper sides. e. A cash debit posting for P5,000 was posted on the credit side. Credit P27,500 Sterling Investigative Services Trial Balance May 31, 2017 Debit Cash P55,800 Accounts Receivable Rent Deposit 7,000 Equipment 80,000 Accounts payable Taxes Payable…arrow_forwardRequired: Post the rectification entry for each of the above errors. Question five: Rectify the following errors: 1. Other income received of Tshs880,000 was correctly recorded in the cash book, but was debited to the other income account. 2. Cash paid for wages of Tshs9.6 million was posted to the wages account as Tshs6.9 million. 3. The purchases day book was overcast by Tshs2 million. 4. The sales day book was undercast by Tshs6 million. 5. The cash book credit side was undercast by Tshsl.3 million. 6. The prepaid expense account debit side was undercast by Tshs0.6 million. 7. A sale of Tshsl.5 million was fully credited to the sales account. However, sales tax of Tshs0.5 million was included in it. 8. A building purchased for Tshs60 million was entered in the building account as Tshs50 million. The company charges 2% depreciation. 9. Repairs to machinery of Tshs5 million were capitalised and a depreciation of 5% was charged on it. Question six: How much will appear in the suspense…arrow_forward

- Which of the following errors would not affect net income?A. Post-dated checks are classified as cash upon receipt from customersB. Purchases on account are unrecorded because the goods are still in transit : butthe goods were included in inventoryC. Depreciation expense was recorded twice for the same yearD. The client charged an ordinary repair as part of equipment cost.arrow_forwardOne company has estimated that $3150 of its accounts receiable will be uncollectible. If allownace for doubtful accounts already has a credit balance of $1102, and the percentage of receivables method is used, it sadjustment to recrod for the period will require a debit to what for what amount?arrow_forwardwhat is the solution for The credit total of a trial balance exceeds the debit total by P350. In investigating the cause of the difference, the following errors were determined:a credit to accounts receivable of P550 was not posted;a P5,000 debit to be made to the Purchases account was debited to Accounts payable instead;a P3,000 credit to be made to the Sales account was credited to the Accounts receivable account instead;the Interest payable account balance of P4,500 was included in the trial balance as P5,400.The correct balance of the trial balance isarrow_forward

- Blackhorse Productions, Incorporated, used the aging of accounts receivable method to estimate that its Allowance for Doubtful Accounts should be $22,350. The account had an unadjusted credit balance of $11,300 at that time. a. The appropriate bad debt adjustment was recorded. b. Later, an account receivable for $2,300 was determined to be uncollectible and was written off. Required: For each transaction listed above, indicate the amount and direction (+ for increase or - for decrease) of effects on the financial statement accounts and on the overall accounting equation. (Enter any decreases to Assets, Liabilities, or Stockholders Equity with a minus sign.) Assets Allowance for Doubtful Accounts Allowance for Doubtful Accounts a. b. b. Accounts Receivable 9,250 X = 1,100 X = (1,100) X = > Answer is complete but not entirely correct. Liabilities + + + + Bad Debt Expense Stockholders' Equity 9,250 Xarrow_forwardThe trial balance of Kelvin does not balance. Which TWO of the following errors could explain this, assuming that Kelvin maintains control accounts for its receivables and payables within the double entry system? (1) The sales day book was undercast by $100.(2) Discounts received were credited to sales revenue account.(3) An opening accrual was omitted from the rent account.(4) The debit side of the cash account was undercast. A (1) and (2)B (2) and (3)C (3) and (4)D (1) and (4) Please give solution with proper explanationarrow_forwardThe balance on the receivables ledger control account of Robin & Co on 30 September amounted to $3,800 which did not agree with the net total of the list of receivables ledger balances at that date. Errors were found and the appropriate adjustments, when made, balanced the books. The items were as follows: (1) Debit balances in the receivables ledger, amounting to $103, had been omitted from the list of balances. (2) An irrecoverable debt amounting to $400 had been written off in the receivables ledger but had not been posted to the irrecoverable debts expense account or entered in the control account. An item of goods sold to Sparrow, $250, had been entered once in the sales day book but posted to his account twice. (4) $25 discount allowed to Wren had been correctly recorded and posted in the books. This sum had been subsequently disallowed, debited to Wren's account, and entered in the discount received column of the cash book. (5) No entry had been made in the control account in…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Accounting Changes and Error Analysis: Intermediate Accounting Chapter 22; Author: Finally Learn;https://www.youtube.com/watch?v=c2uQdN53MV4;License: Standard Youtube License