Fundamentals Of Cost Accounting (6th Edition)

6th Edition

ISBN: 9781259969478

Author: WILLIAM LANEN, Shannon Anderson, Michael Maher

Publisher: McGraw Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 73P

Reconstruct Financial Statements

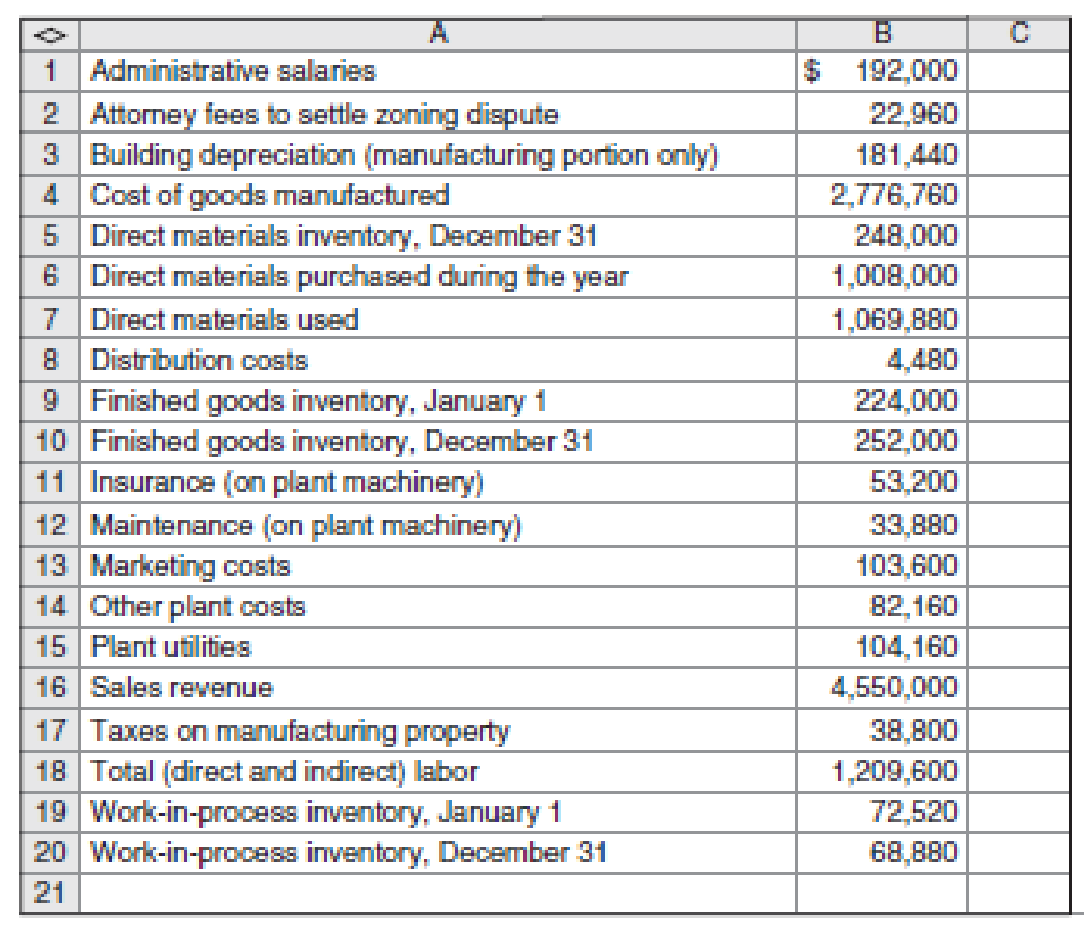

San Ysidro Company manufactures hiking equipment. The company’s administrative and manufacturing operations share the company’s only building. Eighty percent of the building is used for manufacturing and the remainder is used for administrative activities. Indirect labor is 8 percent of direct labor.

The cost accountant at San Ysidro has compiled the following information for the year ended December 31:

Required

Prepare a cost of goods manufactured and sold statement and an income statement.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Prepare income statements for both Garcon Company and Pepper Company. Prepare the current assets section of the

balance sheet for each company. Garcon Company Pepper Company Finished goods inventory, beginning $ 14,300 $

17,650 Work in process inventory, beginning 17, 100 23,700 Raw materials inventory, beginning 11,700 14,700 Rental

cost on factory equipment 31, 250 23,650 Direct labor 24,200 44,600 Finished goods inventory, ending 19,400 14,800

Work in process inventory, ending 24, 400 20, 600 Raw materials inventory, ending 7, 600 9,000 Factory utilities

13,650 14,250 General and administrative expenses 25,000 56, 500 Indirect labor 12, 150 15,480 Repairs-Factory

equipment 5, 900 3, 550 Raw materials purchases 39, 500 63, 500 Selling expenses 54,000 58, 600 Sales

287, 520 388,810 Cash 21,000 21, 200 Accounts receivable, net 14, 600 22,950 GARCON COMPANY Income Statement

For Year Ended December 31 Sales $287, 520 Cost of goods sold: Finished goods inventory, beginning $14, 300 Cost…

The following selected information was extracted from the 20x1 accounting records of Lone Oak Products:

Required:1. Calculate Lone Oak’s manufacturing overhead for the year.2. Calculate Lone Oak’s cost of goods manufactured.3. Compute the company’s cost of goods sold.4. Determine net income for 20x1, assuming a 30% income tax rate.5. Determine the number of completed units manufactured during the year.6. Build a spreadsheet: Construct an Excel spreadsheet to solve all of the preceding requirements. Show how the solution will change if the following data change: indirect labor is $115,000 and other factory costs amount to $516,000.

Prepare a schedule of cost of goods manufactured for the year. The following cost data relate to the manufacturing activities of Chang Company during the just completed year: Manufacturing overhead costs incurred: Indirect materials $ 16, 200 Indirect labor 142, 000 Property taxes, factory 9,200 Utilities, factory 82, 000 Depreciation, factory 169, 900 Insurance, factory 11, 200 Total actual manufacturing overhead costs incurred S 430, 500 Other costs incurred: Purchases of raw materials ( both direct and indirect) S 412, 000 Direct labor cost $ 72, 000 Inventories: Raw materials, beginning $ 21, 200 Raw materials, ending S 31, 200 Work in process, beginning $ 41, 200 Work in process, ending S 71,200 The company uses a predetermined overhead rate of $21 per machine - hour to apply overhead cost to jobs. A total of 20, 900 machine - hours were used during the year.

Chapter 2 Solutions

Fundamentals Of Cost Accounting (6th Edition)

Ch. 2 - What is the difference in meaning between the...Ch. 2 - What is the difference between product costs and...Ch. 2 - What is the difference between outlay cost and...Ch. 2 - Prob. 4RQCh. 2 - Is cost-of-goods sold an expense?Ch. 2 - Is cost-of-goods a product cost or a period cost?Ch. 2 - What are the similarities between the Direct...Ch. 2 - What are the three categories of product cost in a...Ch. 2 - Prob. 9RQCh. 2 - Prob. 10RQ

Ch. 2 - What do the terms step costs and semivariable...Ch. 2 - What do the terms variable costs and fixed costs...Ch. 2 - How does a value income statement differ from a...Ch. 2 - Why is a value income statement useful to...Ch. 2 - Materials and labor are always direct costs, and...Ch. 2 - Prob. 16CADQCh. 2 - In evaluating product profitability, we can ignore...Ch. 2 - Prob. 18CADQCh. 2 - The friend in question 2-18 decides that she does...Ch. 2 - Consider a digital music service such as those...Ch. 2 - Consider a ride-sharing service such as Uber or...Ch. 2 - Pick a unit of a hospital (for example, intensive...Ch. 2 - The dean of Midstate University Business School is...Ch. 2 - Prob. 24CADQCh. 2 - Prob. 25CADQCh. 2 - Basic Concepts For each of the following...Ch. 2 - Basic Concepts For each of the following costs...Ch. 2 - Basic Concepts For each of the following costs...Ch. 2 - Basic Concepts Place the number of the appropriate...Ch. 2 - Basic Concepts Intercontinental, Inc., provides...Ch. 2 - Prob. 31ECh. 2 - For each of the following costs incurred in a...Ch. 2 - Basic Concepts For each of the following costs...Ch. 2 - Basic Concepts The following data apply to the...Ch. 2 - Cost AllocationEthical Issues In one of its...Ch. 2 - Cost AllocationEthical Issues Star Buck, a coffee...Ch. 2 - Prepare Statements for a Manufacturing Company The...Ch. 2 - Prepare Statements for a Service Company Chucks...Ch. 2 - Prepare Statements for a Service Company Where2...Ch. 2 - Prepare Statements for a Service Company The...Ch. 2 - Prepare Statements for a Service Company Lead!...Ch. 2 - Prepare Statements for a Manufacturing Company The...Ch. 2 - Basic Concepts The following data refer to one...Ch. 2 - Basic Concepts The following data refers to one...Ch. 2 - Prepare Statements for a Merchandising Company The...Ch. 2 - Prepare Statements for a Merchandising Company...Ch. 2 - Cost Behavior and Forecasting Dayton, Inc....Ch. 2 - Sophia’s Restaurant served 5,000 meals last...Ch. 2 - Prob. 49ECh. 2 - Components of Full Costs Madrid Corporation has...Ch. 2 - Prob. 51ECh. 2 - Components of Full Costs Larcker Manufacturings...Ch. 2 - Prob. 53ECh. 2 - Gross Margin and Contribution Margin Income...Ch. 2 - Gross Margin and Contribution Margin Income...Ch. 2 - Value Income Statement Ralphs Restaurant has the...Ch. 2 - Value Income Statement DeLuxe Limo Service has the...Ch. 2 - Cost Concepts The following information comes from...Ch. 2 - Cost Concepts The controller at Lawrence...Ch. 2 - Cost Concepts Columbia Products produced and sold...Ch. 2 - Prepare Statements for a Manufacturing Company...Ch. 2 - Prepare Statements for a Manufacturing Company...Ch. 2 - Prepare Statements for a Manufacturing Company The...Ch. 2 - Cost Allocation with Cost Flow Diagram Coastal...Ch. 2 - Cost Allocation with Cost Flow Diagram Wayne...Ch. 2 - Cost Allocation with Cost Flow Diagram The library...Ch. 2 - Greenfield Consultants conducts analyses of public...Ch. 2 - Consider the Business Application, “Indirect Costs...Ch. 2 - Find the Unknown Information After a computer...Ch. 2 - Find the Unknown Information Just before class...Ch. 2 - Cost Allocation and Regulated Prices The City of...Ch. 2 - Koufax Materials Corporation produces plastic...Ch. 2 - Reconstruct Financial Statements San Ysidro...Ch. 2 - Westlake, Inc., produces metal fittings for the...Ch. 2 - Finding Unknowns Marys Mugs produces and sells...Ch. 2 - Finding Unknowns BST Partners has developed a new...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following information is available for the first year of operations of Creston Inc., a manufacturer of fabricating equipment: Determine the following amounts: a. Cost of goods sold b. Direct materials cost c. Direct labor costarrow_forwardThe following data are taken from the general ledger and other records of Phoenix Products Co. on October 31, the end of the first month of operations in the current fiscal year: a. Prepare a statement of cost of goods manufactured. b. Prepare the cost of goods sold section of the income statement.arrow_forwardCost of Goods Manufactured, Income Statement W. W. Phillips Company produced 4,000 leather recliners during the year. These recliners sell for 400 each. Phillips had 500 recliners in finished goods inventory at the beginning of the year. At the end of the year, there were 700 recliners in finished goods inventory. Phillips accounting records provide the following information: Required: 1. Prepare a statement of cost of goods manufactured. 2. Compute the average cost of producing one unit of product in the year. 3. Prepare an income statement for external users.arrow_forward

- Cost of Direct Materials, Cost of Goods Manufactured, Cost of Goods Sold Bisby Company manufactures fishing rods. At the beginning of July, the following information was supplied by its accountant: During July, the direct labor cost was 43,500, raw materials purchases were 64,000, and the total overhead cost was 108,750. The inventories at the end of July were: Required: 1. What is the cost of the direct materials used in production during July? 2. What is the cost of goods manufactured for July? 3. What is the cost of goods sold for July?arrow_forwardEllerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Refer to Exercise 2.21. Last calendar year, Ellerson recognized revenue of 1,312,000 and had selling and administrative expenses of 204,600. Required: 1. What is the cost of goods sold for last year? 2. Prepare an income statement for Ellerson for last year.arrow_forwardAn examination of Buckhorn Fabricators records reveals the following transactions: a. On December 31, the physical inventory of raw material was 9,950 gallons. The book quantity, using the weighted average method, was 10,000 gal @ .52 per gal. b. Production returned to the storeroom materials that cost 775. c. Materials valued at 770 were charged to Factory Overhead (Repairs and Maintenance), but should have been charged to Work in Process. d. Defective material, purchased on account, was returned to the vendor. The material returned cost 234. e. Goods sold to a customer, on account, for 5,000 (cost 2,500) were returned because of a misunderstanding of the quantity ordered. The customer stated that the goods returned were in excess of the quantity needed. f. Materials requisitioned totaled 22,300, of which 2,100 represented supplies used. g. Materials purchased on account totaled 25,500. Freight on the materials purchased was 185. h. Direct materials returned to the storeroom amounted to 950. i. Scrap materials sent to the storeroom were valued at an estimated selling price of 685 and treated as a reduction in the cost of all jobs worked on during the period. j. Spoiled work sent to the storeroom valued at a sales price of 60 had production costs of 200 already charged to it. The cost of the spoilage is to be charged to the specific job worked on during the period. k. The scrap materials in (i) were sold for 685 cash. Required: Record the entries for each transaction.arrow_forward

- Glasson Manufacturing Co. produces only one product. You have obtained the following information from the corporations books and records for the current year ended December 31, 2016: a. Total manufacturing cost during the year was 1,000,000, including direct materials, direct labor, and factory overhead. b. Cost of goods manufactured during the year was 970,000. c. Factory Overhead charged to Work in Process was 75% of direct labor cost and 27% of the total manufacturing cost. d. The beginning Work in Process inventory, on January 1, was 40% of the ending Work in Process inventory, on December 31. e. Material purchases were 400,000 and the ending balance in Materials inventory was 60,000. No indirect materials were used in production. Required: Prepare a statement of cost of goods manufactured for the year ended December 31 for Glasson Manufacturing. (Hint: Set up a statement of cost of goods manufactured, putting the given information in the appropriate spaces and solving for the unknown information.)arrow_forwardUse the following information for Exercises 2-47 through 2-49. Jasper Company provided the following information for last year: Last year, beginning and ending inventories of work in process and finished goods equaled zero. Exercise 2-49 Income Statement Refer to the information for Jasper Company on the previous page. Required: 1. Prepare an income statement for Jasper for last year. Calculate the percentage of sales for each line item on the income statement. (Note: Round percentages to the nearest tenth of a percent.) 2. CONCEPTUAL CONNECTION Briefly explain how a manager could use the income statement created for Requirement 1 to better control costs.arrow_forwardCost Flow Relationships The following information is available for the first year of operations of Idgie Inc., a manufacturer of fabricating equipment: Sales $1,261,700 340,700 Gross profit Indirect labor 113,600 Indirect materials 46,700 Other factory overhead 21,400 Materials purchased 643,500 1,392,900 46,700 Total manufacturing costs for the period Materials inventory, end of period Using the above information, determine the following amounts: a. Cost of goods sold b. Direct materials cost c. Direct labor costarrow_forward

- Cost of direct materials used in production for a manufacturing company Walker Manufacturing Company reported the following materials data for the month ending June 30: Materials purchased $830,200 Materials inventory, June 1 234,100 Materials inventory, June 30 186,900 This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answer in the question below. Open spreadsheet Determine the cost of direct materials used in production by Walker during the month ended June 30. Round your answer to the nearest dollar. $fill in the blank 2arrow_forwardThe followung cost data relate to the manufacturing activities of the Kamas Company during the most recent year. Fcatory overhead costs incurred during the year: Property taxes- factory P1,600 Utilities- factory 2,600 Indirect labor 5,100 Depreciation- factory 13,000 Insurance- factory 2,500 Total ACtual FOH costs P24,800 Other costs incurred during the year: Purchase of raw materials P15,000 Direct labor cost 22,000 Inventories: Raw materials, beginning P5,000 Raw materials, ending 4,400 Work-in process,beginning 3,500 Work-in process, ending 4,500 The company uses a predetermined overhead rate to charge overhead cost to production. Th erate for the year just completed wa P4.00 per machine- hour; a total of 6,000 machine- hours were recorded for the year.…arrow_forwardThe Darwin Company reports the following information that occurred during the current period: Sales commissions expense $15,600 Administrative office supplies 7,300 Depreciation on factory equipment 4,700 Indirect factory labor 5,900 Direct labor 10,500 Factory rent 4,200 Factory utilities 1,200 Sales 76,500 Administrative Office salaries expense 8,900 Indirect materials used 1,200 Manufacturing Overhead applied 17,200 Using the information provided above for Darwin Company, calculate the total costs that will be expensed when incurred on the income statement for the period:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Job Cost Sheet - Job Cost Accounting System; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=ElD8nKNXE1I;License: Standard Youtube License