Concept explainers

Variable Costing Income Statement; Reconciliation L07—2, L07—3

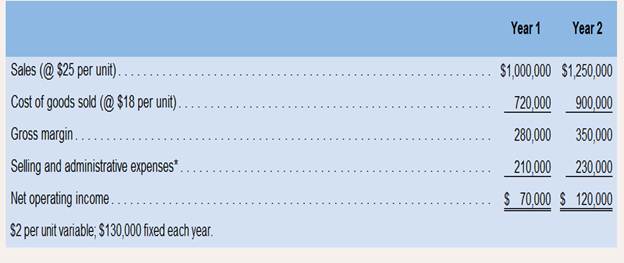

During Heaton Company’s first two years of operations, it reported absorption costing net operating income as follows:

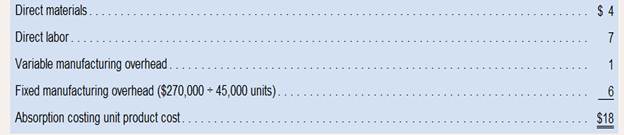

The company’s $18 unit product cost is computed as follows:

Forty percent of fixed manufacturing

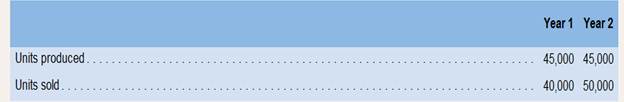

Production and cost data for the first two years of operations are:

Required:

Using variable costing, what is the unit product cost for both years?

What is the variable costing net operating income in Year 1 and in Year 2?

Reconcile the absorption costing and the variable costing net operating income figures for each year.

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Introduction To Managerial Accounting

- Income Statements under Absorption and Variable Costing In the coming year, Kalling Company expects to sell 28,700 units at 32 each. Kallings controller provided the following information for the coming year: Required: 1. Calculate the cost of one unit of product under absorption costing. 2. Calculate the cost of one unit of product under variable costing. 3. Calculate operating income under absorption costing for next year. 4. Calculate operating income under variable costing for next year.arrow_forwardCost Classification Loring Company incurred the following costs last year: Required: 1. Classify each of the costs using the following table format. Be sure to total the amounts in each column. Example: Direct materials, 216,000. 2. What was the total product cost for last year? 3. What was the total period cost for last year? 4. If 30,000 units were produced last year, what was the unit product cost?arrow_forwardThe following product costs are available for Kellee Company on the production of eyeglass frames: direct materials, $32,125; direct labor, $23.50; manufacturing overhead, applied at 225% of direct labor cost; selling expenses, $22,225; and administrative expenses, $31,125. The direct labor hours worked for the month are 3,200 hours. A. What are the prime costs? B. What are the conversion costs? C. What is the total product cost? D. What is the total period cost? E. If 6.425 equivalent units are produced, what is the equivalent material cost per unit? F. What is the equivalent conversion cost per unit?arrow_forward

- Variable-Costing and Absorption-Costing Income Borques Company produces and sells wooden pallets that are used for moving and stacking materials. The operating costs for the past year were as follows: During the year, Borques produced 200,000 wooden pallets and sold 204,300 at 9 each. Borques had 8,200 pallets in beginning finished goods inventory; costs have not changed from last year to this year. An actual costing system is used for product costing. Required: 1. What is the per-unit inventory cost that is acceptable for reporting on Borquess balance sheet at the end of the year ? How many units are in ending inventory? What is the total cost of ending inventory? 2. Calculate absorption-costing operating income. 3. CONCEPTUAL CONNECTION What would the per-unit inventory cost be under variable costing? Does this differ from the unit cost computed in Requirement 1? Why? 4. Calculate variable-costing operating income. 5. Suppose that Borques Company had sold 196,700 pallets during the year. What would absorption-costing operating income have been? Variable-costing operating income?arrow_forwardSummarized data for Walrus Co. for its first year of operations are: Sales (90,000 units) $4,500,000 Production Costs (108,000 units): Direct Material 1,512,000 Direct Labor 1,350,000 Manufacturing Overhead: Variable 810,000 Fixed 216,000 Selling and Administrative Expenses: Variable 234,000 Fixed 387,000 Question Content Area A. Prepare an income statement under absorption costing. Walrus Co.Absorption Costing Income Statement $- Select - Cost of Goods Sold: $- Select - - Select - - Select - - Select - $fill in the blank b43346f81ffcfd3_11 - Select - - Select - $- Select - - Select - $- Select - Question Content Area B. Prepare an income statement under variable costing. Walrus Co.Variable Costing Income Statement $- Select - Variable Cost of Goods Sold: $- Select - - Select - -…arrow_forwardSubject: Cost management & accounting Question No. 3: Absorption and Marginal Costing (remaining part)The Dorset Corporation produces and sells a single product. The following data refer to the year just completed:Beginning inventory 0Units produced 10,000Units sold 8,000Selling price per unit $50Selling and administrative expenses:Variable per unit $5Fixed per year $60,000Manufacturing costs:Direct materials cost per unit $10Direct labor cost per unit $6Variable manufacturing overhead cost per unit $5Fixed manufacturing overhead per year $80,000Assume that direct labor is a variable cost.Required: (remaining part) b. Reconcile the absorption costing and variable costing net operating income figuresa. Prepare an income statement for the year using absorption costing and variable costingarrow_forward

- Cost Accounting assignment 1) Mixed cost – high-low method analysis Byrnes Company accumulated the following data concerning a mixed cost, using units produced as the activity level. Month Units produced Total cost $14,740 $13,250 March 9,800 8,500 April May 7,000 7,600 8,100 $11,100 $12,000 $12,460 June July a. Compute the variable-cost and fixed cost elements using the high-low method. b. Using the information from your answer to part (a), write the cost formula. c. Estimate the total cost if the company produces 8,000 units.arrow_forwardSubject: Cost management & accounting Question No. 3: Absorption and Marginal Costing (remaining part)The Dorset Corporation produces and sells a single product. The following data refer to the year just completed:Beginning inventory 0Units produced 10,000Units sold 8,000Selling price per unit $50Selling and administrative expenses:Variable per unit $5Fixed per year $60,000Manufacturing costs:Direct materials cost per unit $10Direct labor cost per unit $6Variable manufacturing overhead cost per unit $5Fixed manufacturing overhead per year $80,000Assume that direct labor is a variable cost.Required: (remaining part) b. Reconcile the absorption costing and variable costing net operating income figuresarrow_forwardDuring its first year of operations, a company produced 275,000 units and sold 250,000 units. The following costs were incurred during the year: Fixed Costs Direct materials Direct labor Variable Cost per Unit $15.00 10.00 $2,200,000 1,375,000 12.50 Manufacturing overhead Selling and administrative The difference between operating income calculated on the absorption-costing basis and on the variable costing basis is that absorption-costing operating income is (Your response must be i.e., "12000 greater" or "12000 lesser".) 2.50arrow_forward

- Variable costing income statement On July 31,the end of the first month of operations,Rhys Company prepared the following income statement on the absorption costing concept: a. prepare a variable costing statement,assuming that the fixed manufacturing costs were $132,000 and the variable selling and administrative expenses were $115,200. b. Reconcile the absorption costing income from operations of $1,656,000 with variable costing income from operations determined in (a)arrow_forwardSubject: Cost management & accountng MCQ's Bryans Corporation has provided the following data for its two most recent years of operation: Selling price per unit $ 53 Manufacturing costs: Variable manufacturing cost per unit produced: Direct materials $ 13 Direct labor $ 6 Variable manufacturing overhead $ 5 Fixed manufacturing overhead per year $ 63,000 Selling and administrative expenses: Variable selling and administrative expense per unit sold $ 4 Fixed selling and administrative expense per year $ 71,000 Year 1 Year 2 Units in beginning inventory 0 3,000 Units produced 9,000 7,000 Units sold 6,000 7,000 Units in ending inventory 3,000 3,0000 The unit product cost under variable costing in Year 1 is closest to: $31.00 $28.00 $24.00 $35.00arrow_forwardSuper-Variable Costing and Variable Costing Unit Product Costs and Income Statements Lyons Company manufactures and sells one product. The following information pertains to the company’s first year of operations: The company does not incur any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, Lyons produced 60,000 units and sold 52,000 units. The selling price of the company’s product is $40 per unit. Required: 1. Assume the company uses super-variable costing: a. Compute the unit product cost for the year. b. Prepare an income statement for the year. 2. Assume the company uses a variable costing system that assigns $12.50 of direct labor cost to each unit produced: a. Compute the unit product cost for the year. b. Prepare an income statement for the year. 3. Prepare a reconciliation that explains the difference between the super-variable costing and variable costing net operating incomes.arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,