A manager is trying to decide whether to purchase a certain part or to have it produced internally. Internal production could use either of two processes. One would entail a variable cost of $17 per unit and an annual fixed cost of $200,000; the other would entail a variable cost of $14 per unit and an annual fixed cost of $240,000. Three vendors are willing to provide the part. Vendor A has a price of $20 per unit for any volune up to 30,000 units. Vendor B has a price of $22 per unit for demand of 1,000 units or less, and $18 per unit for larger quantities. Vendor C offers a price of $21 per unit for the first 1,000 units, and $19 per unit for additional units.

a)

To determine: The best alternative from a cost standpoint for an annual volume of 10,000 units and 20,000 units.

Introduction: Decision-making is the process that helps to make decision. It is the process of choosing a best alternative by evaluating many alternatives.

Answer to Problem 8P

Explanation of Solution

Given information:

A manager has to decide whether to purchase a product or produce it internally. Internal production consists of two processes. Variable cost and fixed cost of the first process is $17 and $200,000 respectively. Variable cost and fixed cost of the second process is $14 and $240,000 respectively.

There are three vendors available to purchase a product. Vendor A has a price of $20 per unit up to 30,000 units. Vendor B has a price of $22 per unit if the demand is 1,000 units or less and $18 for larger volumes. Vendor C has a price of $21 per unit for first 1,000 units and $19 per unit for additional units.

Determine the best alternative from a cost standpoint for an annual volume of 10,000 units:

Calculate the total cost for the first internal process:

It is calculated by adding the fixed cost with the value attained by multiplying the variable cost and the annual volume. Annual volume is given as 10,000 units. Hence, the total cost for the first internal process is $370,000.

Calculate the total cost for the second internal process:

It is calculated by adding the fixed cost with the value attained by multiplying the variable cost and the annual volume. Annual volume is given as 10,000 units. Hence, the total cost for the first internal process is $380,000.

Calculate the total cost for the Vendor A:

It is calculated by multiplying the price and the annual volume. Hence, the total cost for Vendor A is $200,000.

Calculate the total cost for the Vendor B:

It is calculated by multiplying the price and the annual volume. It is given that the price is $22 if the volume is less than 1,000 and $18 if the volume is larger. As the annual volume is more than 1,000, the price is $18. Hence, the total cost for Vendor B is $180,000.

Calculate the total cost for the Vendor C:

It is calculated by multiplying the price and the annual volume. It is given that the price is $21 for the volume up to 1,000 and $19 for the additional volume. Thus, price is $21 for the 1,000 units and $19 for additional 9,000 units. Hence, the total cost for Vendor C is $192,000.

At the annual volume of 10,000 units, Vendor B has the lowest total cost of ($180,000). Hence, it should be chosen from a cost standpoint.

Determine the best alternative from a cost standpoint for an annual volume of 20,000 units:

Calculate the total cost for the first internal process:

It is calculated by adding the fixed cost with the value attained by multiplying the variable cost and the annual volume. Annual volume is given as 20,000 units. Hence, the total cost for the first internal process is $540,000.

Calculate the total cost for the second internal process:

It is calculated by adding the fixed cost with the value attained by multiplying the variable cost and the annual volume. Annual volume is given as 20,000 units. Hence, the total cost for the first internal process is $520,000.

Calculate the total cost for the Vendor A:

It is calculated by multiplying the price and the annual volume. Hence, the total cost for Vendor A is $400,000.

Calculate the total cost for the Vendor B:

It is calculated by multiplying the price and the annual volume. It is given that the price is $22 if the volume is less than 1,000 and $18 if the volume is larger. As the annual volume is more than 1,000, the price is $18. Hence, the total cost for Vendor B is $360,000.

Calculate the total cost for the Vendor C:

It is calculated by multiplying the price and the annual volume. It is given that the price is $21 for the volume up to 1,000 and $19 for the additional volume. Thus, price is $21 for the 1,000 units and $19 for additional 19,000 units. Hence, the total cost for Vendor C is $382,000.

At the annual volume of 20,000 units, Vendor B has the lowest total cost of ($360,000). Hence, it should be chosen from a cost standpoint.

b)

To determine: The range of the best alternative.

Introduction:Decision-making is the process that helps to make decision. It is the process of choosing a best alternative by evaluating many alternatives.

Answer to Problem 8P

Explanation of Solution

Given information:

A manager has to decide whether to purchase a product or produce it internally. Internal production consists of two processes. Variable cost and fixed cost of the first process is $17 and $200,000 respectively. Variable cost and fixed cost of the second process is $14 and $240,000 respectively.

There are three vendors available to purchase a product. Vendor A has a price of $20 per unit up to 30,000 units. Vendor B has a price of $22 per unit if the demand is 1,000 units or less and $18 for larger volumes. Vendor C has a price of $21 per unit for first 1,000 units and $19 per unit for additional units.

Cost function for each alternative if the annual volume is 1-1,000 units:

First internal process:

Second internal process:

Vendor A:

Vendor B:

Vendor C:

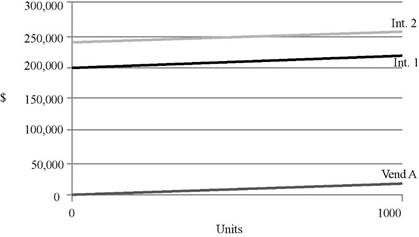

When considering the cost functions, Vendor A would exhibit less cost when compare to Vendor B and Vendor C. Vendor A should be preferred over other alternatives. The graph is as follows:

Cost function for each alternative if the annual volume is more than 1,000 units:

First internal process:

Second internal process:

Vendor A:

Vendor B:

Vendor C:

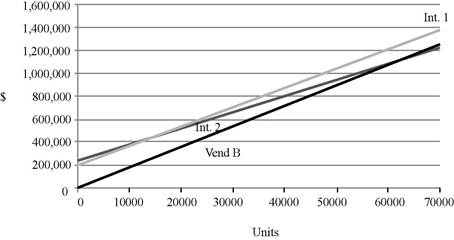

When considering the cost functions, Vendor B would dominate Vendor A and Vendor C. Hence, Vendor A and Vendor C should be eliminated. The graph considering two internal processes and Vendor B is as follows:

Determine the value of Q by equaling two cost equations:

Equal the cost function of second internal process and Vendor B to determine the value of Q.

Calculate the total cost of first internal process:

Substitute the value Q in the cost equation of first internal process. Hence, the total cost is $1,220,000.

Calculate the total cost of second internal process:

Substitute the value Q in the cost equation of second internal process. Hence, the total cost is $1,080,000.

Calculate the total cost of Vendor A:

Substitute the value Q in the cost equation of Vendor A. Hence, the total cost is $1,200,000.

Calculate the total cost of Vendor B:

Substitute the value Q in the cost equation of Vendor B. Hence, the total cost is $1,080,000.

Calculate the total cost of Vendor C:

Substitute the value Q in the cost equation of Vendor C. Hence, the total cost is $1,142,000.

Inference:

- Vendor A should be preferred when the purchasing quantity ranges from 1 to 1,000 units.

- Vendor B should be preferred when the purchasing quantity ranges from 1,001 to 59,999 units.

- There would indifferent between Vendor B and second internal process if the quantity is 60,000 units.

- Second internal process should be preferred if the quantity is more than 60,000 units.

First internal process and Vendor C are never best.

Want to see more full solutions like this?

Chapter 5 Solutions

Operations Management

- A firm is selling two products—chairs and bar stools—each at $50 per unit. Chairs have a variable cost of $25, and bar stools $20. The fixed cost for the firm is $20,000.a. If the sales mix is 1:1 (one chair sold for every bar stool sold), what is the break-even point in dollars of sales? In units of chairs and barstools?b. If the sales mix changes to 1:4 (one chair sold for every four bar stools sold), what is the break-even point in dollars of sales? In units of chairs and barstools?arrow_forwardA Company belonging to the process industry carries out three consecutive processes. The output of the first Process is taken as input of the second process, and the output of the second process is taken as input of the Third process. The final product emerges out of the third process. It is also possible to outsource the intermediate Products. It has been found that over a period of time cost of production of the first process is 10% higher than The market price of the intermediate product, available freely in the market. The company has decided to close Down the first process as a measure of cost saving (vertical spin off) and outsource. Should this event be treated As discontinuing operation?arrow_forwardWhich core process includes the activities required to produce and deliver the service or product to the external customer? A. supplier relationship process B. order fulfillment process C. customer relationship process D. new service/product development processarrow_forward

- Prevar Corporation currently purchases components from one of its suppliers. The current purchase price is $1500 per component, with annual purchase volume of 750 units. The ops manager believes that this component could be made inhouse with some minor modifications to the current factory set up. Fixed cost for dedicating a line for this component is estimated at $50,000. Raw materials for the component is estimated at $900, overhead at $200 and it would take 10 hours of labor (at $20 per hour) to produce each component.arrow_forwardPerform a "product-by-value" analysis on products A, B, C, D, and E: Unit Contribution Total Contribution A $0.75 $63,000 Products B $0.33 $82,000 C D $1.25 $0.85 $95,000 $115,000 Arrange the products in descending order of their individual dollar contribution to the firm: E $0.75 $57,000 Arrange the products in descending order of their total dollar contribution to the firm: Based on the "product-by-value" analysis, which products are the 3 lowest in total dollar contribution and therefore possible candidates for replacement? should be investigated for replacement.arrow_forwardMerrimac Manufacturing Company has always purchased acertain component part from a supplier on the East Coast for$50 per part. The supplier is reliable and has maintained the same price structure for years. Recently, improvements in op-erations and reduced product demand have cleared up some capacity in Merrimac’s own plant for producing componentparts. The particular part in question could be produced at$40 per part, with an annual fixed investment of $25,000.Currently, Merrimac needs 300 of these parts per year.a. Should Merrimac make or buy the component part?b. As another alternative, a new supplier located nearby isoffering volume discounts for new customers of $50per part for the first 100 parts ordered and $45 per partfor each additional unit ordered. Should Merrimacmake the component in-house, buy it from the newsupplier, or stick with the old supplier? c. Would your decision change if Merrimac’s annual de-mand increased to 2000 parts? increased to 5000 parts? d. Develop a set…arrow_forward

- Would critical ratio be better utilized as a static ratio or a dynamic ratio, and why?arrow_forwardYou are hired as a consultant for Cool Zone Inc. The company currently has a 1-year contract for the production of 200,000 fuse-plugs for a new state of the art off-road vehicle. With an increasing demand for these vehicles, The owner however, hope that the contract will be extended which will result in increased volume next year. Cool Zone has developed cost for 3 alternatives namely: General-Purpose Equipment (GPE), Flexible manufacturing System (FMS) and expensive but market dominant machine (DM). The cost associated with labour, raw materials and equipment per unit produced is as follows: GPE is $15, while DM and FMS have an associated cost of $13 and $14 respectively. The cost associated with FMS is $200,000, GPE $ 100,000 and DM $500,000 respectively. Regardless of the decision made, the company has to produce a total of 200,000 fuse plugs. (a) Based on the information above, which is the best option for the contract? What technique was used to determine your answer? Provide an…arrow_forwardMerrimac Manufacturing Company has always purchased acertain component part from a supplier on the East Coast for$50 per part. The supplier is reliable and has maintained thesame price structure for years. Recently, improvements in operations and reduced product demand have cleared up somecapacity in Merrimac’s own plant for producing componentparts. The particular part in question could be produced at$40 per part, with an annual fixed investment of $25,000.Currently, Merrimac needs 300 of these parts per year.a. Should Merrimac make or buy the component part?b. As another alternative, a new supplier located nearby isoffering volume discounts for new customers of $50per part for the first 100 parts ordered and $45 per partfor each additional unit ordered. Should Merrimacmake the component in-house, buy it from the newsupplier, or stick with the old supplier?c. Would your decision change if Merrimac’s annual demand increased to 2000 parts? increased to 5000 parts?d. Develop a set of…arrow_forward

- What production systems are really service processes with a high level of consumer contact? Is it possible to have a high level of customer service even though the process just has internal customers?arrow_forwardA company is about to begin production of a new product. The manager of the department that will produce one of the components for the product wants to know how often the machine used to produce the item will be available for other work. The machine will produce the item at a rate of 200 units a day. Eighty units will be used daily in assembling the final product. Assembly will take place five days a week, 50 weeks a year. The manager estimates that it will take almost a full day to get the machine ready for a production run, at a cost of 300. Inventory holding costs will be a 10 a year. how many days does it take to produce the optimal run quanity?arrow_forwardYou have been called in to review the defects found at a company that makes household cleaning liquid for their customers. The products consist of two different sizes: 16 and 24 oz products in plastic bottles with sprayers attached (see picture below). These products can be run on several different filling lines so management has had difficulty in trouble shooting to determine which defects to tackle, what size product and production line to address first and as a consultant, you've been asked to help with the decision making process. Company executives have provided you with the data listed below, of numbers and costs of different types of defects experienced in the most recent runs of the lines (assume that these defects are out of a recent sample taken from each line, all in the same time frame so they are sharing the same plant-wide conditions). You learned from Purchasing that the containers are purchased from 2 suppliers and the sprayers are purchased from 1 supplier. Labels…arrow_forward

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education

Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.