Corporate Financial Accounting

15th Edition

ISBN: 9781337398169

Author: Carl Warren, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter D, Problem D.10EX

Fair value

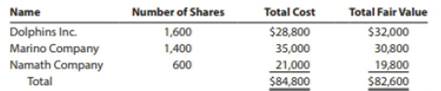

Jets Bancorp Inc. purchased a portfolio of trading securities during 20Y3. The cost and fair value of this portfolio on December 31, 20Y3, was as follows:

Journalize the entry to record the adjustment of the trading security portfolio to fair value on December 31, 20Y3.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Ticker Services began operations in Year 1 and holds long-term investments in available-for-sale debt securities. The year-end cost and

fair values for its portfolio of these investments follow.

Portfolio of Available-for-Sale Securities

December 31, Year 1

December 31, Year 2

December 31, Year 3

December 31, Year 4

View transaction list View journal entry worksheet

Prepare journal entries to record each year-end fair value adjustment for these securities.

No

3

Cost

$11,000

18,900

20,600

14,800

Date

Dec. 31, Year 3 No Transaction Recorded

Fair Value

$17,500

28,000

30, 200

19,700

General Journal

Debit

Credit

Ⓒ

Trading Investments purchased for $10 were compared with the fair value of $12 at the end of the year. The journal entry to adjust the investments would include a:

Group of answer choices

credit to Unrealized Loss on Trading Investments $2.

credit to Unrealized Gain on Trading Investments $2.

debit to Unrealized Loss on Trading Investments $2.

debit to Unrealized Gain on Trading Investments $2.

Trading Investments purchased for $10 were compared with the fair value of $8 at the end of the year. The journal entry to adjust the investments would include a:

Group of answer choices

credit to Valuation Allowance for Trading Investments $2.

debit to Valuation Allowance for Trading Investments $2.

credit to Unrealized Gain on Trading Investments $2.

debit to Unrealized Gain on Trading Investments $2.

Chapter D Solutions

Corporate Financial Accounting

Ch. D - Prob. D.1EXCh. D - Entries for stock investments, dividends, and sale...Ch. D - Bond investment transactions Starks Products uses...Ch. D - Prob. D.4EXCh. D - Prob. D.5EXCh. D - Prob. D.6EXCh. D - Prob. D.7EXCh. D - Valuing trading securities at fair value On...Ch. D - Fair value journal entries, trading investments...Ch. D - Fair value journal entries, trading investments...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ticker Services began operations in Year 1 and holds long-term investments in available-for-sale debt securities. The year-end cost and fair values for its portfolio of these investments follow. Portfolio of Available-for-Sale Securities December 31, Year 1 December 31, Year 2 Cost $ 13,000 20,000 23,000 16,500 December 31, Year 3 December 31, Year 4 Complete this question by entering your answers in the tabs below. Prepare journal entries to record each year-end fair value adjustment for these securities. Adjustment General Journal Calculation Calculation adjustment required to fair value adjustment. 12/31/Year 1 Existing balance in Fair Value Adjustment-AFS (LT) Required balance in Fair Value Adjustment-AFS (LT) Adjustment required to Fair Value Adjustment-AFS (LT) 12/31/Year 2 Existing balance in Fair Value Adjustment-AFS (LT) Required balance in Fair Value Adjustment-AFS (LT) Adjustment required to Fair Value Adjustment-AFS (LT) 12/31/Year 3 Existing balance in Fair Value…arrow_forwardOn December 31, the cost of trading securities portfolio was $64,200, and the fair value was $67,000. The adjusting entry to record the unrealized gain or loss on trading investments would included a : Group of answer choices debit Unrealized Loss on Trading Investments debit Unrealized Gain on Trading Investments credit Unrealized Loss on Trading Investments credit Unrealized Gain on Trading Investmentsarrow_forwardThe investments of Charger Inc. include an investment of trading securities of Raiders Inc. purchased on February 24, 20Y7, for $693,000. The fair value of the securities on December 31, 20Y7, is $924,000. a. Journalize the entries for the February 24 purchase and the adjustment to fair value on December 31, 20Y7. If an amount box does not require an entry, leave it blank. 20Y7 Feb. 24 20Y7 Dec. 31 b. How is a unrealized gain or loss for trading investments reported on the financial statements? The unrealized gain or unrealized loss on trading investments is reported on the (or a separate item if significant). Unrealized losses would be in determining net income, while unrealized gains would be in determining net income... c. If the Raiders Inc. securities had been classified as available-for-sale securities, how would the investment be reported on the financial statements? The unrealized gain on available-for-sale investments would be reported as The debit balance of Valuation…arrow_forward

- Journal entries for trading investments The investments of Charger Inc. include an investment of trading securities of Raiders Inc. purchased on February 24, 20Y7, for $551,000. The fair value of the securities on December 31, 20Y7, is $609,000. a. Journalize the entries for the February 24 purchase and the adjustment to fair value on December 31, 20Y7. If an amount box does not require an entry, leave it blank. 20Y7 Feb. 24 fill in the blank 3edf1609201706b_2 fill in the blank 3edf1609201706b_3 fill in the blank 3edf1609201706b_5 fill in the blank 3edf1609201706b_6 20Y7 Dec. 31 fill in the blank 3edf1609201706b_8 fill in the blank 3edf1609201706b_9 fill in the blank 3edf1609201706b_11 fill in the blank 3edf1609201706b_12 b. How is a unrealized gain or loss for trading investments reported on the financial statements? The unrealized gain or unrealized loss on trading investments is reported on the (or a separate item if significant).…arrow_forwardStorm, Inc. purchased the following available-for-sale securities during Year 1, its first year of operations: Please see the attachment for details: The market price per share for the available-for-sale security portfolio on December 31,Year 1, was as follows: Please see the attachment for details: a. Provide the journal entry to adjust the available-for-sale security portfolio to fair value on December 31, Year 1.b. Describe the income statement impact from the December 31, Year 1, journal entry.arrow_forwardJournal entries for trading investments The investments of Charger Inc. include an investment of trading securities of Raiders Inc. purchased on February 24, 20Y7, for $551,000. The fair value of the securities on December 31, 20Y7, is $609,000. a. Journalize the entries for the February 24 purchase and the adjustment to fair value on December 31, 20Y7. If an amount box does not require an entry, leave it blank. 20Y7 Feb. 24 fill in the blank fill in the blank fill in the blank fill in the blank 20Y7 Dec. 31 fill in the blank fill in the blank fill in the blank fill in the blank b. How is a unrealized gain or loss for trading investments reported on the financial statements? The unrealized gain or unrealized loss on trading investments is reported on the_____________(or a separate item if significant). Unrealized losses would be_____________in determining net income, while unrealized gains would be_____________in determining net income..…arrow_forward

- Journal entries for trading investments The investments of Charger Inc. include an investment of trading securities of Raiders Inc. purchased on February 24, 20Y7, for $216,000. The fair value of the securities on December 31, 20Y7, is $288,000. a. Journalize the entries for the February 24 purchase and the adjustment to fair value on December 31, 20Y7. If an amount box does not require an entry, leave it blank. 20Y7 Feb. 24 Accounting numeric field 20Y7 Dec. 31 Feedback Check My Work a. Increase the investment and reduce Cash for number of shares times the per share price. The unrealized gain (credit) or unrealized loss (debit) is the difference between the acquired per share price and the market price per share at 20Y7 taken times the number of shares acquired. The offset account for the gain or loss entry is the valuation allowance account. b. How is a unrealized gain or loss for trading investments reported on the financial statements? 00arrow_forwardInstructions On January 1, Valuation Allowance for Trading Investments had a zero balance. On December 31, the cost of the trading securities portfolio was $380,400, and the fair value was $346,500. Prepare the December 31 adjusting journal entry to record the unrealized gain or loss on trading investments. Refer to the Chart of Accounts for exact wording of account titles.arrow_forwardFair value adjustment for trading investments During the year ended December 31, 20Y3, trading securities were purchased for $346,000. On December 31, 20Y3, the securities had a fair value of $309,000. Journalize the December 31, 20Y3, adjusting entry to record the unrealized gain or loss on trading investments purchased in 20Y3. If an amount box does not require an entry, leave it blank. 20Y3 Dec. 31arrow_forward

- Analyzing Fair Value Adjustment Account On December 31, Raven Company's portfolio of equity securities was valued at $3,240. The original cost of the investments in the portfolio was $2,880. Raven does not have significant influence on the investees in the portfolio. Prepare the journal entry to adjust the securities to fair value assuming that the Fair Value Adjustment account (unadjusted) has a a. Credit balance of $162. Date Dec. 31 Account Name b. Debit balance of $162. Date Dec. 31 Check Account Name + + + + Dr. Dr. OO 0 0 OO 0 0 Cr. Cr. OO 0 0 OO 0 0arrow_forwardValuing Trading Securities at Fair Value On January 1, Valuation Allowance for Trading Investments had a zero balance. On December 31, the cost of the trading securities portfolio was $54,800, and the fair value was $55,800. Prepare the December 31 adjusting journal entry to record the unrealized gain or loss on trading investments.arrow_forwardOn January 1, Valuation Allowance for Trading Investments had a zero balance. On December 31, the cost of the trading securities portfolio was $379,600, and the fair value was $358,900. Prepare the December 31 adjusting journal entry to record the unrealized gain or loss on trading investments. Refer to the Chart of Accounts for exact wording of account titles.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

Financial instruments products; Author: fi-compass;https://www.youtube.com/watch?v=gvxozM3TUIg;License: Standard Youtube License