Construction Accounting And Financial Management (4th Edition)

4th Edition

ISBN: 9780135232873

Author: Steven J. Peterson MBA PE

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 8, Problem 5P

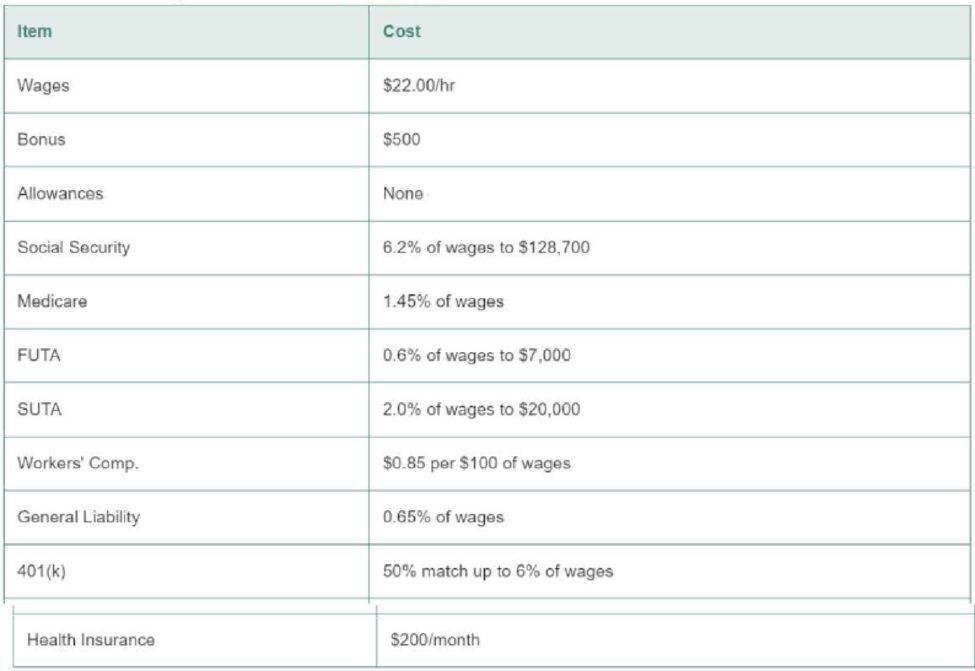

Determine the annual cost, average hourly cost, and burden markup of an hourly employee given the information in Table 8-1. Assume the employee takes full advantage of the 401(k) benefit. The employee’s health insurance is paid for entirely by the employer. Last year the employee worked 2,104 hours and was paid for an additional 80 hours of vacation. The employee was paid for at least 40 hours each week and is to be paid time and a half on any work over 40 hours per week.

Table 8-1 Wage Information for Problem 5

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Calculation of Take-Home Wages (Accounting for Liabilities).

Lina Lu is an hourly worker who earns $50 per hour. During the prior week, Lina worked 40 hours. The FICA rate is 6.2% and Medicare Rate is 1.45%. Lina's total wages for this payroll are subject to the aforementioned taxes. In addition, she had deductions of $280 for federal income tax and $80 for insurance contribution. What is her net pay? Can you please show how you came to this answer? Thank you!

Find the amount of Social Security and Medicare for the current pay period Of the employee.

G. Falk has a current gross earning of $952.41 oh, and he has a year-to-date earning of $109,504.33.

An employer uses a career average formula to determine retirement payments to its employees. The annual retirement payout is 8 percent of the employees’ career average salary times the number of years of service. Calculate the annual benefit payment under the following scenarios.

Years Worked

Career Average Salary

27

$ 68,000

30

70,500

32

72,000

Chapter 8 Solutions

Construction Accounting And Financial Management (4th Edition)

Ch. 8 - What is the difference between an allowance and a...Ch. 8 - Why are the social security and Medicare taxes...Ch. 8 - How does employee turnover affect the labor burden...Ch. 8 - What can a company do to reduce its workers'...Ch. 8 - Determine the annual cost, average hourly cost,...Ch. 8 - Determine the annual cost, monthly cost, and...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In EA14, you prepared the journal entries for the employee of Toren Inc. You have now been given the following additional information: May is the first pay period for this employee. FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to the employee. FICA Social Security and FICA Medicare match employee deductions. The employer is responsible for 70% of the health insurance premium. Using the information from EA14 and the additional information provided: A. Record the employer payroll for the month of May, dated May 31, 2017. B. Record the payment in cash of all employer liabilities only on June 1.arrow_forwardIn EB13, you prepared the journal entries for Janet Evanovich, an employee of Marc Associates. You have now been given the following additional information: June is the first pay period for this employee. FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to the employee. FICA Social Security and FICA Medicare match employee deductions. The employer is responsible for 60% of the health insurance premium. The employer matches 50% of employee pension plan contributions. Using the information from EB13 and the additional information provided: A. Record the employer payroll for the month of June, dated June 30, 2017. B. Record the payment in cash of all employer liabilities only on July 1.arrow_forwardAn employee and employer cost-share pension plan contributions and health insurance premium payments. If the employee covers 35% of the pension plan contribution and 25% of the health insurance premium, what would be the employees total benefits responsibility if the total pension contribution was $900, and the health insurance premium was $375? Include the journal entry representing the payroll benefits accumulation for the employer in the month of February.arrow_forward

- Find the amount of Social Security and Medicare for the current pay period for the employee. N Schwarz has a current gross earning of $1,538.44 and a year-to-date earning of $108,989.41.arrow_forwardDetermine the labor burden for an employee given the information in Table below. Assume the employee takes full advantage of the 401k benefit. Employer provides health insurance $100 a month, and employee doesn't pay for health insurance. Cost $85,000 None Item Wages Bonus Allowances Medicare Social Security FUTA None 1.45% of wages SUTA Workers' Comp. General Liability 401(k) Health Insurance 6.2% of wages to $128,700 0.6% of wages to $7,000 |2.0% of wages to $20,000 $0.85 per $100 of wages 0.65% of wages 50% match up to 6% of wages |$200/montharrow_forwardAn employee earns $16 per hour and 1.5 times that rate for all hours in excess of 40 hours per week. If the employee worked 55 hours during the week. Assume that the social security tax rate is 6.0%, the Medicare tax rate is 1.5%, and the employee’s federal income tax withheld is $230. a. Determine the gross pay for the week.$fill in the blank 1 If applicable, round your final answer to two decimal places. b. Determine the net pay for the week.$fill in the blank 2arrow_forward

- An employee earns $36 per hour and 1.5 times that rate for all hours in excess of 40 hours per week. If the employee worked 55 hours during the week. Assume that the social security tax rate is 6.0%, the Medicare tax rate is 1.5%, and the employee’s federal income tax withheld is $518. a. Determine the gross pay for the week.$fill in the blank 1 If applicable, round your final answer to two decimal places. b. Determine the net pay for the week.arrow_forwardClaude Lopez is the president of Zebra Antiques. His employee, Dwight Francis, is due a raise. Dwight's current benefit analysis is as follows: Yearly Benefit Costs Medical insurance Dental insurance Life insurance AD&D Short-term disability Long-term disability 401(k) Social Security Medicare Tuition reimbursement Total yearly benefit costs (employer) Employee's annual salary. The Total value of employee's compensation Required: Compute the benefit analysis assuming: Company Cost (Current) $ 8,000.00 120.00 300.00 150.00 60.00 30.00 750.00 3,018.16 705.86 $ 2,000.00 $ 15,134.02 50,000.00 $ 65,134.02 Employee Cost (Current) $ 1,200.00 120.00 0 0 0 0 1,500.00 3,018.16 705.86 0 • 3 percent increase in pay. • Dwight will increase his 401(k) contribution to 8 percent with a company match of 50 percent up to 6 percent of the employee's annual salary. • 15 percent increase in medical and dental insurance premiums. (Round your answers to 2 decimal places.)arrow_forwardAn employee receives an hourly rate of $32.00, with time and a half for all hours worked in excess of 40 during a week. Payroll data for the current week are as follows: hours worked, 45; federal income tax withheld, $325.00; social security tax rate, 6.0%; and Medicare tax rate, 1.5% on all earnings. What is the net amount to be paid to the employee? Select the correct answer. $1,001.00 $1,081.00 $1,115.00 $1,520.00arrow_forward

- Study the Employee Earnings Record for Jason C. Jenkins below. In addition to the amounts shown in the earnings record, the employer also paid all employee benefits plus (a) an amount equal to 7 percent of gross pay into Jenkins' pension retirement account, (b) dental insurance for Jenkins at a cost of $40 per month, and (c) parking of $35 per month. Compute the employer's total payroll expense for employee Jason C. Jenkins during 2018. Carry all amounts to the nearest cent. (Click the icon to see Jenkins earnings record.) Gross Pay Employer payroll expenses: CPP contributions El premiums Pension Dental insurance Parking Total payroll expensearrow_forwardAn employee receives an hourly wage rate of $18, with time and a half for all hours worked in excess of 40 hours during a week. Payroll data for the current week are as follows: hours worked, 45; federal income tax withheld, $349; social security tax rate, 6.0%; and Medicare tax rate, 1.5% on all earnings. What is the net amount to be paid to the employee? Select the correct answer. $442 $855 $1,151 $1,207arrow_forwardBecause an employee works 46 hours in a regular week of 40, with an hourly salary of $10 and receives double pay for hours worked in excess of 40, it determines: Gross Income? 7% contribution on income 6.20%Social Security Contribution 1.45% of health care contributions Net income For this same situation, it determines the employer's payroll contribution 6.20% Social Security contribution 1.45% health care contribution 4.40% state unemployment 0.60% federal unemployment 0.60% Temporary disability insurance Total employer's contributionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning  College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

What Is And How To Calculate FICA Taxes Explained, Social Security Taxes And Medicare Taxes; Author: Whats Up Dude;https://www.youtube.com/watch?v=fzK3KDDYCQw;License: Standard Youtube License