Individual Income Taxes

43rd Edition

ISBN: 9780357109731

Author: Hoffman

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 20, Problem 26CE

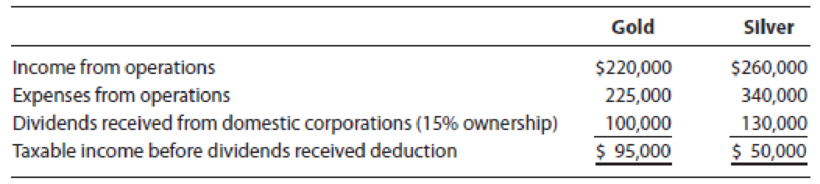

LO.4 Gold and Silver are two unrelated calendar year corporations. For the current year, both entities incurred the following transactions.

What is the dividends received deduction for:

- a. Gold Corporation?

- b. Silver Corporation?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

I- Interest paid on preferred stock is deductible from gross income of the paying corporation.II- A capital expenditure usually benefits more than one accounting period and is deductible from gross income in the year it is paid or incurred.*

True; true

False; true

true; false

false; false

Which of the following is true?*

Payments which constitute bribes, kickbacks and others of similar nature which are necessary to realized profits are allowed as deductions from gross income.

The taxes which are deductible from gross income include the taxes, interest and penalties incident to tax delinquency.

Deductions are amounts allowed by the Tax Code to be deducted from gross income arrive at the income tax liability of a taxpayer.

Losses from wagering transactions shall be allowed only up the extent of the gains from such transactions.

Which statement is correct?*

The compensation income of managerial or supervisory employees is subject to fringe benefit tax.

The taxable fringe benefits…

Requirements

a. What is Sigma Corporation's income tax liability assuming its taxable income is (a) $82,000, (b) $123,000, and (c) $55 million.

b. How would your answers change if Sigma were a personal service corporation?

Requirement a. (a) What is Sigma Corporation's income tax liability assuming its taxable income is $82,000.

ma Corporation's income tax liability =

Requirement a. (b) What is Sigma Corporation's income tax liability assuming its taxable income is $123,000.

pted

Sigma Corporation's income tax liability

Requirement a. (c) What is Sigma Corporation's income tax liability assuming its taxable income is $55 million. (Enter your answer in dollars, not millions.)

=

Sigma Corporation's income tax liability:

=

Requirement b. How would your answers change if Sigma were a personal service corporation?

(a) Assume its taxable income is $82,000.

Sigma Corporation's income tax liability as a personal service corporation : =

(b) Assume its taxable income is $123,000.

Which of the following statements regarding losses is true?

A. A personal net operating loss may be carried back but not forward to other tax years.

B. A sole proprietor may deduct business losses against any form of income.

C. In a regular corporation, entity level losses are passed through to the shareholders.

D. In a S corporation, entity level losses are fully deductible by the shareholder under any circumstance.

Chapter 20 Solutions

Individual Income Taxes

Ch. 20 - Prob. 1DQCh. 20 - LO.1 Sylvia and Trang want to enter into business...Ch. 20 - Prob. 3DQCh. 20 - Prob. 4DQCh. 20 - Prob. 5DQCh. 20 - LO.3, 4, 5 Contrast the income taxation of...Ch. 20 - LO.3, 8, 9 The taxpayer has generated excess...Ch. 20 - Prob. 8DQCh. 20 - Prob. 9DQCh. 20 - Prob. 10DQ

Ch. 20 - Prob. 11DQCh. 20 - Prob. 12DQCh. 20 - Prob. 13DQCh. 20 - Prob. 14DQCh. 20 - LO.5 Beige Corporation has a fiscal year ending...Ch. 20 - Prob. 16DQCh. 20 - Prob. 17DQCh. 20 - Prob. 18DQCh. 20 - Prob. 19DQCh. 20 - Prob. 20DQCh. 20 - Prob. 21DQCh. 20 - Blaine, Cassie, and Kirstin are equal partners in...Ch. 20 - LO.3 Green Corporation, a calendar year taxpayer,...Ch. 20 - Prob. 24CECh. 20 - Prob. 25CECh. 20 - LO.4 Gold and Silver are two unrelated calendar...Ch. 20 - Prob. 27CECh. 20 - Prob. 28CECh. 20 - Prob. 29CECh. 20 - Prob. 30CECh. 20 - Prob. 31CECh. 20 - Prob. 32CECh. 20 - Prob. 33CECh. 20 - LO.3, 4, 5 Using the legend provided below,...Ch. 20 - LO.3 Garnet incurs the following capital asset...Ch. 20 - Prob. 36PCh. 20 - LO.3 Taupe, a calendar year taxpayer, has a...Ch. 20 - LO.3, 8 Robin incurred the following capital...Ch. 20 - Prob. 39PCh. 20 - Prob. 40PCh. 20 - Prob. 41PCh. 20 - Prob. 42PCh. 20 - Prob. 43PCh. 20 - Prob. 44PCh. 20 - Prob. 45PCh. 20 - Prob. 46PCh. 20 - Prob. 47PCh. 20 - Prob. 48PCh. 20 - Prob. 49PCh. 20 - Prob. 50PCh. 20 - During the current year, Thrasher (a calendar...Ch. 20 - Prob. 52PCh. 20 - Prob. 53PCh. 20 - Prob. 54PCh. 20 - Prob. 55PCh. 20 - LO.9 The Pheasant Partnership reported the...Ch. 20 - Prob. 57PCh. 20 - Prob. 58PCh. 20 - Prob. 59PCh. 20 - Prob. 1RPCh. 20 - Prob. 2RPCh. 20 - Prob. 3RPCh. 20 - Prob. 5RPCh. 20 - On January 1, year 5, Olinto Corp., an accrual...Ch. 20 - Prob. 2CPACh. 20 - Prob. 3CPACh. 20 - Prob. 4CPACh. 20 - Prob. 5CPACh. 20 - Prob. 6CPACh. 20 - Prob. 7CPA

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the following statements regarding income recognition is true? A. Owners in a regular corporation realize entity level income at the time the income is earned. B. Owners of an S corporation realize entity level income in the tax year in which the S corporation's year ends. C. Partnership income is recognized in the year in which it is distributed to the partners. D. Sole proprietorship income is recognized at the time the income is distributed to the owner.arrow_forwardWhich of the following statements regarding political contributions made by a corporation is CORRECT? a. Political contributions are allowed as a deduction in the computation of taxable income, therefore they are deducted on Schedule 2. b. Corporations receive a tax credit equal to 15% of political contributions made in the year. O c. Political contributions are not allowed as a deduction in the computation of business income, therefore they are added back on Schedule 1. O d. The total deduction for political contributions is limited to 75% of the corporation's net income in the year.arrow_forwardDuring the current year, Thrasher (a calendar year, accrual basis S corporation) records the following transactions. a. Determine Thrasher Corporations separately stated items for the current year. b. Determine Thrashers ordinary business income for the current year.arrow_forward

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Understanding U.S. Taxes; Author: Bechtel International Center/Stanford University;https://www.youtube.com/watch?v=QFrw0y08Oto;License: Standard Youtube License