Concept explainers

Using FIFO for Multiproduct Inventory Transactions (Chapters 6 and 7)

TrackR, Inc., (TI) has developed a coin-sized tracking tag that attaches to key rings, wallets, and other items and can be prompted to emit a signal using a smartphone app. TI sells these tags, as well as water-resistant cases for the tags, with terms FOB shipping point. Assume TI has no inventory at the beginning of the month, and it has outsourced the production of its tags and cases. TI uses FIFO and has entered into the following transactions:

| Jan. 2: | TI purchased and received 300 tags from Xioasi Manufacturing (XM) at a cost of $9 per tag, n/15. |

| Jan. 4: | TI purchased and received 100 cases from Bachittar Products (BP) at a cost of $2 per case, n/20. |

| Jan. 6: | TI paid cash for the tags purchased from XM on Jan. 2. |

| Jan. 8: | TI mailed 200 tags via the U.S. Postal Service (USPS) to customers at a price of $30 per tag, on account. |

| Jan. 11: | TI purchased and received 400 tags from XM at a cost of $12 per tag, n/15. |

| Jan. 14: | TI purchased and received 200 cases from BP at a cost of $3 per case, n/20. |

| Jan. 16: | TI paid cash for the cases purchased from BP on Jan. 4. |

| Jan. 9: | TI mailed 160 cases via the USPS to customers at a price of $10 per case, on account. |

| Jan. 21: | TI mailed 300 tags to customers at a price of $30 per tag. |

Required:

- 1. Prepare

journal entries for each of the above dates, assuming TI uses a perpetual inventory system. - 2. Calculate the dollars of gross profit and the gross profit percentage from selling (a) tags and (b) cases.

- 3. Which product line yields more dollars of profit?

- 4. Which product line yields more profit per dollar of sales?

1.

Prepare journal entries for the given transactions of Company TI; assume that the company uses perpetual inventory system.

Explanation of Solution

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Perpetual inventory system: The method or system of maintaining, recording, and adjusting the inventory perpetually throughout the year, is referred to as perpetual inventory system.

Prepare journal entry for the given transaction of Company TAC; assume that the company uses weighted average in its perpetual inventory system as follows:

- Prepare journal entry for the transaction occurred on January 2.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| January | 2 | Inventories (Refer working note 1) | 2,700 | ||

| Accounts Payable | 2,700 | ||||

| (To record the purchase of 300 tags at a cost of $9 on account) | |||||

Table (1)

- Inventory is an asset and increased by $2,700. Therefore, debit the inventory account with $2,700.

- Accounts Payable is a liability and decreased by $2,700. Therefore, credit the accounts payable account with $2,700.

- Prepare journal entry for the transaction occurred on January 4.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| January | 4 | Inventories (Refer working note 1) | 200 | ||

| Accounts Payable | 200 | ||||

| (To record the purchase of 100 tags at a cost of $2 on account) | |||||

Table (2)

- Inventory is an asset and increased by $200. Therefore, debit the inventory account with $200.

- Accounts Payable is a liability and decreased by $200. Therefore, credit the accounts payable account with $200.

- Prepare journal entry for the transaction occurred on January 6.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| January | 6 | Accounts Payable | 2,700 | ||

| Cash | 2,700 | ||||

| (To record the payment of cash for the goods purchased on January 2) | |||||

Table (3)

- Accounts Payable is a liability and increased by $2,700. Therefore, debit the accounts payable account with $2,700.

- Cash is an asset and there is a decrease in the value of asset. So credit the cash account with $2,700

- Prepare journal entry for the transaction occurred on January 8.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| January | 8 | Accounts Receivable (Refer working note 1) | 6,000 | ||

| Sales Revenue | 6,000 | ||||

| (To record sale of inventories on account) | |||||

| Cost of Goods Sold (Refer working note 1) | 1,800 | ||||

| Inventories | 1,800 | ||||

| (To record the cost of goods sold ) | |||||

Table (4)

Description:

- Accounts Receivable is an asset and there is an increase in the value of asset. So debit the accounts receivable account with $6,000.

- Sales Revenue is a component of stockholder’s equity and there is an increase in the value of stockholder’s equity. So credit the sales revenue account for $6,000.

- Cost of goods sold is an expense and increased; hence it has decreased the equity by $1,800. Therefore, debit cost of goods sold account with $1,800.

- Inventory is an asset and decreased by $1,800. Therefore, credit the inventory account with $1,800.

- Prepare journal entry for the transaction occurred on January 11.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| January | 11 | Inventories (Refer working note 1) | 4,800 | ||

| Accounts Payable | 4,800 | ||||

| (To record the purchase of 300 tags at a cost of $9 on account) | |||||

Table (5)

- Inventory is an asset and increased by $4,800. Therefore, debit the inventory account with $4,800.

- Accounts Payable is a liability and decreased by $4,800. Therefore, credit the accounts payable account with $4,800.

- Prepare journal entry for the transaction occurred on January 14.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| January | 14 | Inventories (Refer working note 1) | 600 | ||

| Accounts Payable | 600 | ||||

| (To record the purchase of 300 tags at a cost of $9 on account) | |||||

Table (6)

- Inventory is an asset and increased by $600. Therefore, debit the inventory account with $600.

- Accounts Payable is a liability and decreased by $600. Therefore, credit the accounts payable account with $600.

- Prepare journal entry for the transaction occurred on January 16.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| January | 16 | Accounts Payable | 200 | ||

| Cash | 200 | ||||

| (To record the payment of cash for the goods purchased on January 4) | |||||

Table (7)

- Accounts Payable is a liability and increased by $200. Therefore, debit the accounts payable account with $200.

- Cash is an asset and there is a decrease in the value of asset. So credit the cash account with $200.

- Prepare journal entry for the transaction occurred on January 19.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| January | 19 | Accounts Receivable (Refer working note 1) | 1,600 | ||

| Sales Revenue | 1,600 | ||||

| (To record sale of inventories on account) | |||||

| Cost of Goods Sold (Refer working note 1) | 380 | ||||

| Inventories | 380 | ||||

| (To record the cost of goods sold ) | |||||

Table (8)

Description:

- Accounts Receivable is an asset and there is an increase in the value of asset. So debit the accounts receivable account with $6,000.

- Sales Revenue is a component of stockholder’s equity and there is an increase in the value of stockholder’s equity. So credit the sales revenue account for $6,000.

- Cost of goods sold is an expense and increased; hence it has decreased the equity by $380. Therefore, debit cost of goods sold account with $380.

- Inventory is an asset and decreased by $380. Therefore, credit the inventory account with $380.

- Prepare journal entry for the transaction occurred on January 21.

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | |

| January | 19 | Accounts Receivable (Refer working note 1) | 9,000 | ||

| Sales Revenue | 9,000 | ||||

| (To record sale of inventories on account) | |||||

| Cost of Goods Sold (Refer working note 1) | 3,300 | ||||

| Inventories | 3,300 | ||||

| (To record the cost of goods sold ) | |||||

Table (9)

Description:

- Accounts Receivable is an asset and there is an increase in the value of asset. So debit the accounts receivable account with $9,000.

- Sales Revenue is a component of stockholder’s equity and there is an increase in the value of stockholder’s equity. So credit the sales revenue account for $9,000.

- Cost of goods sold is an expense and increased; hence it has decreased the equity by $3,300. Therefore, debit cost of goods sold account with $3,300.

- Inventory is an asset and decreased by $3,300. Therefore, credit the inventory account with $3,300.

Working note 1:

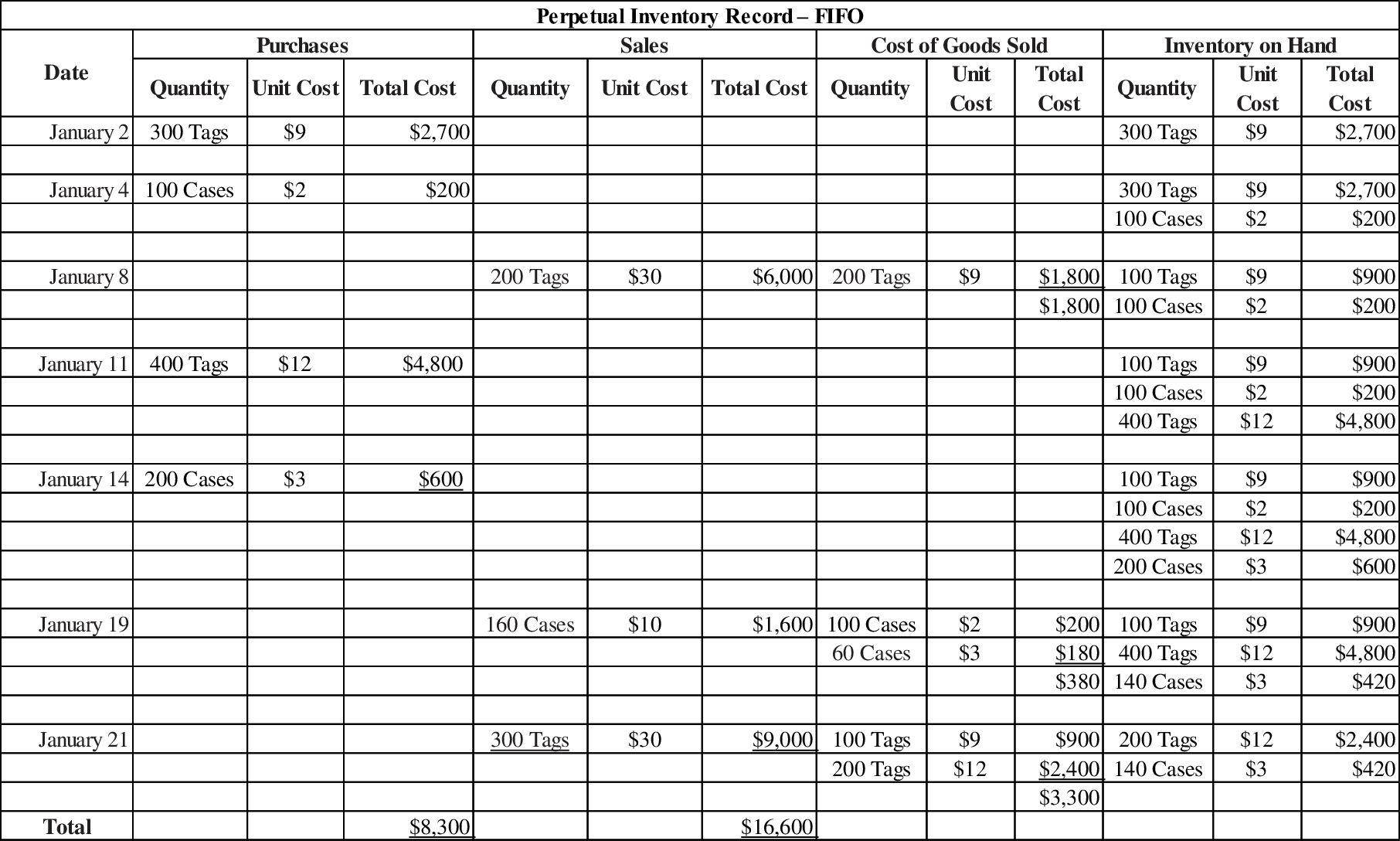

Calculate the amount of sales, cost of goods sold, purchases and inventory on hand (Ending inventory) under FIFO method as follows:

Figure (1)

2.

Calculate the dollars of gross profit and the gross profit percentage from selling the following items:

- a) Tags and

- b) Cases.

Explanation of Solution

Gross margin (gross profit): Gross margin is the amount of revenue earned from goods sold over the costs incurred for the goods sold.

Gross margin percentage: The percentage of gross profit generated by every dollar of net sales is referred to as gross profit percentage. This ratio measures the profitability of a company by quantifying the amount of income earned from sales revenue generated after cost of goods sold are paid. The higher the ratio, the more ability to cover operating expenses.

a. Calculate the dollars of gross profit and the gross profit percentage from the sale of Tags as follows:

Calculate the dollars of gross profit as follows:

| Particulars | $ |

| Sales Revenue (Refer working note 1) | $6,000 |

| Sales Revenue (Refer working note 1) | 9,000 |

| Total Sales | 15,000 |

| Less: Cost of Goods Sold | |

| On January 8 (Refer working note 1) | 1,800 |

| On January 21 (Refer working note 1) | 3,300 |

| Gross Profit | $9,900 |

Table (10)

Calculate the dollars of gross profit percentage as follows:

b. Calculate the dollars of gross profit and the gross profit percentage from the sale of Cases as follows:

Calculate the dollars of gross profit as follows:

| Particulars | $ |

| Sales Revenue (Refer working note 1) | $1,600 |

| Less: Cost of Goods Sold | |

| On January 19 (Refer working note 1) | 380 |

| Gross Profit | $1,220 |

Table (11)

Calculate the dollars of gross profit percentage as follows:

3.

State the product line that yields more dollars of profit.

Explanation of Solution

State the product line that yields more dollars of profit as follows:

In this case, the Tags product line yields more dollars of profit than Cases product line. From the above calculation it is clear that the gross profit of Tags product line ($9,900) is more than the gross profit of Cases product line ($1,220).

4.

State the product line that yields more profit per dollar of sales.

Explanation of Solution

State the product line that yields more profit per dollar of sales as follows:

The cases product line yields more profit per dollar of sales than the Tags product line. Since the cases product line has a higher gross profit percentage of 76.25%, while the tags product line has a gross profit percentage of only 66%.

Want to see more full solutions like this?

Chapter 7 Solutions

Fundamentals Of Financial Accounting

- Your client, Daves Sport Shop, sells sports equipment and clothing in three retail outlets in New York City. During 2019, the CFO decided that keeping track of inventory using a combination of QuickBooks and spreadsheets was not an efficient way to manage the stores inventories. So Daves purchased an inventory management system for 9,000 that allowed the entity to keep track of inventory, as well as automate ordering and purchasing, without replacing QuickBooks for its accounting function. The CFO would like to know whether the cost of the inventory management program can be expensed in the year of purchase. Write a letter to the CFO, Cassandra Martin, that addresses the tax treatment of purchased software. Cassandras mailing address is 867 Broadway, New York, NY 10003.arrow_forwardWaterway Inc. is a retailer operating in British Columbia. Waterway uses the perpetual inventory system. All sales returns from customers result in the goods being returned to inventory; the inventory is not damaged. Assume that there are no credit transactions; all amounts are settled in cash. You are provided with the following information for Waterway Inc. for the month of January 2022. Date Description Quantity Unit Cost or Selling Price January 1 Beginning inventory 100 $21 January 5 Purchase 148 24 January 8 Sale 114 36 January 10 Sale return 10 36 January 15 Purchase 55 26 January 16 Purchase return 5 26 January 20 Sale 94 41 January 25 Purchase 26 28 Calculate the Moving-average cost per unit at January 1, 5, 8, 10, 15, 16, 20, & 25 For each of the following cost flow assumptions, calculate cost of goods sold,…arrow_forwardAn auditor is examining the financial statements of a wholesale cosmetics distributor with an inventory consisting of thousands of individual items. The distributor keeps its inventory in its own distribution centre and in two public warehouses. An electronic inventory file is maintained on a computer disk, and at the end of each business day the file is updated. Each record of the inventory file contains the following data: · Item number. · Location of item. · Description of item. · Quantity on hand. · Cost per item. · Date of last purchase. · Date of last sale. · Quantity sold during year. The auditor plans to observe the distributor's physical count of inventory as of a given date. The auditor will have available a computer tape of the data on the inventory file on the date of the physical count and a generalized audit software package. Required: The auditor is planning to perform basic inventory-auditing procedures. Identify the basic inventory-auditing procedures and describe…arrow_forward

- Waterway Inc. is a retailer operating in British Columbia. Waterway uses the perpetual inventory system. All sales returns from customers result in the goods being returned to inventory; the inventory is not damaged. Assume that there are no credit transactions; all amounts are settled in cash. You are provided with the following information for Waterway Inc. for the month of January 2022. Date January 1 January 5 January 8 January 10 January 15 January 16 January 20 January 25 (a1) January 1 January 5 January 8 January 10 January 15 January 16 January 20 Description January 25 Beginning inventory Purchase Sale Sale return Purchase Purchase return Sale Purchase $ $ $ $ $ $ Quantity 100 $ 139 Calculate the Moving-average cost per unit at January 1, 5, 8, 10, 15, 16, 20, & 25. (Round moving-average cost per unit answers to 3 decimal places, eg. 5.251.) Moving-Average Cost per unit $ 111 10 55 5 88 18 Unit Cost or Selling Price $13 16 27 27 18 18 31 20arrow_forwardRichardson Company cans a variety of vegetable-type soups. Recently, the company decided to value its inventories using dollar-value LIFO pools. The clerk who accounts for inventories does not understand how to value the inventory pools using this new method, so, as a private consultant, you have been asked to teach him how this new method works. He has provided you with the following information about purchases made over a 6-year period. Date Dec. 31, 2021 Dec. 31, 2022 Dec. 31, 2023 Dec. 31, 2024 Dec. 31, 2025 Dec. 31, 2026 2021 2022 2023 2024 2025 Ending Inventory (End-of-Yeat Prices) 2026 $ You have already explained to him how this inventory method is maintained, but he would feel better about it if you were to leave him detailed instructions explaining how these calculations are done and why he needs to put all inventories at a base-year value. (a) Compute the ending inventory for Richardson Company for 2021 through 2026 using c $ $ $ $ $80,000 111,300 108,000 128,700 147,000…arrow_forwardLamplight Plus sells lamps to consumers. The company contracts with a supplier who provides them with lamp fixtures. There is an agreement that Lamplight Plus is not required to provide cash payment immediately and instead will provide payment within thirty days of the invoice date. You are to provide the journal entries for the following transactions assuming a perpetual inventory system. Cash Accounts Payable Purchases Accounts Receivable Merchandise Inventory Sales PLEASE NOTE: You must enter the account names exactly as written above and all whole dollar amounts will be with "$" and commas as needed (i.e. $12,345). Lamplight purchases thirty light fixtures for $20 each on August 1, invoice date August 1, with no discount terms DR CR Lamplight returns ten light fixtures, receiving a credit amount for the full purchase price on August 3: DR CR Lamplight purchases an additional fifteen light fixtures for $15 each on August 19, invoice…arrow_forward

- Required information [The following information applies to the questions displayed below.] Luther has a bird shop that sells canaries. Luther maintains accurate records on the number of birds purchased from its suppliers and the number sold to customers. The records show the following purchases and sales during 2024. Date January 1 April 14 August 22 October 29 Transactions Beginning inventory Purchase Purchase Purchase (a) Ending inventory (b) Retained earnings (c) Cost of goods sold (d) Net income Units Unit Cost 27 72 122 87 308 272 2025 $32 34 36 38 January 1 to December 31 Sales ($52 each) Luther uses a periodic inventory system and believes there are 36 birds remaining in ending inventory. However, Luther neglects to make a final inventory count at the end of the year. An employee accidentally left one of the cages open one night and 10 birds flew away, leaving only 26 birds in ending inventory. Luther is not aware of the lost canaries. Total Cost $864 2,448 4,392 3,306 $11,010…arrow_forwardMothercity Traders is a gift shop in Cape Town. Mothercitx Traders uses the perpetual inventory system to record inventory transactions. VAT can be ignored on all transactions. The following transactions took place in the month of January 2022: 1. Owner contributed cash R200 000 2. purchased goods for cash R10 000 3. Sold goods with a selling price of R1 000 cash Cost price of goods R500 Paid R300 for an advert in the local newspaper 5 The owner took goods for personal use. The selling price of the goods is R500. The goods are marked up by 100% Analyse each of the above transactions and complete the table as follows: 4. 5. 6. NO ACCOUNT ACCOUNT DEBITED CREDITED Example Telephone Bank ASSETS -200 OWNER'S LIABILITIES EQUITY -200arrow_forwardInventory Analysis QT, Inc. and Elppa Computers, Inc. compete with each other in the personal computer market. QT assembles computers to customer orders, building and delivering a computer within four days of a customer entering an order online. Elppa, on the other hand, builds computers for inventory prior to receiving an order. These computers are sold from inventory once an order is received. Selected financial information for both companies from recent financial statements follows (in millions): QT Elppa Sales $52,560 $65,800 Cost of goods sold 43,800 62,050 Inventory, beginning of period 1,856 7,339 Inventory, end of period 2,056 8,539 a. Determine for both companies (1) the inventory turnover and (2) the number of days' sales in inventory. Round your calculations and answers to one decimal place. Assume 365 days a year. QT Elppa 1. Inventory turnover 2. Number of days' sales in inventory days daysarrow_forward

- Required 1. Assume that Urban One sells a $300 gift certificate to a customer, collecting the $300 cash in advance. Prepare the journal entry for (a) collection of the cash for delivery of the gift certificate to the customer and (b) revenue from the subsequent delivery of merchandise when the gift certificate is used. 2. How can keeping less inventory help to improve Urban One's profit margin? 3. Cathy Hughes understands that many companies carry considerable inventory, and she is thinking of carrying additional inventory of merchandise for sale. Cathy desires your advice on the pros and cons of carrying such inventory. Provide at least one reason for, and one reason against, carrying additional inventory.arrow_forwardHaynes Jewelers uses a perpetual inventory system and had the following purchase transactions. Journalize all necessary transactions. Explanations are not required. View the transactions. Journalize all necessary transactions in the order they are presented in the transaction list. (Record debits first, then credits. Exclude explanations from journal entries. Round all numbers to the nearest whole dollar.) Jun. 20: Purchased inventory of $5,900 on account from Luca Diamonds, a jewelry importer. Terms were 1/15, n/45, FOB shipping point. Date Jun. 20 Accounts Debit Credit Transactions Purchased inventory of $5,900 on account from Luca Diamonds, a jewelry importer. Terms were 1/15, n/45, FOB shipping point. Paid freight charges, $200. Returned $700 of inventory to Luca Diamonds. Jun. 20 Jun. 20 Jul. 4 Jul. 14 Jul. 16 Jul. 18 Jul. 24 Paid Jia Diamonds, less allowance and discount. Paid Luca Diamonds, less return. Purchased inventory of $4,100 on account from Jia Diamonds, a jewelry…arrow_forwardConcord Inc. is a retailer using a perpetual inventory system. All sales returns from customers result in the goods being returned to inventory. (Assume that the inventory is not damaged.) Assume that there are no credit transactions; all amounts are settled in cash. You are provided with the following information for Concord Inc. for the month of January. Unit Cost or Date Description Quantity Selling Price Dec. 31 Beginning inventory 160 $21 Jan. 2 Purchase 100 22 Jan. 6 Sale 180 40 Jan 9 Sale return 10 40 Jan. 9 Purchase 75 24 Jan. 10 Purchase return 15 24 Jan. 10 Sale 50 45 Jan. 23 Purchase 100 26 Jan. 30 Sale 120 51 Using FIFO method, calculate (i) cost of goods sold, (ii) ending inventory, and (iii) gross profit. (Assume sales returns had a cost of $21 and purchase returns had a cost of $24.) Cost of goods sold 2$ Ending Inventory 24 Gross Profit 24 Using Average method, calculate (i) cost of goods sold, (ii) ending inventory, and (iii) gross profit. (Round average cost to 3…arrow_forward

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT