Individual Income Taxes

43rd Edition

ISBN: 9780357109731

Author: Hoffman

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 9, Problem 34P

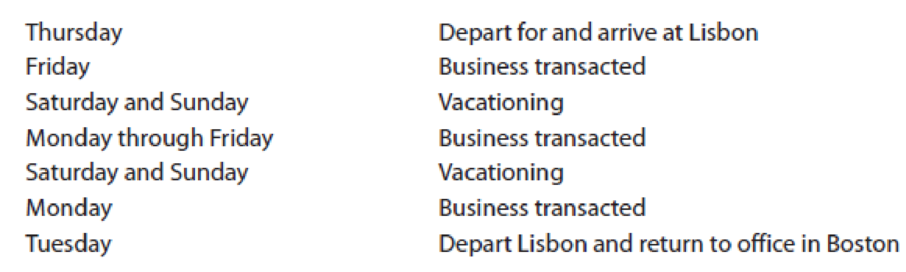

Monica, a self-employed taxpayer, travels from her office in Boston to Lisbon, Portugal, on business. Her absence of 13 days was spent as follows:

- a. For tax purposes, how many days has Monica spent on business?

- b. What difference does it make?

- c. Could Monica have spent more time than she did vacationing on the trip without loss of existing tax benefits? Explain.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Which one of the following conditions must be satisfied in order for a married taxpayer to be taxed on only his income if he resides in a community property state?

a.The husband and wife must live apart for the entire year.

b.The husband and wife must live apart for more than half the year.

c.The husband and wife must be in the process of filing for a divorce.

d.Only one of the spouses can be working and earning an income.

e.None of these choices are correct.

(LO.3 Federal Taxation) Monica, a self-employed taxpayer, travels from her office in Boston to Lisbon, Portugal, on business. Her absence of 13 days was spent as follows:

Thursday Depart for and arrive at Lisbon

Friday Business transacted

Saturday and Sunday Vacationing

Monday through Friday Business transacted

Saturday and Sunday Vacationing

Monday Business transacted

Tuesday Depart Lisbon and return to office in Boston

For tax purposes, how many days has Monica spent on business?

What difference does it make?

Could Monica have spent more time than she did vacationing on the trip without loss of existing tax benefits?

Monica, a self-employed taxpayer, travels from her office in Boston to Lisbon, Portugal, on business. Her absence of 13 days was spent as follows:

Thursday

Depart for and arrive in Lisbon

Friday

Business transacted

Saturday and Sunday

Vacationing

Monday through Friday

Business transacted

Saturday and Sunday

Vacationing

Monday

Business transacted

Tuesday

Depart Lisbon and return to office in Boston

a. For tax purposes, how many days has Monica spent on business?fill in the blank ff3ca702cfdf052_1 days

b. What difference does it make?

If Monica's trip satisfies the seven day/thirteen day

test or the less-than-25/more-than-25

% test, then her transportation costs do not have to/must

be allocated between business and personal.

c. Could Monica have spent more time than she did vacationing on the trip without loss of existing tax benefits?

Monica can/cannot

satisfy the seven-day/thirteen-day/less-than-25%/more-than-25%…

Chapter 9 Solutions

Individual Income Taxes

Ch. 9 - Prob. 1DQCh. 9 - Mason performs services for Isabella. In...Ch. 9 - Milton is a resident of Mobile (Alabama) and is...Ch. 9 - In 2017, Emma purchased an automobile, which she...Ch. 9 - Prob. 5DQCh. 9 - Prob. 6DQCh. 9 - Prob. 7DQCh. 9 - Prob. 8DQCh. 9 - Prob. 9DQCh. 9 - Prob. 10DQ

Ch. 9 - Prob. 11DQCh. 9 - Prob. 12DQCh. 9 - Prob. 13DQCh. 9 - Prob. 14DQCh. 9 - Paul wholly owns and operates an office supplies...Ch. 9 - Prob. 16DQCh. 9 - Prob. 17DQCh. 9 - Lara uses the standard mileage method for...Ch. 9 - Fred, a self-employed taxpayer, travels from...Ch. 9 - Prob. 20CECh. 9 - Prob. 21CECh. 9 - In 2019, Robert entertains four key clients and...Ch. 9 - In 2019, the CEO of Crimson, Inc., entertains...Ch. 9 - Prob. 24CECh. 9 - Cindy maintains an office in her home that...Ch. 9 - Prob. 26CECh. 9 - Prob. 27CECh. 9 - Prob. 28PCh. 9 - Prob. 29PCh. 9 - Prob. 30PCh. 9 - In June of this year, Dr. and Mrs. Bret Spencer...Ch. 9 - Prob. 32PCh. 9 - On Thursday, Justin flies from Baltimore (where...Ch. 9 - Monica, a self-employed taxpayer, travels from her...Ch. 9 - Prob. 35PCh. 9 - Prob. 36PCh. 9 - Prob. 37PCh. 9 - Prob. 38PCh. 9 - Prob. 39PCh. 9 - Prob. 40PCh. 9 - Shelly has 200,000 of QBI from her local jewelry...Ch. 9 - Prob. 42PCh. 9 - Prob. 43PCh. 9 - Prob. 44PCh. 9 - Prob. 45PCh. 9 - Prob. 46PCh. 9 - Ben and Molly are married and will file jointly....Ch. 9 - Prob. 48PCh. 9 - Prob. 49PCh. 9 - Prob. 50PCh. 9 - David R. and Ella M. Cole (ages 39 and 38,...Ch. 9 - Addison Parker (Social Security number...Ch. 9 - In the current year, Barlow moved from Chicago to...Ch. 9 - Prob. 2CPACh. 9 - Prob. 3CPACh. 9 - Prob. 4CPACh. 9 - Prob. 5CPACh. 9 - Prob. 6CPACh. 9 - Calculate the taxpayers 2019 qualifying business...Ch. 9 - Prob. 8CPA

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Martha is a self-employed tax accountant who drives her car to visit clients on a regular basis. She drives her car 4,000 miles for business and 10,000 for commuting and other personal use. Assuming Martha uses the standard mileage method, how much is her auto expense for the year? Where in her tax return should Martha claim this deduction? _________________________________________________ _______________________________________________________________________________ _______________________________________________________________________________arrow_forwardMs. Filipina A. Ko, a Filipino, works abroad. Ms. Filipina’s work requires her to be overseas most of the time. In fact, she comes home to our country only once every two years. Her only source of income is the salary she earns abroad. Which of the following taxes will the BIR require her to pay? A. Income Tax B. Business Tax C. A and B D. None of thesearrow_forwardKendra is a self-employed taxpayer working exclusively from her home office. Before the home office deduction, Kendra has $6,000 of net income. Her allocable home expenses are $10,000 in total. How are the home office expenses treated on her current year tax return? a.Only $3,000 a year of the home office expenses may be deducted. b.All home office expenses may be deducted, resulting in a business loss of $4,000. c.Only $6,000 of home office expenses may be deducted, resulting in a net business income of zero. None of the remaining $4,000 of home office expenses may be carried forward or deducted. d.Only $6,000 home office expenses may be deducted, resulting in net business income of zero. The remaining $4,000 of home office expenses may be carried forward and deducted in a future year against business income.arrow_forward

- Quin owns a house in Connecticut and an apartment in New Orleans. Quin spends most of her time in Connecticut, so she sometimes rents out the apartment in New Orleans when she is not there. This year, Quin rented out the apartment for thirty days and personally used the apartment for forty days. How will Quin’s rental activity be classified for tax purposes and why? A.Nontaxable activity because Quin used the apartment personally more than she rented it out. B.Mixed-use activity because Quin both rented out the apartment and used it personally. C.Mixed-use activity because Quin rented out the apartment for more than 14 days and personally used the apartment for the greater of 14 days or 10% of the rental days. D.Rental activity because Quin rented out the apartment for more than 14 days.arrow_forwardCampbell, a single taxpayer, earns $400,000 in taxable income and $2,000 in interest from an investment in State of New York bonds. (Use the U.S. tax rate schedule) Required: a. How much federal tax will she owe? b. What is her average tax rate? c. What is her effective tax rate? d. What is her current marginal tax rate? Answer is not complete. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D How much federal tax will she owe? Note: Do not round intermediate calculations. Round "Federal tax to the nearest dollar 5148.000 Federal tax Required B >arrow_forwarda. Assume that Eva is concidered to be an employee. What amount of FICA taxes is she required to pay for the year? b. What is her regular income tax liability for the year? c. Assume that Eva is concidered self-employed contractor. What is her self-employment tax liability and additional medicare tax liability for the year? d. Assume Eva is concidered to be self employed contractor. What is her regular tax liability for the year?arrow_forward

- Meredith owns her own business. In 2020, she had business revenue of $268,450 and business deductions of $75,900. She had no other activity that affected her tax return.a. Calculate her self-employment tax.b. Calculate her AGI.arrow_forwardFor each of the following situations, indicate whether the taxpayer(s) is (are) required to file a tax return for 2021. Explain your answer. Yes? No? and Why Monica is a maid in a San Francisco Hotel. Monica received $500 in unreported tips during 2021 and owes Social Security taxes on these tips. Her total income for the year, including tips, is $4,500. Is Monica required to file an income tax return for 2021?arrow_forwardLO.3 During the year (not a leap year), Anna rented her vacation home for 30 days, used it personally for 20 days, and left it vacant for 315 days. She had the following income and expenses: Compute Anna’s net rent income or loss and the amounts she can itemize on her tax return, using the court’s approach to allocating property taxes and interest. How would your answer in part (a) differ using the IRS’s method of allocating property taxes and interest?arrow_forward

- Campbell, a single taxpayer, earns $411,000 in taxable income and $2,880 in interest from an investment in State of New York bonds. (Use the U.S. tax rate schedule.) Required: a. If Campbell earns an additional $17,200 of taxable income, what is her marginal tax rate on this income? b. What is her marginal rate if, instead, she had $17,200 of additional deductions? Note: For all requirements, do not round intermediate calculations. Round percentage answers to whole percent. a. Marginal tax rate b. Marginal tax rate % %arrow_forwardEkiya, who is single, has been offered a position as a city landscape consultant. The position pays $132, 200 in wages. Assume Ekiya has no dependents. Ekiya deducts the standard deduction instead of itemized deductions, and she is not eligible for the qualified business income deduction. (Use the tax rate schedules.) a. What is the amount of Ekiya's after-tax compensation (ignore payroll taxes)?arrow_forwardFor the following taxpayers, indicate whether the taxpayer should file a tax return and why. a. Robert earned $50,000 this year as a staff accountant. His estimated tax liability is $4,500, and he expects to receive a $500 tax refund. b. Amy earned $4,000 this year working part-time. She will have no federal tax liability and has not made any federal tax payments. c. Ty earned $2,500 this summer and had $200 of federal taxes withheld from his paycheck. He will have no federal tax liability this year. d. Startup Corporation had a $50,000 loss this year. e. The Walker Family Trust earned $500 of gross income this year.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

How to (Legally) Never Pay Taxes Again; Author: Next Level Life;https://www.youtube.com/watch?v=q63F1pBrUHA;License: Standard Youtube License