Concept explainers

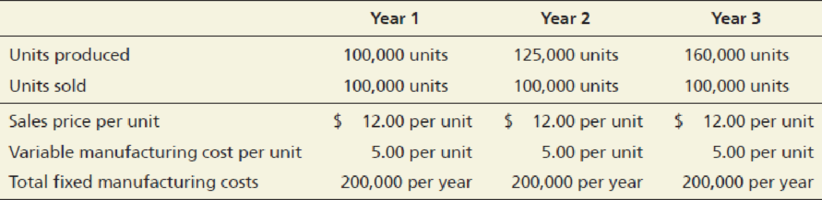

Sampson Company operates a manufacturing facility where several products are made. Each product is considered a business segment, and the product managers have the opportunity to receive a bonus based on the profit of the segment. Franco Hopper is the manager for the scissors product line. Production and sales data for the scissors product line for the past three years are shown below:

Hopper’s bonus is 0.5% of the gross profit of the scissors product line, based on absorption costing. Upper management is discussing changing the bonus system so that bonuses are based on operating income using variable costing. Hopper is opposed to this change and has been trying to convince the other product mangers to join him in voicing their opposition. There are no beginning inventories in Year 1.

Requirements

- 1. Calculate the fixed cost per unit produced for each year.

- 2. Prepare income statements for the three years using absorption costing.

- 3. Calculate Hopper’s bonus based on the current plan.

- 4. Prepare income statements for the three years using variable costing.

- 5. Calculate Hopper’s bonus based on the proposed plan.

- 6. Give possible reasons why Hopper is opposed to the proposed bonus plan. Do you think Hopper’s actions have been ethical the past three years? Why or why not?

Want to see the full answer?

Check out a sample textbook solution

Chapter 21 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Additional Business Textbook Solutions

Principles of Accounting Volume 1

Intermediate Accounting (2nd Edition)

Financial Accounting

Horngren's Accounting (11th Edition)

Fundamentals of Cost Accounting

Financial Accounting (12th Edition) (What's New in Accounting)

- Ventana Window and Wall Treatments Company provides draperies, shades, and various window treatments. Ventana works with the customer to design the appropriate window treatment, places the order, and installs the finished product. Direct materials and direct labor costs are easy to trace to the jobs. Ventanas income statement for last year is as follows: Ventana wants to find a markup on cost of goods sold that will allow them to earn about the same amount of profit on each job as was earned last year. Required: 1. What is the markup on cost of goods sold (COGS) that will maintain the same profit as last year? (Round the percentage to two significant digits.) 2. A customer orders draperies and shades for a remodeling job. The job will have the following costs: What is the price that Ventana will quote given the markup percentage calculated in Requirement 1? (Round the price to the nearest dollar.) 3. What if Ventana wants to calculate a markup on direct materials cost, since it is the largest cost of doing business? What is the markup on direct materials cost that will maintain the same profit as last year? (Round the percentage to two significant digits.) What is the bid price Ventana will use for the job given in Requirement 2 if the markup percentage is calculated on the basis of direct materials cost? (Round to the nearest dollar.)arrow_forwardRoper Furniture manufactures office furniture and tracks cost data across their process. The following are some of the costs that they incur. Classify these costs as fixed or variable costs, and as product costs or period costs. Wood used to produce desks ($125,00 per desk) Production labor used to produce desks ($15 per hour) Production supervisor salary ($45,000 per year) Depreciation on factory equipment ($60,000 per year) Selling and administrative expenses ($45,000 per year) Rent on corporate office ($44,000 per year) Nails, glue, and other materials required to produce desks (varies per desk) Utilities expenses for production facility Sales staff commission (5% of gross sales)arrow_forwardCorazon Manufacturing Company has a purchasing department staffed by five purchasing agents. Each agent is paid 28,000 per year and is able to process 4,000 purchase orders. Last year, 17,800 purchase orders were processed by the five agents. Required: 1. Calculate the activity rate per purchase order. 2. Calculate, in terms of purchase orders, the: a. total activity availability b. unused capacity 3. Calculate the dollar cost of: a. total activity availability b. unused capacity 4. Express total activity availability in terms of activity capacity used and unused capacity. 5. What if one of the purchasing agents agreed to work half time for 14,000? How many purchase orders could be processed by four and a half purchasing agents? What would unused capacity be in purchase orders?arrow_forward

- Mott Company recently implemented a JIT manufacturing system. After one year of operation, Heidi Burrows, president of the company, wanted to compare product cost under the JIT system with product cost under the old system. Motts two products are weed eaters and lawn edgers. The unit prime costs under the old system are as follows: Under the old manufacturing system, the company operated three service centers and two production departments. Overhead was applied using departmental overhead rates. The direct overhead costs associated with each department for the year preceding the installation of JIT are as follows: Under the old system, the overhead costs of the service departments were allocated directly to the producing departments and then to the products passing through them. (Both products passed through each producing department.) The overhead rate for the Machining Department was based on machine hours, and the overhead rate for assembly was based on direct labor hours. During the last year of operations for the old system, the Machining Department used 80,000 machine hours, and the Assembly Department used 20,000 direct labor hours. Each weed eater required 1.0 machine hour in Machining and 0.25 direct labor hour in Assembly. Each lawn edger required 2.0 machine hours in Machining and 0.5 hour in Assembly. Bases for allocation of the service costs are as follows: Upon implementing JIT, a manufacturing cell for each product was created to replace the departmental structure. Each cell occupied 40,000 square feet. Maintenance and materials handling were both decentralized to the cell level. Essentially, cell workers were trained to operate the machines in each cell, assemble the components, maintain the machines, and move the partially completed units from one point to the next within the cell. During the first year of the JIT system, the company produced and sold 20,000 weed eaters and 30,000 lawn edgers. This output was identical to that for the last year of operations under the old system. The following costs have been assigned to the manufacturing cells: Required: 1. Compute the unit cost for each product under the old manufacturing system. 2. Compute the unit cost for each product under the JIT system. 3. Which of the unit costs is more accurate? Explain. Include in your explanation a discussion of how the computational approaches differ. 4. Calculate the decrease in overhead costs under JIT, and provide some possible reasons that explain the decrease.arrow_forwardBoston Executive. Inc., produces executive limousines and currently manufactures the mini-bar inset at these costs: The company received an offer from Elite Mini-Bars to produce the insets for $2,100 per Unit and supply 1,000 mini-bars for the coming years estimated production. If the company accepts this offer and shuts down production of this part of the business, production workers and supervisors will be reassigned to other areas. Assume that for the short-term decision-making process demonstrated in this problem, the companys total labor costs (direct labor and supervisor salaries) will remain the same if the bar inserts are purchased. The specialized equipment cannot be used and has no market value. However, the space occupied by the mini bar production can be used by a different production group that will lease it for $55,000 per year. Should the company make or buy the mini-bar insert?arrow_forwardSampson Company operates a manufacturing facility where several products are made. Deach product is considered a business segment, and the product managers have the opportunity to receive a bonus based on the profit of the segment. Franco Hopper is the manager for the scissors product line. Production and sales for the scissors product line loene for the past three years are shown below: Year 1: Year 2: Year 3: Units produced 100,000 125,000 160,000 Units sold 100,000 100,000 100,000 Sales price per unit 12.00 12.00 12.00 Variable manufacturing cost per unit 5.00 5.00 5.00 Total fixed manufacturing cost 200,000 200,000 200,000 Hopper’s bonus is .5% of the gross profit of the scissors product line, based on absorption costing. Upper management is discussing changing the bonus system so that bonuses are based on operating income using variable costing. Hopper is opposed to this change and has been trying to convince the other product managers to join him in voicing their…arrow_forward

- As the newly appointed Controller of Lynbrook, Inc. you have been asked to evaluate several scenarios that management is considering to improve the overall profitability of the company. Lynbrook manufactures and sells a product called a Wren, its only product. The company normally produces and sells 60,000 Wrens each year at a selling price of $32 per unit. The company's unit costs at this level of activity are included below: Direct materials $10.00 Direct labor 4.50 Variable manufacturing 2.30 overhead Fixed manufacturing overhead 5.00 ($300,000 total) Variable selling expenses 1.20 Fixed selling expenses 3.50 ($210,000 total) Total cost per unit $26.50 The CFO of Lynbrook would like your response to the following three (3) independent situations to present to the management team early next week. Situation #1 Assume that Lynbrook has sufficient capacity to produce 90,000 Wrens each year without any increase in fixed manufacturing overhead costs. The company could increase its unit…arrow_forwardSyracuse Beverages Inc. has three plants that make and bottle cola, lemon-lime, and miscellaneous flavored beverages, respectively. The raw materials, labor costs, and automated technology are comparable among the three plants. Top management has initiated an incentive compensation plan whereby the workers and managers of the plant with the lowest unit cost per bottle will receive a year-end bonus. The results, approved by the plant manager and reported by the plant controllers at each location, were as follows ITEM DEWITT FAYETTEVILLE MANLIUS Materials 200,000 450,000 325,000 Labor 170,000 375,000 250,000 Overhead 340,000 750,000 500,000 TOTAL 710,000 1575,000 1075,000 Equivalents Units of Production Completed 3500,000 6200,000 6450,000 Ending Work in process 100,000(50% complete) 400,000(25% complete Equivalent units 3550,000 6300,000 6450,000 Unit Cost $0.20 $0.25 $0.167 When provided copies of the results as a justification for distributing the…arrow_forwardUnderwood Company is preparing its annual profit plan. As part of its analysis of the profitability of individual products, the controller estimates the amount of manufacturing overhead that should be assigned to each of the two product lines from the information given below. Total units produced Total number of material moves Direct labor hours per unit Budgeted material-handling costs are $50,000. The material handling cost per wall mirror under activity-based costing is: Multiple Choice O O $0. $250. Wall Mirrors 50 10 165 $770. Specialty Windows 50 30 165.arrow_forward

- Sampson Company operates a manufacturing facility where several products are made. Deach product is considered a business segment, and the product managers have the opportunity to receive a bonus based on the profit of the segment. Franco Hopper is the manager for the scissors product line. Production and sales for the scissors product line loene for the past three years are shown below: Year 1: Year 2: Year 3: Units produced 100,000 125,000 160,000 Units sold 100,000 100,000 100,000 Sales price per unit 12.00 12.00 12.00 Variable manufacturing cost per unit 5.00 5.00 5.00 Total fixed manufacturing cost 200,000 200,000 200,000 Hopper’s bonus is .5% of the gross profit of the scissors product line, based on absorption costing. Upper management is discussing changing the bonus system so that bonuses are based on operating income using variable costing. Hopper is opposed to this change and has been trying to convince the other product managers to join him…arrow_forwardSampson Company operates a manufacturing facility where several products are made. Deach product is considered a business segment, and the product managers have the opportunity to receive a bonus based on the profit of the segment. Franco Hopper is the manager for the scissors product line. Production and sales for the scissors product line loene for the past three years are shown below: Year 1: Year 2: Year 3: Units produced 100,000 125,000 160,000 Units sold 100,000 100,000 100,000 Sales price per unit 12.00 12.00 12.00 Variable manufacturing cost per unit 5.00 5.00 5.00 Total fixed manufacturing cost 200,000 200,000 200,000 Hopper’s bonus is .5% of the gross profit of the scissors product line, based on absorption costing. Upper management is discussing changing the bonus system so that bonuses are based on operating income using variable costing. Hopper is opposed to this change and has been trying to convince the other product managers to join him…arrow_forwardThe Gadget Co produces three products, A, B and C, all made from the same material. Until now, it has used traditional absorption costing to allocate overheads to its products. The company is now considering an activity based costing system in the hope that it will improve profitability. Information for the three products for the last year is as follows:A B CProduction and sales volumes (units) 15,000 12,000 18,000Selling price per unit K7.50 K12 K13Raw material usage (kg) per unit 2 3 4Direct labour hours per unit 0·1 0·15 0·2Machine hours per unit 0·5 0·7 0·9Number of production runs per annum 16 12 8Number of purchase orders per annum 24 28 42Number of deliveries to retailers per annum 48 30 62The price for raw materials remained constant throughout the year at K1·20 per kg. Similarly, the direct labour cost for the whole workforce was K14·80 per hour. The annual overhead costs were as follows:KMachine set up costs 26,550Machine running costs 66,400Procurement costs 48,000Delivery…arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning